I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook. On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his...

Read More »Bi-Weekly Economic Review: Extending The Cycle

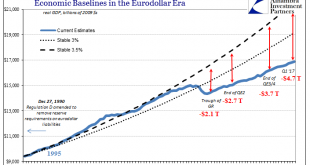

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

Read More »FX Weekly Preview: Don’t Be Confused by the Facts or Why Neither the Data nor the Fed Will Alter Market Trends

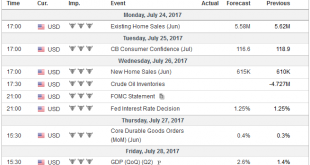

Summary: FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume. The US economy accelerated in Q2. The eurozone economy is enjoying steady growth, but the momentum appears to...

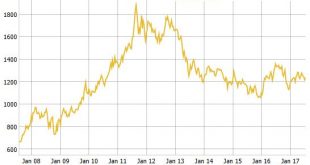

Read More »Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing - Gold hedge against currency devaluation - cost of fuel, food, housing- True inflation figures reflect impact on household spending- Household items climbed by average 964%- Pint of beer sees biggest increase in basket of goods - rise of 2464%- Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%- Gold rises 2672% and hold's its value over 40 years- Savings eaten away by money creation and...

Read More »“Time To Position In Gold Is Right Now” – Rickards

“Time To Position In Gold Is Right Now” – Rickards - "Time to position in gold is right now” - James Rickards- Fed has hit the ‘pause’ button; No more rate hikes for foreseeable future- Fed’s theories "bear no relation to reality" and has "blundered by raising rates"- Growth is weak, inflation is weak, retail sales and real incomes are weak- Tight money, weak economy & stock bubble classic recipe for market crash- Reduce allocations to stocks and reallocate to...

Read More »Competing CPI,PPI, Industrial Production and Retail Sales: No Luck China, Either

Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level. If there’s a country in the world which is really...

Read More »Burkhard Varnholt: “Internet has killed inflation”

Why is inflation so low and what is driving the stock market? Find out here. The world economy is growing and stock markets are rising ever higher. However, inflation and capital market yields remain low. Burkhard Varnholt, Global deputy chief investment officer at Credit Suisse, explains the...

Read More »Inflation. A Loyal Swiss Ally

Switzerland has been classified as one of the happiest countries in the world. Commonly stated reasons for this are the sense of community, beautiful landscapes, fresh air, and clean water. Not to mention prosperity. 'Switzerland: A Financial Market History', by the Credit Suisse Research Institute in partnership with leading experts from the London...

Read More »Global Inflation: Low for Longer

Inflation rates in the advanced and developing economies are showing little upside pressure. Global inflation trends remain quite benign. In most of the major advanced economies, headline inflation peaked in the first quarter once the positive base effects from energy price developments had faded....

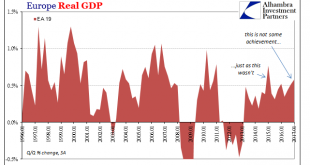

Read More »Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org