Summary: Fundamental driver, divergence is still intact. The dollar’s losses have barely met the minimum retracements of a bull market. Sentiment may be exaggerating the positive developments in Europe and the negative developments in the US. The US dollar is sitting near multi-month lows against the major European currencies and the dollar bloc. Where does this leave our strategic view of the third...

Read More »FOMC Sticks to Script: Balance Sheet Unwind to Begin “Relatively Soon” and USD Retreats

Summary: Little new in FOMC statement. Seems consistent with a Sept announcement to begin reducing the balance sheet in Oct. USD sold off as if reflecting sentiment held in bay until the statement was out of the way. The FOMC statement reads very much like the June statement. There were some minor tweaks in the first paragraph that discusses the broad economic performance since the last FOMC statement. There...

Read More »FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

Swiss Franc The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. EUR/CHF and USD/CHF, July 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The euro finished last week near CHF1.1030 and is now...

Read More »Great Graphic: Surprise-S&P 500 Outperforming the Dow Jones Stoxx 600

Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax...

Read More »FX Daily, July 27: Dollar Remains on the Defensive

Swiss Franc The Euro has risen by 0.82% to 1.1244 CHF. EUR/CHF and USD/CHF, July 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and...

Read More »Progress in St. Petersburg

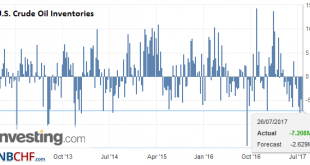

Expectations going into the OPEC monitoring meeting in St. Petersburg were low. The OPEC agreement to reduce output appeared to be fraying. June output appeared to have increased in several countries, and private sector estimates suggest output rose further in July. Russia expressed reluctance to extend the agreement further. Ecuador announced it would no longer participate in the output restraint. Hopes that...

Read More »FX Daily, July 26: Quiet Fed Day without Yellen

Swiss Franc The euro is up by 0.56% to 1.1152 CHF EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month’s rate hike, there is practically no chance of a new policy initiative either on the balance sheet...

Read More »FX Daily, July 25: Summer Markets Ahead of FOMC

Swiss Franc EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets are subdued today; a dearth of fresh news and tomorrow’s FOMC meeting are making for light activity and limited price movement. The US dollar is little changed against most of the major currencies. The net change on the day through most of the European...

Read More »FX Daily, July 24: Euro Recovers from Softer Flash PMI

Swiss Franc The Euro has fallen by 0.17% to 1.1009 CHF. EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a...

Read More »Weekly Speculative Positions (as of July 18): Speculators short CHF against USD again

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org