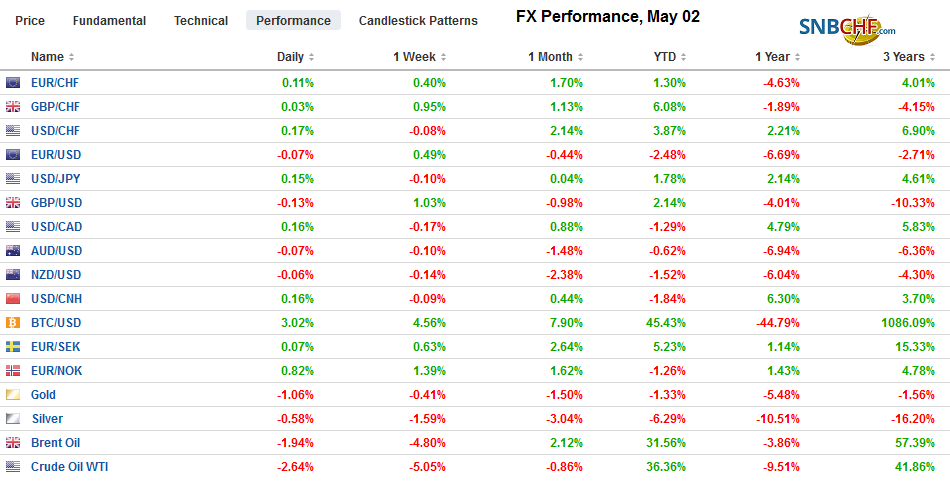

Swiss Franc The Euro has risen by 0.07% at 1.1402 EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is consolidating yesterday’s post-Fed rally, and this is giving it a slightly heavier tone today. Equities are mostly lower and Europe’s Dow Jones Stoxx 600 is off about 0.5% in late morning turnover, which if sustained would be the largest decline in three weeks. The S&P 500 posted a potential key reversal yesterday by setting new record highs and then closing below the previous session’s low. Benchmark 10-year bond yields are mostly a couple basis points firmer, though Italian bonds are the exception. A stronger than

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Bank of England, Brexit, Eurozone Manufacturing PMI, Featured, Federal Reserve, FX Daily, Germany Manufacturing PMI, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.07% at 1.1402 |

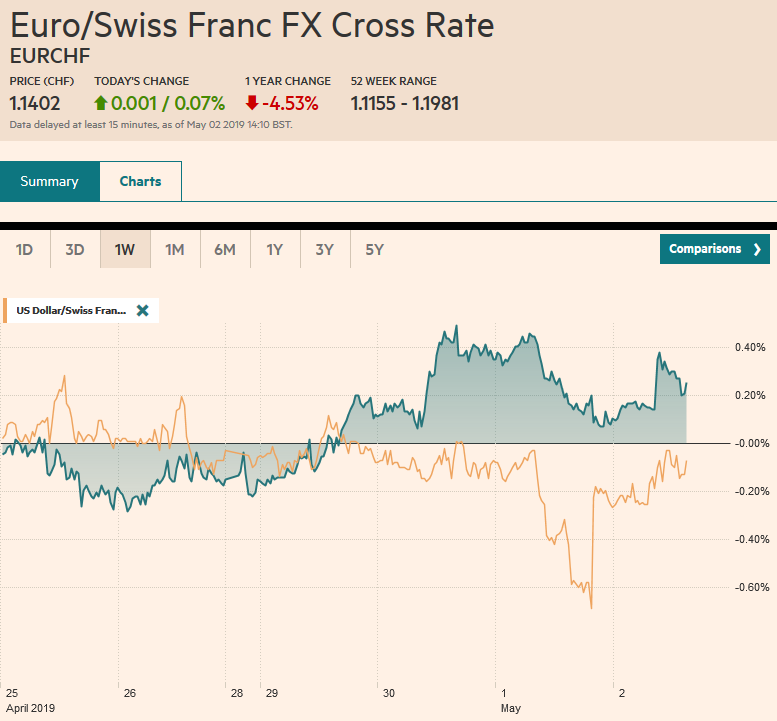

EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar is consolidating yesterday’s post-Fed rally, and this is giving it a slightly heavier tone today. Equities are mostly lower and Europe’s Dow Jones Stoxx 600 is off about 0.5% in late morning turnover, which if sustained would be the largest decline in three weeks. The S&P 500 posted a potential key reversal yesterday by setting new record highs and then closing below the previous session’s low. Benchmark 10-year bond yields are mostly a couple basis points firmer, though Italian bonds are the exception. A stronger than expected manufacturing PMI appeared to spur demand. Meanwhile, press reports seem to be playing up the possibility that a Brexit agreement between Labour and the government and a US-China trade deal may be struck in a week. |

FX Performance, May 02 |

Asia Pacific

Chinese and Japanese markets are closed and will remain so tomorrow. China’s markets reopen on after the weekend while Japan’s markets will be closed on Monday. Heightened speculation that the Reserve Bank of New Zealand may deliver a rate cut next week appeared to lift local shares 1.2% to lead the region. The manufacturing PMI among developing Asia were mixed. Of note, South Korea’s reading rose to 50.2 from 48.8, while Taiwan’s eased to 48.2 from 49.0. Indonesia reported a tick up in inflation (2.83% from 2.67%), but the focus on the MSCI decision to drop PT Bank Danamon Indonesia from its index, which triggered a sell-off that push the Jakarta Composite (-1.2%). Note that Japan’s Mitsubishi UFJ has a majority stake in the bank. On the other hand, S&P upgraded the Philippines credit rating one-notch to BBB+. The benchmark 10-year bond yield fell six basis points (to ~5.80%). The currency edged higher and as did shares.

