The Fed operates in secret, creates inflation, and bails out Wall Street. - Click to enlarge President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous. On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically...

Read More »Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

Submitted by Gordon T Long via MATASII.com, President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful...

Read More »SMI up on post Trump rally

SMI Swiss stocks continued to rise this week, in line with other global stocks thanks to a strong performance from financials which gained as investors weighted the prospects of higher interest rates in the US. SMI Index, November 18 - Click to enlarge Economic Data Stocks in the financial sector advanced after Federal Reserve Chair Janet Yellen said the US central bank is close to lifting interest rates as the...

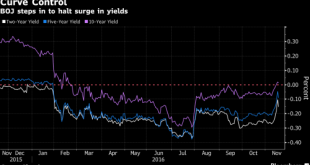

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

Submitted by John Rubino via DollarCollapse.com, At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable: SNB’s U.S. Stock Holdings Hit $62.4 Billion...

Read More »Jim Grant Puzzled by the actions of the SNB

Retaken from Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold. From multi-billion bond buying programs to negative interest rates and probably soon helicopter money: Around the globe, central bankers are...

Read More »Financial Repression Is Now “In Play”

Submitted by Gordon T Long via FinancialRepressionAuthority.com, A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and...

Read More »Evacuate or Die…

Escaping the Hurricane BALTIMORE – Last week, we got a peek at the End of the World. As Hurricane Matthew approached the coast of Florida, a panic set in. Gas stations ran out of fuel. Stores ran out of food. Banks ran out of cash. A satellite image of hurricane Matthew taken on October 4. He didn’t look very friendly. Image via twitter.com - Click to enlarge “Evacuate or die,” we were told. Not wanting to do...

Read More »Swiss central bank can cut rates further if needed, says bank president Jordan

© Yulan | Dreamstime.com - Click to enlarge The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted...

Read More »Swiss central bank can cut rates further if needed, says bank president Jordan

© Yulan | Dreamstime.com - Click to enlarge The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org