As widely expected, core PCE inflation picked up further in January, but the increase was surprisingly pronounced. However, we do not expect much more upside over the rest of the year. In Friday’s report on income and consumption, data were also published on the Personal Consumption Expenditures (PCE) deflator, the price measure targeted by the Fed. Following higher-than-expected CPI numbers the week before, a relatively marked monthly increase was also expected last Friday. However, the...

Read More »Euro area: large drop in core inflation delivers the final blow to the ECB

Today’s inflation report raises the likelihood of an even bigger easing package to be delivered at the 10 March meeting. Not only were today’s preliminary inflation figures for the euro area very weak, but the breakdown raised new concerns over the underlying trend in consumer prices – a potential headache for the ECB, independently of recent developments in the real economy and financial markets. According to Eurostat’s estimates, euro area HICP inflation fell to -0.19% y-o-y in...

Read More »Swiss inflation: in negative territory, but no sign of a deflationary spiral

Despite the deeply negative inflation rate, the SNB has become somewhat less sensitive to persistent undershoots of its inflation target. According to Swiss Federal Statistical Office, consumer prices in Switzerland remained broadly stable at -1.3% y-o-y in January, in line with consensus expectations and thus marking the seventeenth consecutive month in negative territory. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) was stable at...

Read More »Euro area: little evidence of large second-round effects of oil on core inflation

Much of the ECB’s decision at the upcoming 10 March meeting will depend on the assessment of the effects of lower oil prices on inflation. We find little evidence at this stage of large second-round effects on consumer prices. Draghi’s latest hint at fresh monetary easing heralds a six-week period of waiting and guessing what the next measures might look like. One critical factor driving the decision will be the ECB’s assessment of indirect effects of lower oil prices on inflation....

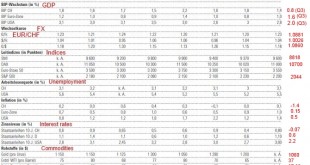

Read More »Economic Forecasts: Swiss Banks were too Optimistic

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates were far lower in 2015 than they expected. The forecast errors for stock indices and unemployment, however, were smaller. In December 2014, the Neue Zürcher Zeitung (NZZ) published the forecasts of the leading Swiss banks for the year 2015. UBS, Credit Suisse, Julius Bär, die ZKB, Raiffeisen, Pictet und J. Safra...

Read More »2016: growth, but no momentum

Published: 16th December 2015 Download issue: A case of lacklustre Goldilocks The coming year can just about be described as a ‘Goldilocks’ environment (not too hot, not too cold), but not a very appealing one. It is likely to be characterised by weak inflation, an absence of momentum in economic growth, concerns about the effectiveness of monetary policy, ongoing weakness in emerging markets, and periods of elevated volatility in financial markets. This scenario for 2016, as outlined in...

Read More »LA CRISE vue par le prof Henri Regnault (Extraits)

Résumé: En réponse aux troubles économiques et financiers de la période, toutes les grandes banques centrales ont fini par se lancer dans une création monétaire massive et totalement inédite, accompagnée de taux d’intérêt très faibles ou nuls. La nouvelle cuisine monétaire est donc abondante et pas chère. Elle est très loin de mériter le procès en sorcellerie inflationniste que lui font certains de ses détracteurs. Mais, pour autant, est-elle saine et exempte de risques d’intoxication? De...

Read More »The Upside and Downside of 2016

The same, only more of it. That’s the kind of year 2016 promises to be, according to Credit Suisse’s Global Markets annual outlook. Markets will obsess over if, when, and how much the Federal Reserve will raise interest rates. (Four times starting in December for a total of 1 percentage point, says Credit Suisse.) Credit Suisse’s Global Markets team believes global economic growth will pick up, driven by improvement in the U.S. and Europe, central bank policy will diverge further, and...

Read More »Time to Dust Off that Inflation Hedge

Given that consumer prices have either moved lower or essentially stayed put in the developed world for much of the past year, the word inflation does feel a little strange on the tongue. U.S. consumer prices declined through the 12 months ended in May and have pretty much flatlined since, while Japanese inflation has stayed under 1 percent all year. After falling for four consecutive months, starting in December 2014, European consumer prices have stayed where they are as well. But Credit...

Read More »Keith Weiner: Inflation Caused the Greek Tragedy

By inflation, I don’t refer to rising consumer prices in Athens. My Greek friends tell me that prices have been steady there in recent years. The focus on prices is the greatest sleight of hand ever perpetrated. It diverts your attention away from the real action. Inflation is the counterfeiting of credit. It is borrowing, when you can’t pay and you know it. Inflation is taking money under false pretenses, and issuing fraudulent bonds. This describes the Greek finances perfectly. Greece...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org