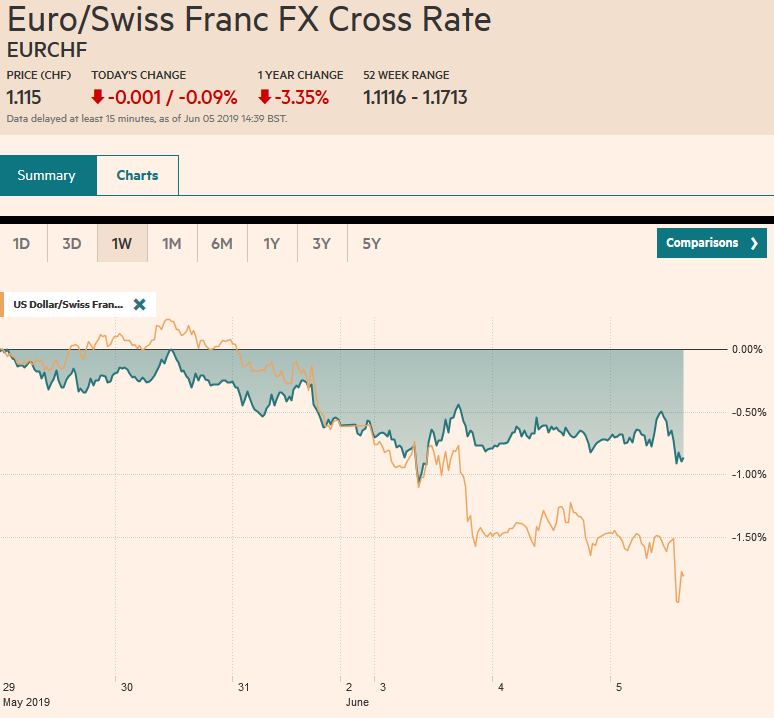

Swiss Franc The Euro has fallen by 0.09% at 1.115 EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve’s patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has some tempering of trade anxiety on the margin that is also constructive. Asia and European equities were pulled higher after the strongest rally in several months in the US. The Nikkei gapped higher, leaving a two-day island in its wake, after gapping lower on Monday. Chinese shares were narrowly mixed.

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, China Caixin Services PMI, Eurozone Markit Composite PMI, Eurozone Services Purchasing Managers Index, Featured, Federal Reserve, Germany Composite PMI, newsletter, trade, U.K. Services PMI, U.S. Markit Composite PMI, U.S. Services PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.09% at 1.115 |

EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The Federal Reserve’s patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has some tempering of trade anxiety on the margin that is also constructive. Asia and European equities were pulled higher after the strongest rally in several months in the US. The Nikkei gapped higher, leaving a two-day island in its wake, after gapping lower on Monday. Chinese shares were narrowly mixed. The Dow Jones Stoxx 600 is advancing for the third consecutive session and is near the 20-day moving average, which it has not closed above in a month. US shares are trading higher, and the S&P 500 could also gap higher after yesterday’s strong close. Most benchmark yields are a little softer, including the US 10-year yield that is now near 2.12%. The dollar is softer against all the major currencies with the sole exception being the Japanese yen, which is trading quietly within yesterday’s range. The euro is edging closer to $1.13, which it has not seen since late April. |

