Swiss Franc The euro has depreciated by 1.16% to 1.1316CHF. EUR/CHF and USD/CHF, August 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is decidedly mixed. The Swiss franc, not the yen is the strongest of the major currencies. It is up nearly 1.1%. If sustained, it could be the biggest single day dollar loss against the franc this year, edging out more than 1% losses on January 5 and May 16. The dollar was sold against the yen yesterday, finished the North American session on its lows, and proceeded to sell-off further in Asia. The dollar hit a low near JPY09.60 in the European morning and appears poised to recover. JPY110.00-JPY110.20 which had been

Topics:

Marc Chandler considers the following as important: CHF, China, China Consumer Price Index, China Producer Price Index, EUR, EUR/CHF, FX Daily, FX Trends, GBP, Italy Industrial Production, JPY, Korea, newslettersent, Oil, TLT, U.S. Crude Oil Imports, U.S. Crude Oil Inventories, U.S. Nonfarm Productivity, U.S. Unit Labor Costs, USD, USD/CHF

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Swiss FrancThe euro has depreciated by 1.16% to 1.1316CHF. |

EUR/CHF and USD/CHF, August 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

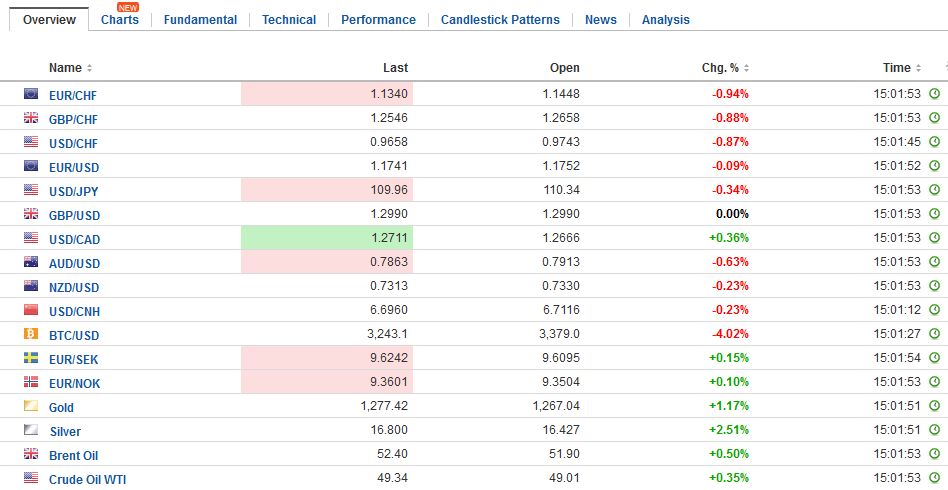

FX RatesThe US dollar is decidedly mixed. The Swiss franc, not the yen is the strongest of the major currencies. It is up nearly 1.1%. If sustained, it could be the biggest single day dollar loss against the franc this year, edging out more than 1% losses on January 5 and May 16. The dollar was sold against the yen yesterday, finished the North American session on its lows, and proceeded to sell-off further in Asia. The dollar hit a low near JPY09.60 in the European morning and appears poised to recover. JPY110.00-JPY110.20 which had been supporting now may act as resistance. We note that there is about $1.3 bln dollar of options struck between JPY109.75 and JPY110.00 that expire today. The MSCI Asia Pacific Index was off 0.4% today. It has risen once in the past five sessions. The Nikkei suffered a slightly larger decline than the Kospi (-1.3%). The rising yen (the dollar sold through JPY110) may have also weighed on Japanese equities. The Nikkei has fallen for the past three weeks and has posted a decline in five of the past six weeks. |

FX Daily Rates, August 09 |

| The bellicose rhetoric from the US and North Korean officials is the main driver today. We would qualify that assessment by noting that first, the market moves are rather modest, suggesting a low-level anxiety among investors. Second, pre-existing trends have mostly been extended.