In recent days, reports have suggested that the US has softened its position in trade talks with China on patents for biologics and on cyber espionage. Reports also indicated that if a deal is not wrapped up later this month, President Trump may lose his interest. The reports give a sense that the Trump Administration wants a deal and soon. China’s Vice Premier will be in Washington next week. There is the hope that this is the last round before a date for a meeting between Trump and Xi is announced. The media built up market expectations in the past for such an announcement, but now the timeframe may be a bit more compelling.

Today is the first session in six that the dollar has risen above the previous day’s high against the Japanese yen. It has traded a little through JPY111.65. So far, it has stopped shy of the 20-day moving average and the 50% retracement of the drop since the year’s high was recorded (~JPY112.40) on March 25. Both are found near JPY111.70, and above there, another push on JPY112.00 is likely. Before that though, the JPY111.50 level houses an $850 mln expiring option and may be sticky. The Australian dollar fell back to nearly $0.7000 in the greenback’s post-Fed rally yesterday. Last week’s low was set slightly below $0.6990. It would make a technically more compelling case of a resumption of the US dollar’s uptrend if the Aussie were sold through there. Without the break, near-term consolidation is likely. The week’s high was set just below resistance we identified near $0.7070.

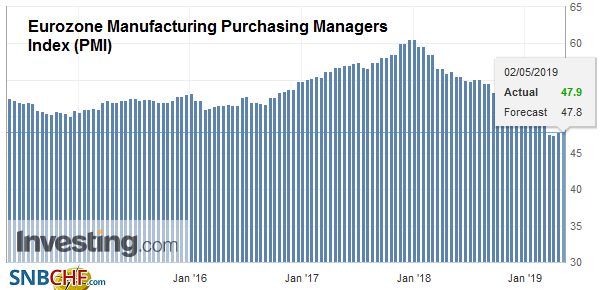

EuropeThree of the four largest eurozone countries reported stronger than expected April manufacturing PMI. German was the exception. France’s flash PMI of 49.6 was revised to 50.0, and this follows a 49.7 reading in March. Spain’s PMI increased to 51.8 from 50.9, and Italy’s rose to 49.1 from 47.4. For the EMU as a whole, the PMI ticked up to 47.9 from the 47.8 flash report. It was at 47.5 in March. It is the first increase since last July, which was the only time it increased in 2018. |

Eurozone Manufacturing Purchasing Managers Index (PMI), April 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

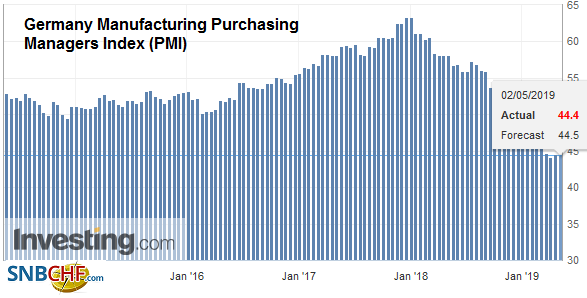

| German disappointed. The depressed flash estimate of 44.5 was revised to 44.4. It was at 44.1 in March. |

Germany Manufacturing Purchasing Managers Index (PMI), April 2019(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

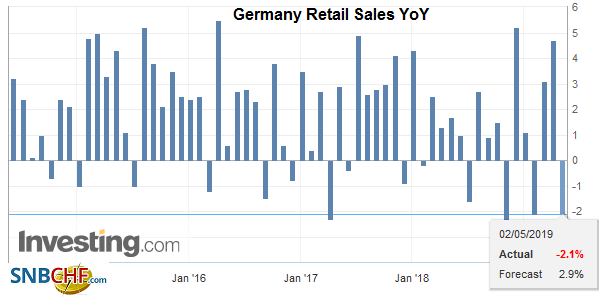

| Adding to its woes, March retail sales declined by 0.2%. Although this was not as large of a decline as feared (-0.5%), the downward revision in February figures (0.5% instead of 0.9%) brings the year-over-year pace to -2.1% from a revised 4.4%. The data can only increase the calls on Germany to provide more fiscal stimulus, most vocally by those who are larger debtors than Germany. Financial stability reports and the commentariat class often underscore the risks of Italian debt and/or bank bad loans. Italy’s condition is worrisome, but it is chronic (not acute), and few are in denial. A likely candidate for disruption is not that which is plain sight, and everyone and their sister is looking at. Rather than the periphery, we would argue, EMU’s biggest immediate challenges are in the core. |

Germany Retail Sales YoY, March 2019(see more posts on Germany Retail Sales, ) Source: investing.com - Click to enlarge |

There are three talking points about the UK. First, the BOE meets and issues its quarterly inflation report, which updates its forecasts. In this digital age, to say the BOE is on hold adds little. The market has gone out another “decimal point.” It is reasonable to anticipate a hawkish hold. Perhaps, we could add even another “decimal point,” we might consider it to be a less dovish hold. The extension of Brexit allows economic forces to push back into considerations. There is some risk that there is a dissent (Saunders?), which even though maybe only one, underscores the slight tilt.

