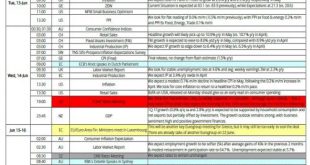

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014. At that time, the BLS in its various data series suggested an almost perfect labor market acceleration...

Read More »Signs of Something, Just Not Wage Acceleration

I have been writing for many years that they really don’t know what they are doing. I only wish it was that simple. There has been developing another layer or dimension to that condition, a second derivative of stupid, whereby when faced with this now well-established fact the same people, experts and authorities all, they have no frame of reference to figure out what next to do. In other words, they really don’t know...

Read More »The Anti-Perfect Jobs Condition

The irony of the unemployment rate for the Federal Reserve is that the lower it gets now the bigger the problem it is for officials. It has been up to this year their sole source of economic comfort. Throughout 2015, the Establishment Survey improperly contributed much the same sympathy, but even it no longer resides on the plus side of the official ledger. So many people may have exited the labor force in May that the...

Read More »Negative Rates: The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other...

Read More »Government Debt with State Contingent Coupons

On VoxEU, Myrvin Anthony, Narcissa Balta, Tom Best, Sanaa Nadeem, and Eriko Togo discuss the history of government debt with state contingent coupons and offer some lessons. In the mid-19th century, the Confederate states issued cotton-linked bonds In the late 1970s, Mexico issued oil-linked bonds In the 2000s, Turkey issued revenue-indexed bonds Since 2014, Uruguay issues nominal wage-issued bonds Some other examples (figure taken from the column): Obviously, confidence in data quality...

Read More »The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other valuables are ramping up their capacity to help cash in on the soaring...

Read More »The Internet Helped Kill Inflation In America, Says Credit Suisse

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen – as he told CNBC two days ago – is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt....

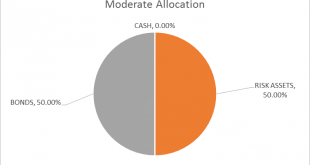

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs. Based on the bond markets there has been little change in the growth and inflation outlook since the last asset allocation update. Based on...

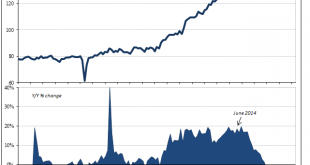

Read More »Staying Stuck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org