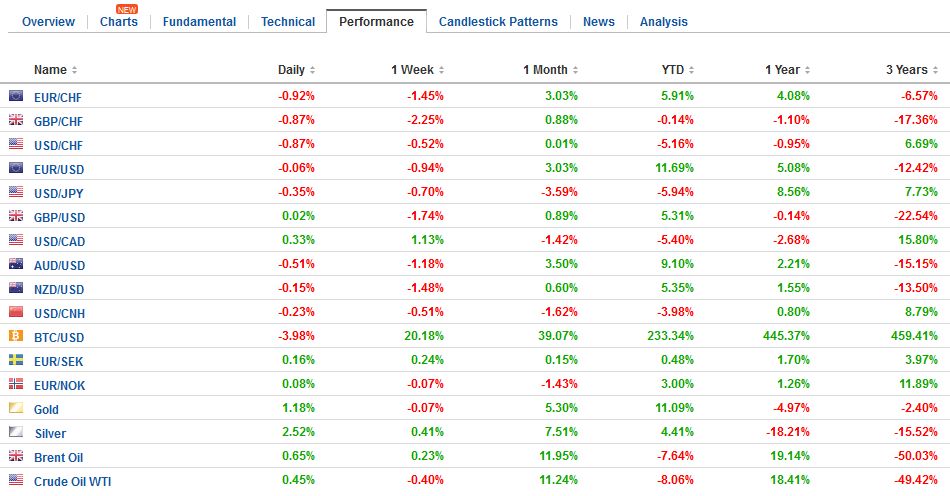

Turning to Asia first, the Korea’s equity market fell 1.1%. The Kospi has fallen for the past two weeks (~2.2%). Through July it was up eight months in a row. However, as we had noted previously, foreign investors had begun taking some profits since July. In the first six months of the year, foreigners bought nearly $9 bln worth of Korean equities, and here in Q3, they have sold almost $1 bln. The Korean won fell 0.9% today. The US dollar has edged 0.6% higher against the won over the past two weeks. The dollar fell 2.2% against the won in July. The euro held yesterday’s low near $1.1720, but the upside appears blocked by the $1.1760-$1.1770 area. There are around 1.2 bln euros of options struck between $1.1700 and $1.1725 that expire today. The euro is up four consecutive weeks coming into this week’s session. After the healthy US jobs data, widening of interest rate differentials, and the sharp fall in Macron’s support in France, coupled with the overstretched technical indicators warned of the risk of a euro setback. Thus far the euro’s pullback is minor. A break of $1.1680 would likely be needed to signal another leg lower. Should the euro’s losses be sustained, it would be the first back-to-back fall in the euro since July 12-13. |

FX Performance, August 09 |

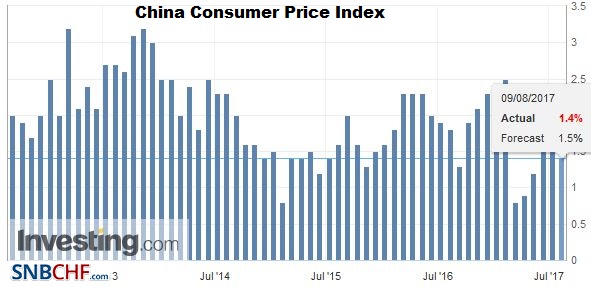

ChinaThere have been two economic reports to note. First was China’s July inflation readings. July consumer prices eased to 1.4% year-over-year from 1.5%. Food prices fell 1.1%, while non-food prices rose 2.0%. On the month, CPI rose 0.1%. |

China Consumer Price Index (CPI) YoY, July 2017(see more posts on China Consumer Price Index, ) Source: investing.com - Click to enlarge |

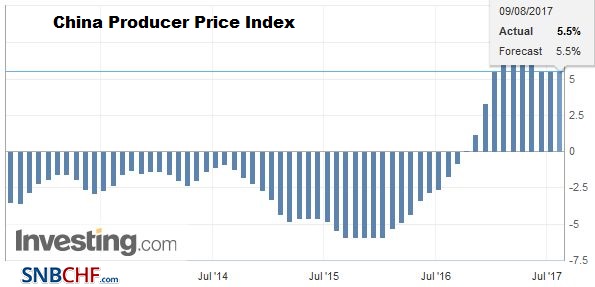

| Producer prices remained at 5.5% for the third month. |

China Producer Price Index (PPI) YoY, July 2017(see more posts on China Producer Price Index, ) Source: investing.com - Click to enlarge |

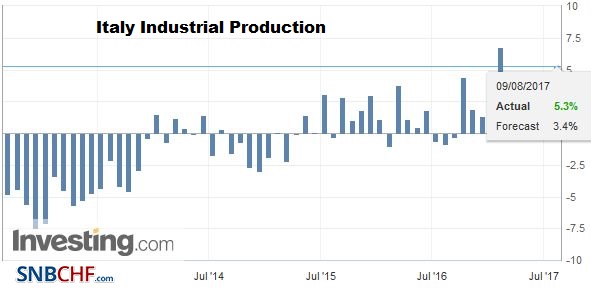

ItalySecond, Italy reported a considerably stronger than expected June industrial production report that will lift expectations for Q2 GDP, which will be reported in a week’s time (0.4-0.5%?). Flattered by transportation and energy, Italian industrial output jumped 1.1% in June. The market had been looking for around a 0.2% gain. It follows a 0.7% rise in May. Industrial production rose an average of 0.5% a month in Q2 after falling 0.3% a month in Q1. Q3 comparisons may be difficult as last year Italy posted some strong increases. Still, the favorable news follows on the heels of better than expected employment and retail sales data. |

