Swiss Franc The euro has depreciated by 1.16% to 1.1316CHF. EUR/CHF and USD/CHF, August 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is decidedly mixed. The Swiss franc, not the yen is the strongest of the major currencies. It is up nearly 1.1%. If sustained, it could be the biggest single day dollar loss against the franc this year, edging out more than...

Read More »FX Daily, August 08: Trade Featured as Dollar Drifts Lower

Swiss Franc The euro has depreciated by 0.17 to 1.1451 CHF. EUR/CHF and USD/CHF, August 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended...

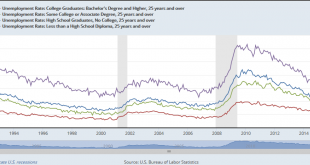

Read More »Great Graphic: Unemployment by Education Level

The US reports the monthly jobs data tomorrow. The unemployment rate stood at 4.4% in June, after finishing last year at 4.7%. At the end of 2015 was 5.0%. Some economists expect the unemployment rate to have slipped to 4.3% in July. Recall that this measure (U-3) of unemployment counts those who do not have a job but are looking for one. There are several other measures, and which one is right depends on what question...

Read More »FX Daily, August 07: Outlaw Mondays

Swiss Franc The Euro has risen by 0.17% to 1.1469 CHF. EUR/CHF and USD/CHF, August 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed to start the new week. Two main developments stand out. First, the dollar-bloc currencies are trading heavily. The Australian dollar is pushing lower for the fifth consecutive session. The greenback is advancing...

Read More »Weekly Speculative Positions (as of August 01): Speculators Press Ahead with Dollar-Bloc Currencies, but Hesitate with Euro and Yen

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Moving Toward September

Summary: The technical and fundamental case for the euro has weakened. Rate differentials have begun moving back in the US favor. France’s Macron and Japan’s Abe have sunk in the polls lower than Trump. The release of the US employment data before the weekend ushers in a three-week period before the Jackson Hole confab at the end of the month that will start the new phase. In September, the FOMC is likely to...

Read More »FX Weekly Review, July 31 – August 05: Second Week of Strong CHF Losses

Swiss Franc vs USD and EUR The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc by 2% during this week. The euro could add another percent in the last days. The EUR/CHF reached 1.1521 after the strong US job figures. Finally, however the euro fell to 1.1451 for two reasons: Profit taking at the end of the week and secondly that...

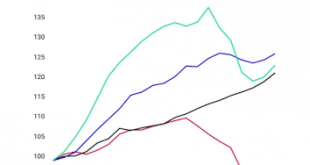

Read More »Great Graphic: Italy-It is Not Just about Legacy

A little while back I was part of a small exchange of views on twitter. It was about Italy. I was arguing against a claim that Italy’s woes are all about its past fiscal excesses. It is not just about about Italy’s legacy. It is true that Italy runs a primary budget surplus. The primary budget surplus has averaged in excess of 2% for nearly two decades. Over this period, Italy debt has soared. I took exception with a...

Read More »Bank of England Crushes Sterling

Sterling reached a new 11-month high against the dollar earlier today, but the dovish take away from the Bank of England has seen sterling reverse lower. It has now fallen below the previous day’s low, and a close below there (~$1.3190) would confirm the bearish key reversal pattern. Support near the week’s low just below $1.3100 is holding, and if that goes, the $1.30 level can be tested. A break of $1.2930, the low...

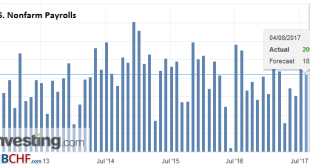

Read More »Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. United States Nonfarm payrolls The 287k nonfarm payroll growth in June (265k private sector) will ease fears that the US is headed for a recession. That type of jobs growth, and the stronger than expected, service sector ISM earlier this week, are not consistent with a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org