Swiss Franc The Euro has fallen by 0.13% to 1.0619 EUR/CHF and USD/CHF, February 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is one overriding driver today, and that is the incorporation of CAT scan diagnoses of the virus in Hubei, ground-zero. This follows the arrival of WHO officials into China a couple days ago. Not only have the cases jumped, but so did the number of deaths. It plays on fears...

Read More »Inflation, But Only At The Morgue

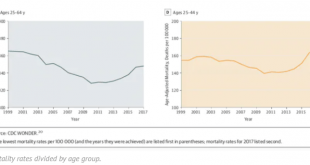

Why is everyone so angry? How can socialism possibly be on such a rise, particularly among younger people around the world? Why are Americans suddenly dying off? According to one study, two-thirds of millennials are convinced they are doing worse when compared to their parents’ generation. Sixty-two percent say they are living paycheck to paycheck, with no savings and no way to get any (though they also tend to “overspend” when compared to other age groups). Worst of...

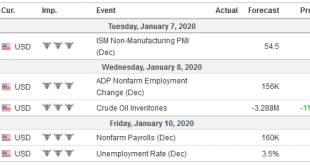

Read More »FX Weekly Preview: High-Frequency Data may Underscore Four Thematic Points

Full liquidity returns to the markets gradually in the coming days, and the week ahead culminates with the US December employment report. The highlights include the service and composite PMI readings, and December eurozone and China’s CPI. The UK reports December PMIs, November GDP, and industrial output figures. While the economic reports may pose some headline risk, the course of events suggests investors will look past the data. How the economies perform in Q1 20...

Read More »Die Inflation wird überschätzt

Die Preise für Essen, Kleidung oder Benzin steigen viel weniger, als die meisten Menschen denken. Woher kommt diese Fehleinschätzung? Entscheidend ist, wer was konsumiert: Wer täglich Auto fährt, spürt Benzinpreisschwankungen stärker als ein Velofahrer. Foto: Christian Beutler (Keystone) Hand aufs Herz: Wissen Sie, wie hoch die Inflation derzeit liegt? Falls nicht, können Sie beruhigt sein. Die Mehrheit der Bürger weiss es auch nicht. Das ergeben Untersuchungen sowohl...

Read More »The End of an Epoch, Report 8 Dec

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” What the heck did John Maynard Keynes mean by saying this? Overturning the existing basis of society?! Let’s begin by stating something that is both obvious and unpopular. We are living in days...

Read More »All Signs Of More Slack

The evidence continues to pile up for increasing slack in the US economy. While that doesn’t necessarily mean there is a recession looming, it sure doesn’t help in that regard. Besides, more slack after ten years of it is the real story. The Federal Reserve’s favorite inflation measure in October 2019 stood at 1.31%, matching February for the lowest in several years. Despite constantly referencing a tight labor market and its fabulous unemployment rate, broad...

Read More »Money and Prices Are a Dynamic System, Report 1 Dec

The basic idea behind the Quantity Theory of Money could be stated as: too much money supply is chasing too little goods supply, so prices rise. We have debunked this from several angles. For example, we can use a technique that every first year student in physics is expected to know. Dimensional analysis looks at the units on both sides of an equation. Money supply is a quantity, a stocks, i.e. dollars or tons in the gold standard. Goods supply is a quantity per...

Read More »Raising Rates to Fight Inflation, Report 24 Nov

Physics students study mechanical systems in which pulleys are massless and frictionless. Economics students study monetary systems in which rising prices are everywhere and always caused by rising quantity of currency. There is a similarity between this pair of assumptions. Both are facile. They oversimplify reality, and if one is not careful they can lead to spectacularly wrong conclusions. And there are two key differences. One, in physics, students know that...

Read More »Where the Phillips Curve is Alive, Contd

In an NBER working paper, Laurence Ball and Sandeep Mazumder question the puzzles of first, missing disinflation and subsequently, missing inflation in the Euro area. From the abstract: … we measure core inflation with the weighted median of industry inflation rates, which is less volatile than the common measure of inflation excluding food and energy prices. We find that fluctuations in core inflation since the creation of the euro are well explained by three factors: expected inflation...

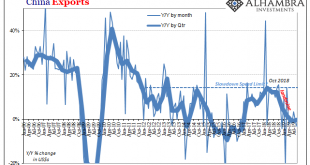

Read More »China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org