Much of the ECB’s decision at the upcoming 10 March meeting will depend on the assessment of the effects of lower oil prices on inflation. We find little evidence at this stage of large second-round effects on consumer prices. Draghi’s latest hint at fresh monetary easing heralds a six-week period of waiting and guessing what the next measures might look like. One critical factor driving the decision will be the ECB’s assessment of indirect effects of lower oil prices on inflation. Draghi promised “a more comprehensive picture” of those various transmission channels at the March meeting, warning that “we have to take seriously the fact that low oil prices, low commodity prices for a long period of time may actually have second-round effects that we definitely want to take action against”, echoing his speech in New York from last December. In this note we take stock of recent moves in oil prices and their influence on inflation dynamics. Using a variety of models, including from the ECB, we find little evidence of large second-round effects on consumer prices at the moment. Conservative models suggest that the latest 40% drop in Brent oil prices since mid-November may depress core inflation by up to 0.15% relative to the ECB’s baseline. By comparison, changes in the trade-weighted currency could be three to four times more important.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: ECB, inflation, Macroview, Oil

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Yen Jumps on Rate Hike Speculation

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Much of the ECB’s decision at the upcoming 10 March meeting will depend on the assessment of the effects of lower oil prices on inflation. We find little evidence at this stage of large second-round effects on consumer prices.

Draghi’s latest hint at fresh monetary easing heralds a six-week period of waiting and guessing what the next measures might look like. One critical factor driving the decision will be the ECB’s assessment of indirect effects of lower oil prices on inflation. Draghi promised “a more comprehensive picture” of those various transmission channels at the March meeting, warning that “we have to take seriously the fact that low oil prices, low commodity prices for a long period of time may actually have second-round effects that we definitely want to take action against”, echoing his speech in New York from last December.

In this note we take stock of recent moves in oil prices and their influence on inflation dynamics. Using a variety of models, including from the ECB, we find little evidence of large second-round effects on consumer prices at the moment. Conservative models suggest that the latest 40% drop in Brent oil prices since mid-November may depress core inflation by up to 0.15% relative to the ECB’s baseline. By comparison, changes in the trade-weighted currency could be three to four times more important.

However, this should be no reason for complacency. Hysteresis is a real threat, not only for unemployment but for inflation expectations as well. We continue to believe that the ECB, acting as a risk manager for euro area recovery, will ease at its 30 March meeting, including another 10bp deposit cut and a EUR20bn increase in the pace of monthly purchases, to EUR80bn a month, with risks tilted towards an even more ambitious package.

Direct vs. indirect effects of lower oil prices on inflation

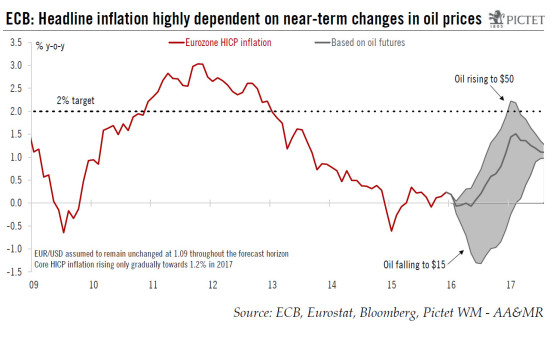

Changes in oil prices tend to mechanically influence headline inflation via the energy component (the first-round effects) with a delay of less than two months. Energy products account for about 10% of the total HICP index, but the pass-through to the various sub-components (liquid fuels, electricity, natural gas, heat energy and solid fuels) is only incomplete depending on various structural factors, including distribution costs and taxes. Moreover, these direct effects tend to be asymmetric and a function of the level of oil prices rather than growth rates only: the lower the oil price, the larger the changes in relative terms but the smaller their effects on HICP components. In other words, the elasticity of consumer prices is an increasing function of oil prices, as noted by the ECB.