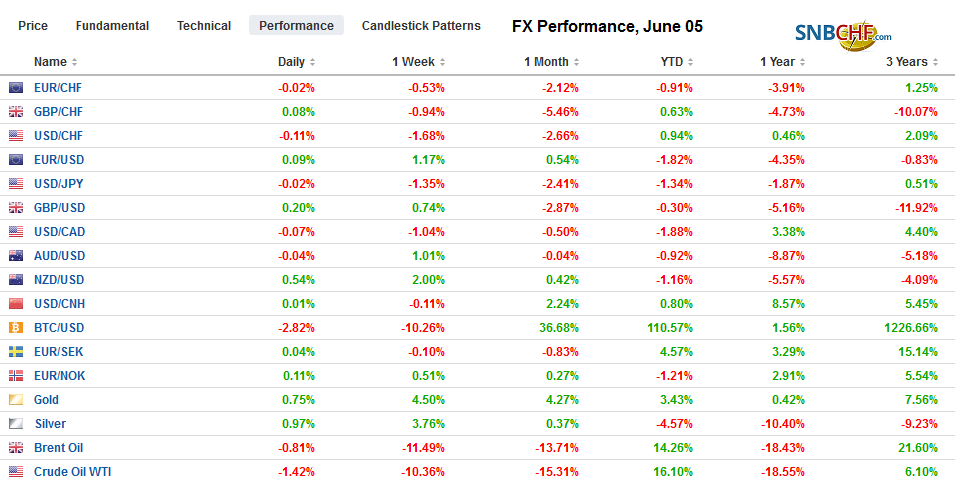

FX Performance, June 05 |

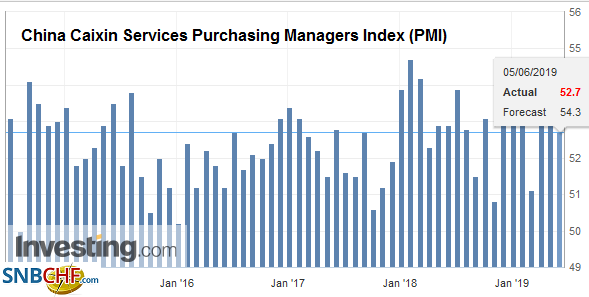

Asia PacificUS Treasury Secretary Mnuchin and People’s Bank of China Governor Yi Gang will meet this weekend at the G20 finance ministers meeting in Japan. This will be the first meeting of officials since Trump’s tweets announced the end of the tariff truce a month ago. Both men are seen to be among the free-trade or liberal (meaning market-oriented) wings of their respective governments. Recall, Mnuchin had worked out a trade agreement with his counterparts a year ago that Trump rejected. The comments that will emerge will likely be calming for investors even though the impact either has on shaping the trade position of their respective governments is questionable. Separately, China has fined Ford’s JV CNY163 mln ($23.5 mln) for anti-trust violations in another parry. Also, China appears to have stepped up the inspection of beef imports from Canada in the low-level conflict between the two countries that was sparked by Canada’s cooperation with the US on the arrest of the Huawei executive earlier this year. The main economic data from the region included Australia’s Q1 GDP. At 1.8% year-over-year, it was in line with expectations but is the slowest since Q3 09. On the other hand, the 0.4% quarterly expansion was the strongest since Q2 18. China Caixin non-manufacturing and composite PMI readings eased (52.7 from 54.5 and 51.5 from 52.7, respectively. Japan’s non-manufacturing and composite PMI for May also slipped (51.7 from 51.8 and 50.7 from 50.8. |

China Caixin Services Purchasing Managers Index (PMI), May 2019(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

The dollar remains in its trough against the yen. It has mostly held above JPY108.00 but has remained below the Monday-Tuesday high of JPY108.40-JPY108.45. There are options for nearly $1.2 bln in the JPY108.50-JPY108.55 range that expire today and $450 mln at JPY108.75. There are also options at JPY108.30 for almost $775 mln. The Australian dollar, despite yesterday’s rate cut and expectations for a follow-up cut in Q3, is poking through $0.7000 for the first time since mid-May. There is an option struck there for around A$560 mln that will be cut today. The intra-day technical readings are getting stretched, and the Aussie may struggle to overcome the $0.7020-$0.7030 area. The dollar remains in tight ranges around CNY6.90-CNY6.91.

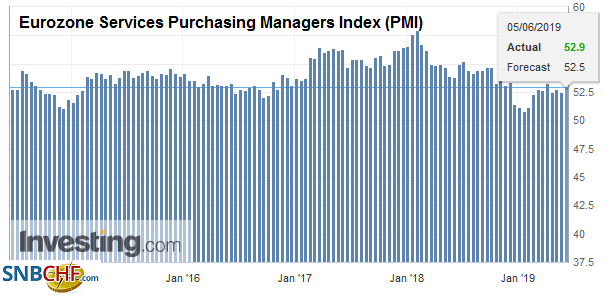

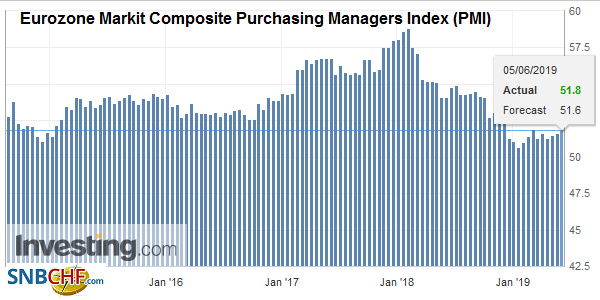

EuropeThe eurozone services PMI and the composite ticked up from the flash readings. The service PMI rose to 52.9 from 52.5 (flash) and edged up April’s 52.8. |

