Healthy consumer spending figures lead us to believe that US GDP growth might actually be better than we have been forecasting. Inflation pressures look likely to remain modest for a while Real consumer spending in the US rose by a healthy 0.3% month over month in May, according to the Bureau of Economic Analysis (BEA) on 29 June, beating consensus expectations. Moreover April’s number was revised up, so that between Q1 and April-May, US personal consumption grew by an astonishing 4.8% annualised.All this supports our optimistic view of US consumer spending growth. Employment and household income should continue to grow healthily, consumer confidence is relatively upbeat and the saving rate, which remains high, may well fall back further. All these factors should support personal consumption down the road. Personal consumption growth may easily reach 4.0% in Q2 2016 and should remain solid in the second half of this year (around 2.5%). Our forecast that US GDP will grow at a quarter-on-quarter pace of 2.5% (annualised) in Q2 remains unchanged, as do our projections for yearly average growth rates of 1.8% in 2016 and 2.0% in 2017. But for the first time in a long while, risks to our 2016 growth forecasts for the US are tilted to the upside.The BEA also released core US PCE inflation figures on 29 June. The core PCE number remained unchanged at 1.

Topics:

Bernard Lambert considers the following as important: Macroview, US consumer spending, US growth, US inflation, US PCE inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Healthy consumer spending figures lead us to believe that US GDP growth might actually be better than we have been forecasting. Inflation pressures look likely to remain modest for a while

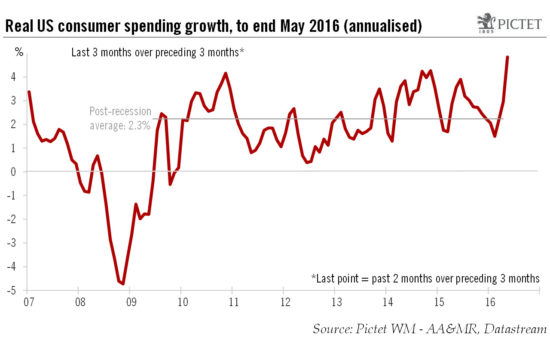

Real consumer spending in the US rose by a healthy 0.3% month over month in May, according to the Bureau of Economic Analysis (BEA) on 29 June, beating consensus expectations. Moreover April’s number was revised up, so that between Q1 and April-May, US personal consumption grew by an astonishing 4.8% annualised.

All this supports our optimistic view of US consumer spending growth. Employment and household income should continue to grow healthily, consumer confidence is relatively upbeat and the saving rate, which remains high, may well fall back further. All these factors should support personal consumption down the road. Personal consumption growth may easily reach 4.0% in Q2 2016 and should remain solid in the second half of this year (around 2.5%). Our forecast that US GDP will grow at a quarter-on-quarter pace of 2.5% (annualised) in Q2 remains unchanged, as do our projections for yearly average growth rates of 1.8% in 2016 and 2.0% in 2017. But for the first time in a long while, risks to our 2016 growth forecasts for the US are tilted to the upside.

The BEA also released core US PCE inflation figures on 29 June. The core PCE number remained unchanged at 1.6% year-on-year in May, in line with consensus expectations.

Labour market slack in the US has diminished markedly so that wage increases are likely to pick up gradually. However, wage inflation remains modest for the time being, and we think the impact of wage increases on overall core inflation should remain pretty muted, at least this year. Moreover, the global backdrop is not conducive to more inflation in the US – quite the opposite, actually – and domestic long-term inflation expectations have continued to decline.

We continue to believe that core PCE inflation in the US will only pick up modestly over the rest of 2016. Our forecast that it will reach 1.9% by the year’s end remains unchanged.