The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff. Politics has been front and center recently but...

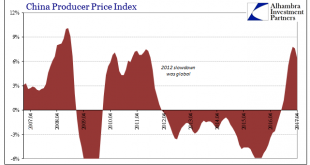

Read More »China Inflation Now, Too

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all....

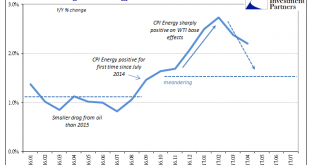

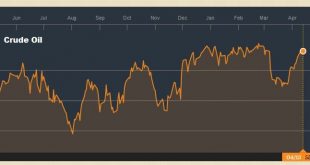

Read More »Inflation Is Oil, But Inflation Is Much More Than Consumer Prices

The average annual change in the WTI benchmark price was in April about 25%. That was still a sizable increase year-over-year, and just marginally less than March’s average of 33%. For calculated inflation rates, it represents the last of the base effects that have to this point made it appear as if economic improvement was possibly serious. CPI Changes On Energy, January 2016 - May 2017 - Click to enlarge Combined...

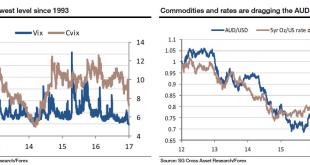

Read More »SocGen: Beware The Ghost Of 1993

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note,...

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More »Die Mär vom inflationsfreien Aufschwung

Unberechenbare Preisentwicklung: Noch ist unklar, ob sich die Situation normalisiert. (Bild: Reuters/ Edgar Su) Die Weltwirtschaft erholt sich in raschen Schritten. Konjunkturauguren revidieren erstmals wieder ihre Wachstumsprognosen nach oben, ein Phänomen, das es seit bald zehn Jahren nicht mehr in dieser Form gegeben hat. Frühindikatoren, wie die Einkaufsmanagerindizes, fallen seit Monaten sehr kräftig aus. Selbst die Unternehmensinvestitionen – lange Zeit das grösste Sorgenkind der...

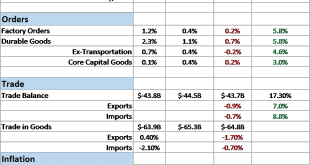

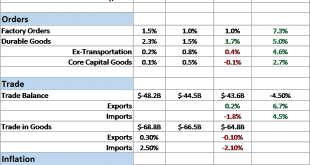

Read More »Bi-Weekly Economic Review

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now. Republicans can’t agree among...

Read More »Decoupling of Oil and US Interest Rates

Summary: US yields have trended lower as oil prices have trended higher. The correlation between the 10-year breakeven and oil has also weakened considerably. Technicals readings are getting stretched, but no compelling sign of a top. Rising oil prices traditionally boost inflation expectations and US interest rates. The May futures contract for light sweet crude oil is up today for the sixth consecutive...

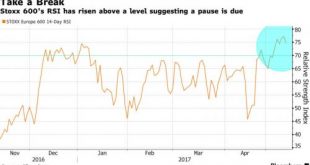

Read More »Saxo Warns Reflation Trade Ends In Q2 With “Healthy Correction”

The reflation trade that started before Donald Trump’s victory in the US presidential elections accelerated in Q1 as global economic data improved and surprised against expectations. Global equities are up 6.5% in dollar terms with markets such as Hong Kong, emerging markets, and Brazil the clear outperformers. In its Q2 2017 Outlook report, Saxo Bank warns that the reflation trade will end in Q2 with a healthy correction in global equities. The biggest perception-versus-reality...

Read More »Deutsche Mark: Eine ironische Geschichte

Ab dem 28. Februar 2002 mussten Händler keine Deutsche Mark mehr annehmen. Foto: Joerg Sarbach (Keystone, AP) Die Bundesbank feiert dieses Jahr ihren 60. Geburtstag – eine Gelegenheit, kurz auf die moderne Geschichte der deutschen Währung zurückzublicken. Im Gegensatz zur schweizerischen Geschichte war sie voller Brüche und endete mit einer ironischen Wendung. Zunächst war die deutsche Währung zweimal ein Misserfolg, und als sie im dritten Anlauf endlich erfolgreich war, wurde das...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org