Eurozone Services Purchasing Managers Index (PMI), May 2019(see more posts on Eurozone Services Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

| The composite rose to 51.8 from 51.6 (flash) and 51.5 in April. |

Eurozone Markit Composite Purchasing Managers Index (PMI), May 2019(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

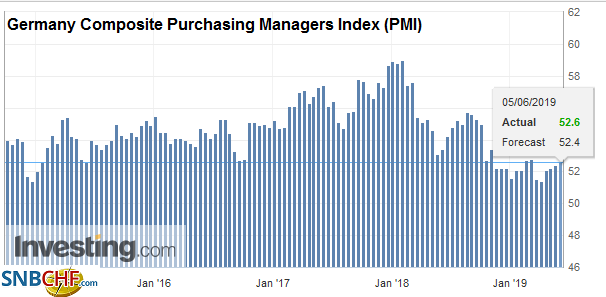

| German flash readings were revised higher, and at 52.6, the composite is at a three-month high. French flash estimates were shaved, but at 51.2, the composite remains at the high of the year. Italy’s composite edged up, but at 49.9, it is not yet back into expansion territory. Spain’s service and composite readings slipped from April, as the economy appears to have lost some momentum. Spain’s composite of 52.1 represents a new cyclical low. Separately, note that April EMU retail sales fell 0.4% for a 1.5% year-over-year gain, which was in line with expectations. |

Germany Composite Purchasing Managers Index (PMI), May 2019(see more posts on Germany Composite PMI, ) Source: investing.com - Click to enlarge |

| UK Prime Minister May will step down shortly, and the Tory Party has expedited the leadership challenge to find her replacement. The new rules aim to have the new leader in place by the third week in July. The new Tory leader becomes Prime Minister but heads a minority government. The key is whether the DUP continues to support it even if the new Prime Minister is willing to leave the EU without an agreement.

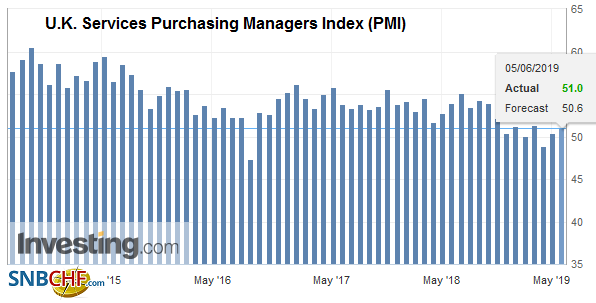

The euro is extending its advance for a fourth session against the US dollar. Such a streak has not been seen since late March. The euro is approached stalled in the European morning near $1.1290, fully retracing 38.2% of this year’s decline. The $1.1325 area is the next hurdle, represented by the mid-April highs and $1.1340, which is the 50% retracement objective. Sterling’s advance has also carried into the fourth successive session. It is poking through $1.27 for the first time since May 27, when it reached $1.2750, which also corresponds to the 20-day moving average today. Support is seen in the $1.2680-$!.2700 area. |

U.K. Services Purchasing Managers Index (PMI), May 2019(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