Second, reports are playing up the progress between the government and Labour, and there is some optimism that a deal could be reached by the end of next week. If true and can pass parliament, the UK could avoid participating in the EU elections at the end of the month. However, if it falls through, it is not clear where the UK goes next, but it would seem increasingly difficult to May to remain Prime Minister.

That is a nice segue for the third point: today’s local elections. Around 8000 local council seats are up, and most are in Conservative hands. The question is how many will they lose and who will be the biggest beneficiary. Some estimates suggest the Tories could lose 400-800 seats and the Lib Dems may be the biggest beneficiary rather than Labour.

The euro reversed lower yesterday though Mr. Powell did not sell a single one. It closed below $1.12 after being as high as $1.1265. The candlestick pattern looks like a potential shooting star (bearish), but there has been no follow-through selling, though some participants may be waiting now for tomorrow’s US jobs report. Expiring options may also impact the price action. There is a 1.2 bln euro option at $1.12 and almost 1.5 bln euros in options struck between $1.1225 and $1.1235. There is an option for 1.5 bln euro at $1.12 that will be cut tomorrow too. Sterling poked through $1.31 yesterday for the first time in two weeks. It is consolidating now but yesterday’s reversal on the Fed was not nearly as dramatic as the euro’s. Mote that the five-day moving average is likely to cross above the 20-day average today or tomorrow for the first time in over a month. This is a rule of thumb metric and proxy for some short-term trend following systems.

America

There are two important takeaways from the FOMC’s meeting. First, the Fed’s understanding of inflation is evolving. Previously Powell said that low inflation is “one of the major challenges of our time.” Now, Powell says that the recent weakness in inflation may be transitory. Of course, this is what the Fed’s March forecasts showed, but putting it into words had an impact. This, more than anything else, seems to explain the nearly 12 bp increase in the two-year note yield and sparked the dollar’s recovery as well. Considering the decline in inflation to be a short-run phenomenon puts some teeth in the Fed’s claim that the current policy setting is appropriate and it can be patient. This seems to be a firm push back against market expectations, and White House calls for a rate cut.

Second, the Fed announced a five basis point reduction in the interest rate on reserves (excess and required reserves) to 2.35% The effective average fed funds rate has crept through the interest on reserves, which should be the cap. It was five basis points above at the end of April. Recall in H2 18, the Fed raised the fed funds target by 50 bp but hiked interest on reserves by 40 bp. This was to ensure that the effective fed funds rate stays below the top of the corridor system (range rather than a point target). The Fed assured investors and businesses that the “cut in interest on reserves does not reflect any shift in the intended stance of monetary policy.” Is that true in the sense that it is not an easing? In an op-ed piece earlier this week, former NY Fed President Dudley argued that the Fed should consider jettisoning the fed funds target as the interest on reserves is the key. Separately, it is ironic that the Fed said the same thing about reducing its balance sheet–that there was not monetary signal–and yet so many pushed back against it.

We recognized that a cut in interest on reserves was a distinct possibility, but we thought after trying this approach two other times with little success, and not wanting to send conflicting messages to investors, the Fed was going to try something different. We thought it was more likely to launch a new repo facility to inject reserves into the system, just like it defends the lower end of the range with reverse repos. We are skeptical then that the five basis point move will provide any more of a durable cap than the earlier two adjustments. It might just buy time to work out the new repo facility, which Powell indicated remains under review.

The US dollar is little changed against the Canadian dollar. It is in tight ranges as yesterday’s gains are consolidated. The three drivers we emphasis in US-CAD exchange rate are short-term interest rate differentials, oil prices, and a function for risk (equities). Canada could not keep pace with the jump in US rates yesterday. Record US output and a larger than expected rise in US oil inventories is weighing on crude prices. The S&P 500 reversed lower after rising to new intrasession record highs. The near-term downtrend is found near CAD1.3455 today. Yesterday’s high was just above CAD1.3460. A move above this area could lift the greenback’s tone ahead of tomorrow jobs data. The dollar could hardly resurface above MXN19.00. Initial support is seen near MXN18.90 now. Mexico reports PMI today. Meanwhile, although Mexico has passed labor market reforms required by the new free trade agreement, Canada’s parliament and, possibly, the US Senate, will not take up the deal unless the Trump Administration lifts the steel and aluminum tariffs.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: Bank of England,Brexit,Eurozone Manufacturing PMI,Featured,Federal Reserve,FX Daily,Germany Manufacturing PMI,newsletter