By EconMatters We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks extreme monetary...

Read More »The Bank of England and its Contemporaries

In the Journal of Economic Literature, William Roberds reviews Christine Desan’s “Making Money: Coin, Currency, and the Coming of Capitalism” and he provides his own perspective on European monetary history. … the transition of the Bank of England’s notes from the status of experimental debt securities (in 1694) to “as good as gold” (1833) required more than a century of legal accommodation and business comfort with their use. Desan emphasizes England’s traditions of nominalism (as...

Read More »WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but… growth, and inflation, and supply cuts, and growth again… Well that de-escalated quickly… As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th. WTI CrudeWTI Crude - Click to enlarge “The OPEC cuts are going to prevent some of the mega-glut,” said Olivier Jakob, managing director at Petromatrix GmbH in Zug,...

Read More »Healthcare: Inflation Hidden in Plain Sight

Can we be honest and say that many of the reductions in value, quantity and quality are actually instances of fraud? Yesterday, I showed how Consumer Prices Have Soared 160% Since 2001 for everything from burritos to healthcare. This enormous loss of purchasing power is not reflected in the official measure of inflation, which claims inflation is subdued (1% or so annually). But price inflation doesn’t necessarily...

Read More »“Fehldiagnose Secular Stagnation (Secular Stagnation Skepticism),” FuW, 2016

Finanz und Wirtschaft, November 23, 2016. PDF. The diagnosis is far from clear. Nor is the therapy.

Read More »Secular Deflation Fears Are a Thing of the Past

Between November 8 and 9, medium and long-term US Treasury Yield Curve rates increased substantially: Date1 Mo3 Mo6 Mo1 Yr2 Yr3 Yr5 Yr7 Yr10 Yr20 Yr30 Yr 11/01/160.240.350.500.650.830.991.301.611.832.242.58 11/02/160.240.370.510.640.810.981.261.571.812.222.56 11/03/160.240.380.520.640.810.981.261.581.822.252.60 11/04/160.250.380.520.620.800.951.241.551.792.222.56 11/07/160.280.410.540.630.820.991.291.601.832.262.60 11/08/160.280.430.560.710.871.041.341.651.882.292.63...

Read More »Great Graphic: Consumer Inflation: US, UK, EMU

Summary: Price pressures appear to have bottomed for the US, UK, and to a lesser extent, EMU. Rise in prices cannot be reduced solely to the increase of oil. Core prices are also rising. Back in the early post-crisis days, many pundits consumed lots of ink and column inches warning the strong inflationary pressures would be fueled by the orthodox and unorthodox monetary policy. Not only did this not...

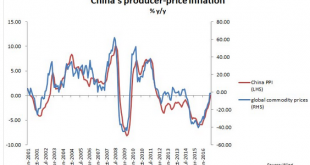

Read More »Great Graphic: China’s PPI and Commodities

Summary: China’s PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China’s PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside. China reported its first increase in producer prices in four years earlier today. As one might suspect, producer prices are often driven by commodity...

Read More »US Election: Status Quo vs. Who Knows?

What politicians say and what presidents do often have little to do with one another. U.S. President Franklin D. Roosevelt, for example, implemented the New Deal a year after the Democratic Party pledged to slash government spending. Still, with the U.S. presidential election fast approaching, the economists on Credit Suisse’s Global Markets team analyzed the campaign promises made to date in the hope of giving investors some sense of what the future might hold. They determined that if...

Read More »Monetarism

At the recent Karl Brunner Centenary event, Ernst Baltensperger characterized Monetarism as a set of five convictions: Money matters (as accepted in the neoclassical synthesis) Rules are preferred over discretion (in contrast to the views of Modigliani, Samuelson or Klein), but some flexibility is accepted Inflation and inflation expectations are key (in contrast to traditional Keynesian views)—adaptive expectation formation, parallels to Phelps Money growth targeting is useful—Brunner...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org