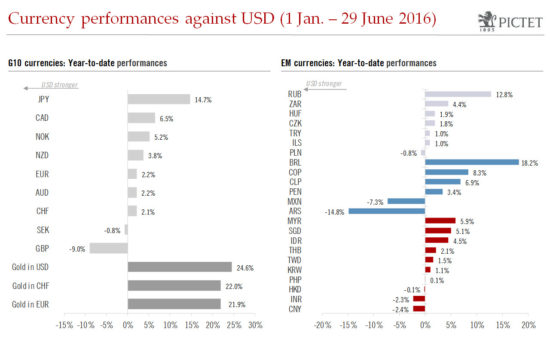

Following the Brexit referendum, prolonged GBP weakness is likely, while the Swiss franc faces renewed upward pressure Greater uncertainties, such as those caused by the Brexit vote, generally favour lower risk appetite. As a result, safe-haven currencies like the US dollar and currencies with positive current accounts and/or positive net international investment positions (JPY and CHF) are expected to outperform. Between the Bank of Japan and the Swiss National Bank, the latter would seem to have more leeway to curb the strengthening of its currency. Having fallen sharply in the days following the UK’s vote to leave the EU, the GBP is expected to remain weak given the fall in the growth outlook for the UK, the more dovishness stance the BoE is expected to adopt and the UK’s negative current account. When risk appetite is low, “safe” currencies tend to outperform “riskier” currencies. Currencies with positive current accounts such as the JPY and CHF — but also the euro — are deemed safer than currencies with negative current accounts. However, Brexit is a reminder that populist parties are on the rise in Europe, increasing the odds of a potential break-up of the euro area at some point. Consequently, the euro is not as safe as its positive current account implies.

Topics:

Luc Luyet considers the following as important: Brexit currencies, Brexit sterling, Macroview, US dollar appreciation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Following the Brexit referendum, prolonged GBP weakness is likely, while the Swiss franc faces renewed upward pressure

Greater uncertainties, such as those caused by the Brexit vote, generally favour lower risk appetite. As a result, safe-haven currencies like the US dollar and currencies with positive current accounts and/or positive net international investment positions (JPY and CHF) are expected to outperform. Between the Bank of Japan and the Swiss National Bank, the latter would seem to have more leeway to curb the strengthening of its currency.

Having fallen sharply in the days following the UK’s vote to leave the EU, the GBP is expected to remain weak given the fall in the growth outlook for the UK, the more dovishness stance the BoE is expected to adopt and the UK’s negative current account.

When risk appetite is low, “safe” currencies tend to outperform “riskier” currencies. Currencies with positive current accounts such as the JPY and CHF — but also the euro — are deemed safer than currencies with negative current accounts. However, Brexit is a reminder that populist parties are on the rise in Europe, increasing the odds of a potential break-up of the euro area at some point. Consequently, the euro is not as safe as its positive current account implies. The downturn in the growth outlook for the EU as a whole following the UK referendum and resultant political uncertainty also look like making Emerging Europe currencies less attractive — at least until we have more clarity on what Brexit will look like.

Our current scenario is based on the assumption that uncertainties caused by Brexit will not lead to persistently high financial stress (which would notably cause the Fed to reverse its monetary policy and actually start cutting rates again). As a result, we still expect the USD to appreciate on the back of robust US activity and supportive monetary policy divergences.

The long-term USD appreciation trend, we believe, is unlikely to reverse in the next two years given the absence of extreme overvaluations in its long-term fundamental. The weakening Chinese growth outlook should weigh on the Chinese yuan and on Asian emerging currencies, supporting a strong US dollar on a trade-weighted basis.