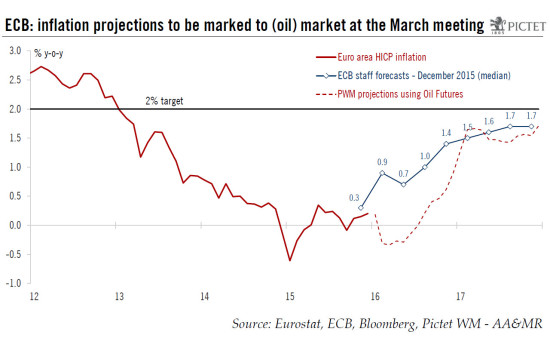

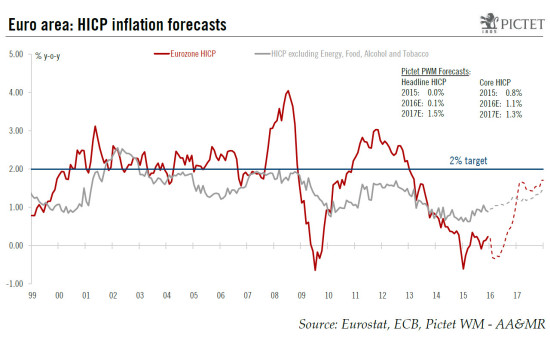

As a result, coming from $40-50 per barrel in H2 2015, the decline in oil prices of roughly 40% that we have experienced since mid-November (the last cut-off date for ECB staff projections) has the potential to reduce euro area HICP inflation by up to 120 percentage points (40% decline x elasticity of 30% x 10% share of the overall HICP index), all else equal. In practice, all else is never equal and even direct oil effects on consumer prices reflect a larger number of factors and transmission channels, depending on the nature of the oil shock (supply vs demand), indirect taxation, the oil-intensity of various sectors, etc. Still, this order of magnitude – a circa 1% drop in overall inflation projections for this year – is broadly in line with the expected revisions to ECB staff projections. Specifically, we expect the median projection for 2016 HICP inflation to be lowered from 1.0% to around 0.1%, in line with our own forecasts (see chart below).

In theory, the ECB should not be influenced by temporary factors but it should instead focus on the potential for indirect effects of commodity prices on non-energy HICP components, most notably those affecting production costs and, ultimately, goods and services prices **. International institutions have put substantial effort into trying to gauge those indirect effects, including the ECB in its monthly bulletin dated from December 2014.

At the time, the ECB concluded that those indirect effects accounted for around one-third of the overall impact of oil on consumer prices. Specifically, based on various models described in a Eurosystem staff study in 2010, a 10% change in oil prices was said to have an approximate 0.2 percentage point impact via non-energy HICP components, on top of direct effects. This would point to a potential 0.8 percentage point drag on core inflation from the last 40% drop in oil prices, on top of everything else.

However, there are good reasons to believe that the actual impact will be much lower this year and next. For a start, the previous ECB studies were conducted when oil prices were hovering around USD60-80 per barrel, before falling below USD50 in 2015. The elasticity of core inflation is likely to be lower at current levels. A weaker exchange rate should help as well in terms of imported inflation, as reflected for instance in the euro area GDP deflator which rose to +1.3% y-o-y in Q3 15.

Moreover, those indirect oil effects have likely declined since the 1980s, as noted by the ECB, owing to structural changes (lower oil-intensity of most economic sectors) as well as changes in wage and price-setting behaviour. In particular, the ECB notes that models accounting for a better anchoring of inflation expectations point to a milder reaction of core inflation to oil prices.

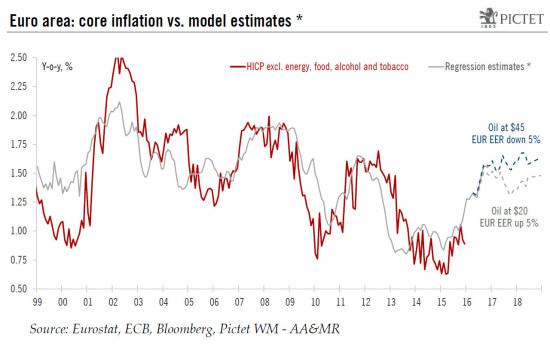

Our own models for core inflation also point to a much weaker pass-through from oil prices to core inflation at the current juncture. In particular, using a simple regression of core HICP controlling for a number of macro and financial variables (the unemployment rate; the EUR nominal effective exchange rate; the World manufacturing PMI index; the Chinese Producer Price Index (PPI) for consumer goods), the coefficient of oil prices is significant (t-stat of -2.8) but relatively weak, at -0.04%. This estimate implies that the latest 40% drop in oil prices would depress euro area core inflation by 0.15% ‘only’. By comparison, our model points to an elasticity of core inflation to the trade-weighted EUR three to four times larger.