Italy Industrial Production YoY, June 2017(see more posts on Italy Industrial Production, ) Source: investing.com - Click to enlarge |

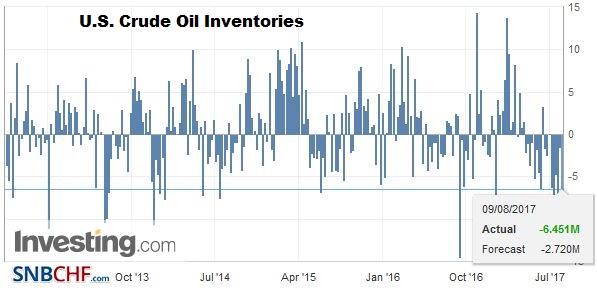

United StatesLate yesterday, API reported a sharper than expected drop in US oil inventory. |

U.S. Crude Oil Inventories, August 09 2017(see more posts on U.S. Crude Oil Inventories, ) Source: investing.com - Click to enlarge |

| The nearly 7.9 mln barrel draw down contrasts with expectations for around a 2.2 mln barrel decline. The EIA (DOE) estimate today will be looked upon for confirmation. |

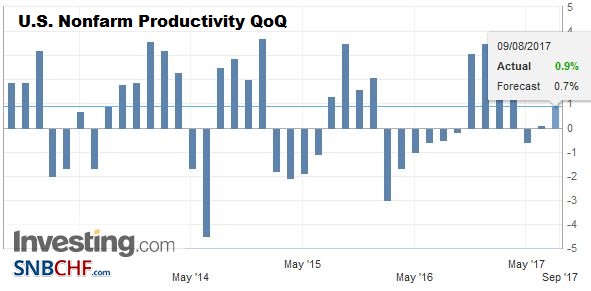

U.S. Nonfarm Productivity QoQ, Q2 2017(see more posts on U.S. Nonfarm Productivity, ) Source: investing.com - Click to enlarge |

| For the sixth session running, the September light sweet crude oil futures contract looks to trade comfortably between $48 and $50 a barrel. |

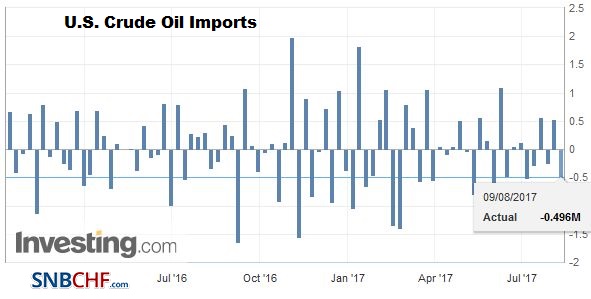

U.S. Crude Oil Imports, August 09 2017(see more posts on U.S. Crude Oil Imports, ) Source: investing.com - Click to enlarge |

| US does report Q2 unit labor costs and productivity. These are derived from the Q2 GDP estimate and are not independently observed. |

U.S. Unit Labor Costs QoQ, Q2 2017(see more posts on U.S. Unit Labor Costs, ) Source: investing.com - Click to enlarge |

The price of gold has risen 0.6% today on top of yesterday’s 0.25% rise. It had fallen 0.9% last week, which ended a three-week advance. The price of gold is up $10 an ounce this week and $27 an ounce since the end of Q2.

European shares are lower as well today, with the Dow Jones Stoxx 600 off 0.65% in late morning turnover in Europe. The benchmark rallied 1.1% last week, though it had lost 3.1% in the back-to-back decline in June and July. Financials and materials are the hardest hit today, but all sectors are lower.

Bond yields are lower. European 10-year benchmark yields are mostly 3-4 bp lower, while the US 10-year yield is off two bp to dip below 2.24%. Among two-year tenors, the demand for Germany is clear, with the yield off nearly three basis points to 70 bp. Spanish and Italian two-year yields are 1-2 bp higher.

Sterling closed below $1.30 yesterday for the first time since July 21. It fell to almost $1.2950 yesterday but seems content to consolidate today. It moved above $1.30 again in late Asia but is trying to build on those gains in Europe. Resistance is pegged near $1.3040-$1.3060. We note that the five-day moving average is falling through the 20-day average for the first time since late June today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CHF,$EUR,$JPY,$TLT,China,China Consumer Price Index,China Producer Price Index,EUR/CHF,FX Daily,Italy Industrial Production,Korea,newslettersent,OIL,U.S. Crude Oil Imports,U.S. Crude Oil Inventories,U.S. Nonfarm Productivity,U.S. Unit Labor Costs,USD/CHF