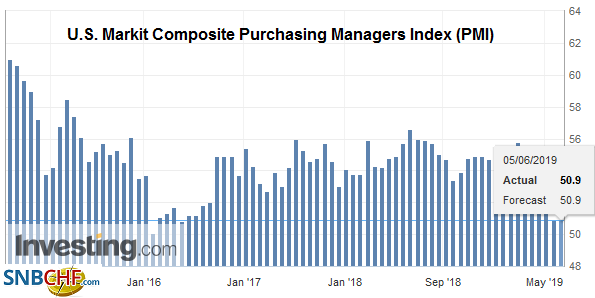

AmericaFederal Reserve Chair Powell communication style is evolving. He did not appear tone-deaf as some of his critics have claimed. He indicated a willingness to cut rates if needed to sustain the expansion, “with a strong labor market and inflation near our symmetric 2% target.” But it did not seem that his patience was running as thin as say Bullard’s, based on yesterday’s comments. We noted that Kashkari, also seen as a dove, does not think a cut is warranted now. Chicago Fed President Evans, who hosted the event that Powell spoke at, and is also seen one of the more dovish members, recognized that inflation was a bit low, the fundamentals and the consumer were “solid.” Some suggest that Powell comments may have sparked a “buy the rumor sell the fact,” but this would imply that 1) Powell pivoted again and 2) that Powell has become more dovish that Kashkari and Evans, which seems like a stretch. The Beige Book is likely to reinforce the idea that economic activity remains moderate and labor market robust. The impact of the tariffs on the goods-producing sector will be of key interest to investors. The ADP private sector jobs estimate steals some of the thunder from the non-farm payroll report. It is expected to show a moderation to around 185k jobs from 275k in April. |

U.S. Markit Composite Purchasing Managers Index (PMI) , May 2019(see more posts on U.S. Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| Allow us to offer an alternative explanation, one that can explain the backing up of yields, the biggest rise in the S&P 500 since January, the strength of the carmakers, and the biggest gain in the Mexican peso in two months. The tariffs on Mexico may not be implemented. Mexico’s foreign minister assessed the probability of an agreement that will deter the US from imposing 5% tariffs on all imports from Mexico in less than a week. If Powell or Evans did not speak, but investors downgraded the risk of imminent tariffs on all goods from Mexico, the market reaction would have likely been the same or similar. Trump has been broadly criticized for the action, including by some Republicans in the Senate. It has sparked some talk of Congress trying to re-take the authority it had surrendered to the executive, and possibly over-rule the President’s claim of emergency powers to impose the tariff on Mexico. If no tariffs are imposed on Mexico, is it a case of no harm, no foul, like in a basketball game? We are suspicious that the threat is sufficient to create some doubts, or to say the same thing, expose some risks, that might not have been there or perceived previously. That an agreement is struck does not prevent a repeat of this in other circumstances. |

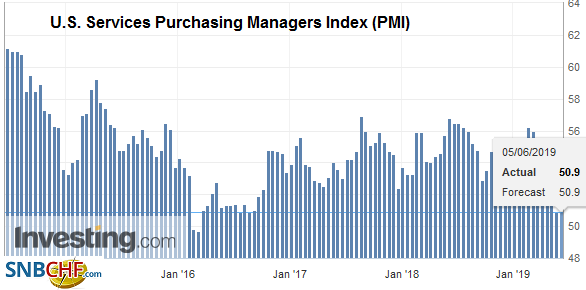

U.S. Services Purchasing Managers Index (PMI), May 2019(see more posts on U.S. Services PMI, ) Source: investing.com - Click to enlarge |

The S&P 500 rally closed two upside gaps (last Wednesday and Friday’s sharply lower openings) with yesterday’s surge. Trump’s tweets threatening tariffs on Mexico send the S&P 500 through the 200-day moving average. It rallied back through it (~2775). However, three levels may help divine whether the three-legged decline since the record high on May 1 that retraced almost to the tick 38.2% of the rally from the end of last year’s lows is complete: 2815 is a (38.2%) retracement objective of decline since the record. Above there is a gap from the lower opening on May 23. The bottom of it is near 2841.50, which is also the 50% retracement of the drop since the start of last month. The top of the gap is a little above 2851. The S&P 500 is poised to gap higher today.

The US dollar finished last week above CAD1.35 and now has broken below CAD1.34. Last month’s low was a little below CAD1.3360. Rising equities and the broader weakness in the US dollar are the main drivers, though as we have noted, the two-year interest rate differential has moved steadily in Canada’s favor. The US offered a premium of 85 bp in early March. The premium is around 45 bp now, the lowest since April 2018. The US dollar reached nearly MXN19.88 at the start of the week and tested MXN19.50 today. The MXN19.46 area corresponds to a 50% retracement of the tariff-threat induced dollar-surge. Below there, the next retracement (61.8%) is near MXN19.36.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,China Caixin Services PMI,Eurozone Markit Composite PMI,Eurozone Services Purchasing Managers Index,Featured,Federal Reserve,Germany Composite PMI,newsletter,Trade,U.K. Services PMI,U.S. Markit Composite PMI,U.S. Services PMI