*See our post of 18 December 2015

While our actual forecasts for core inflation are more conservative than the above projections, we nonetheless believe that the order of magnitude for those indirect oil effects is closer to the reality than those based on old ECB estimates, which will have to be updated ahead of the March meeting.

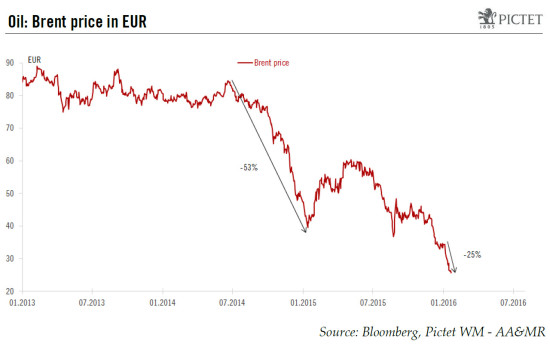

Implications for inflation projections and the ECB

This week’s December HICP data (revised slightly higher to 0.2% y-o-y in the final estimate) confirmed that euro area headline inflation averaged 0% in 2015, the lowest print on record. As regards underlying price pressures, core HICP inflation (excluding energy, food, alcohol and tobacco) ended the year at 0.9% y-o-y. Looking ahead, the renewed weakness in oil prices (-25% since January 2016 in EUR terms) has destroyed most of the favourable base effects, with headline HICP inflation now expected to turn negative again from February to May, if not longer.

As a result, we have lowered our forecast for headline inflation from 1.0% to 0.1% for 2016, assuming a gradual rise of oil prices to USD45 by end-2017 and a EUR/USD exchange rate at 1.09 (albeit reaching a lower point in the meantime). More importantly, the underlying inflation dynamic is likely to remain subdued. Looking at a broad set of underlying price measures, the momentum remains weak. We expect core inflation to rise only gradually, averaging 1.1% in 2016 and 1.3% in 2017.

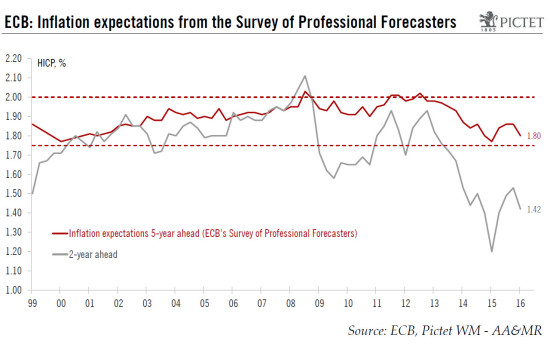

As noted in our reaction piece, the ECB is likely to respond again to rising risks to price stability. We believe that the expectations channel is the one that the ECB is increasingly worried about. The longer headline HICP inflation remains at depressed levels, the higher the risks to inflation expectations. Draghi noted that most measures of inflation expectations were falling (not only the infamous 5y5y inflation swaps) and that those indicators were again more closely correlated to oil prices. Indeed, the Survey of Professional Forecasters released today suggests that survey-based indicators could eventually be affected by the collapse in oil prices. Long-term inflation expectations have fallen back to 1.80%, not far away from their lowest level on record, while the distribution of expectations has further shifted to the downside.

In all, we believe that the ECB, acting as a risk manager for euro area recovery, will ease at its 30 March meeting, including another 10bp deposit rate cut and a EUR20bn increase in the pace of monthly purchases, to EUR80bn a month. A more ambitious package cannot be ruled out in the event of external shocks – the menu of potential surprises includes a larger rate cut, purchases of riskier assets, new TLTROs, the removal of the QE yield floor, or a deviation from the geographical breakdown of bond buying based on capital keys.

**As the ECB notes, indirect oil effects “are also likely to be present in the case of consumer goods and services that are produced with relatively high oil and, more generally, energy intensity, such as some pharmaceutical products and some materials used for household maintenance and repair. Moreover, given the important role of imports as inputs in domestic production processes or as final consumption goods, changes in oil prices may also have indirect effects on euro area inflation if they trigger changes in output prices in the economies of the trading partners.”