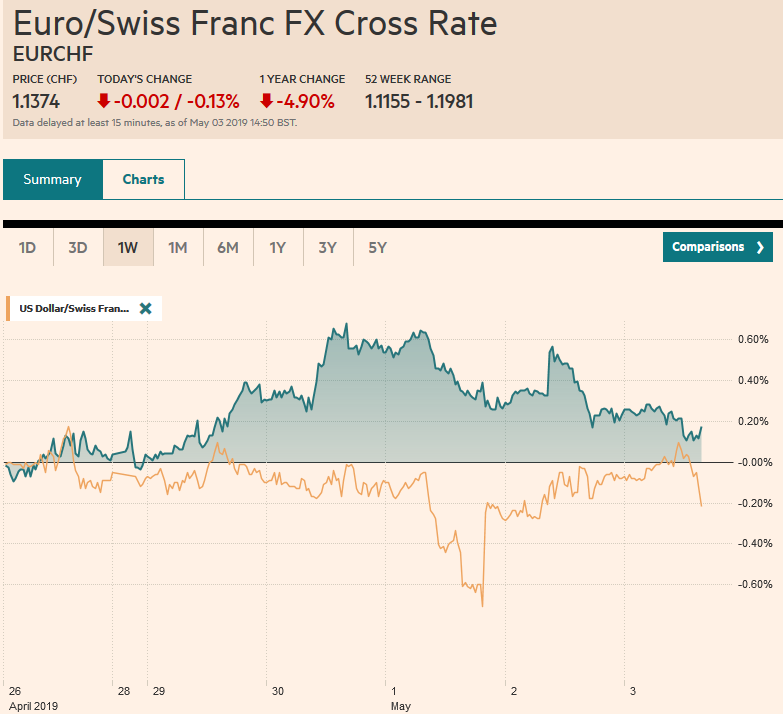

Swiss Franc The Euro has fallen by 0.13% at 1.1374 EUR/CHF and USD/CHF, May 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US April jobs data stand before the weekend, and the greenback is holding on to most of yesterday’s gains as participants wait for the report. Equities in the Asia Pacific region were mixed without leadership from China and Japan, where the markets remain closed for the extended holiday. On the week, Australia’s ASX was the worst performing. It lost 0.8%. Hong Kong was the best with a 1.6% gain, followed closely by Singapore’s 1.3% rise. European shares advanced through the morning and pared the week’s loss to 0.4% to snap a two-week

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, Federal Reserve, newsletter, Oil, U.K., U.K. Services PMI, U.S. participation rate, U.S. unemployment rate, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.13% at 1.1374 |

EUR/CHF and USD/CHF, May 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

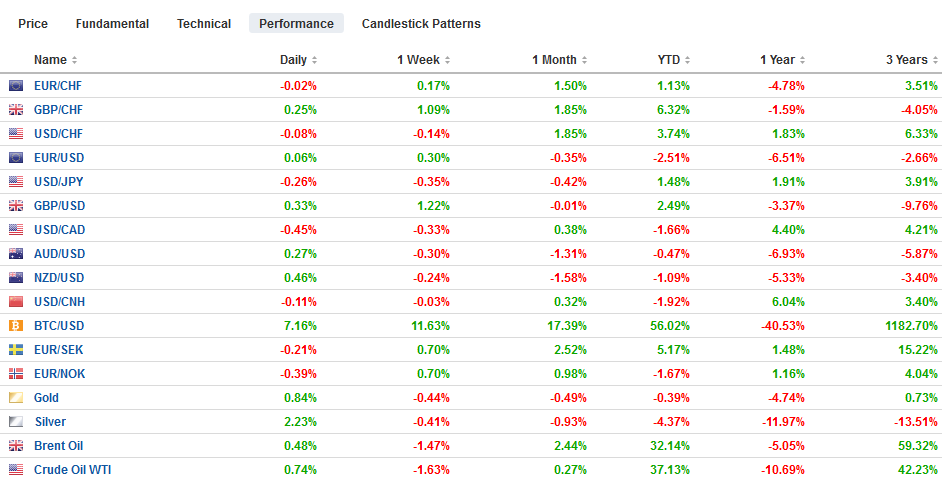

FX RatesOverview: The US April jobs data stand before the weekend, and the greenback is holding on to most of yesterday’s gains as participants wait for the report. Equities in the Asia Pacific region were mixed without leadership from China and Japan, where the markets remain closed for the extended holiday. On the week, Australia’s ASX was the worst performing. It lost 0.8%. Hong Kong was the best with a 1.6% gain, followed closely by Singapore’s 1.3% rise. European shares advanced through the morning and pared the week’s loss to 0.4% to snap a two-week gain. The S&P 500 reversed lower on Wednesday after setting a new record a little below 2955. It saw follow-through selling yesterday but found bid near 2900 and looks technically set to recovery further, depending on the US employment report. Benchmark 10-year yields are firmer today and adding to the week’s increase. US 10-year yields are up three basis points on the week ahead of the jobs data. The UK yield is up five basis points and Germany up four this week. Italian and Spanish yields are slightly softer on the week. The dollar gained broadly yesterday and is holding on to most of these gains today. The Scandis and the Antipodean currencies are the heaviest on the week. Sweden’s Riksbank tilted dovish, and the Norwegian krone has been sold on softer manufacturing data and the drop in oil prices. Brent has fallen for six of the past eight sessions. Around $70.20, Brent for July delivery is off a little more than 2.0% for the week, ending a five-week advance. |

FX Performance, May 03 |

Asia Pacific

The Reserve Bank of Australia and New Zealand meet next week. Both meetings are live in the sense that a change of policy is possible. In New Zealand, the market thinks it is likely and discounted a little more than a 50% chance. In Australia, despite the plunge in building approvals reported earlier today (-27.3% year-over-year, after February’s 12.3% drop), the RBA is seen waiting a little longer. There is about a one-in-three chance of a cut discounted.

Without Japanese and Chinese markets open, investors have to look for regional clues elsewhere. Today, Malaysia reported March trade data that suggest that while still challenged, the slowdown is easing. Malaysian exports slipped 0.5% year-over-year. They had fallen 5.3% in February and economists did not expect the magnitude of this improvement. Similarly, imports eased 0.1% after a 9.4% drop in February.

With the extended holiday in Japan, the market has been reluctant to move the yen very far. The dollar was on the JPY111-handle all week, and net-net is virtually unchanged on the week around JPY111.50. The Australian dollar is trading heavily. In late April, it dipped below $0.6990 but bounced back to close above $0.7000. It ran out of steam early this week near $0.7070 and closed at $0.7000 yesterday. Earlier today, it made a new marginal low since the January 3 flash crash (~$0.6085). There is a roughly A$870 mln option at $0.7000 that will be cut today.

Eurozone

The results from the local elections in the UK are not all counted yet, but the overall results are clear. The Tories, who had the most seats on the line, were punished severely. With less than half the councils reporting, the Conservative lost about 440 seats. Labour was also punished. With the partial results, Labour lost near 80 seats. The big winner for the Liberal Democrats, who picked up over 300 seats, and Independents. Small parties with a clear anti-Brexit message also did well, according to the early results. Many observers see even these partial results as likely adding to the pressure for the Tories and Labour to reach an agreement. On the other hand, some argue that Labour was punished for not being more supportive of a second referendum or being “strategically ambivalent.” At the same time, there is speculation that after losing the Conservatives parliamentary majority and now this drubbing, pressure on May to leave may increase. This is not good for sterling as it appears to renew the risk of leaving without an agreement.

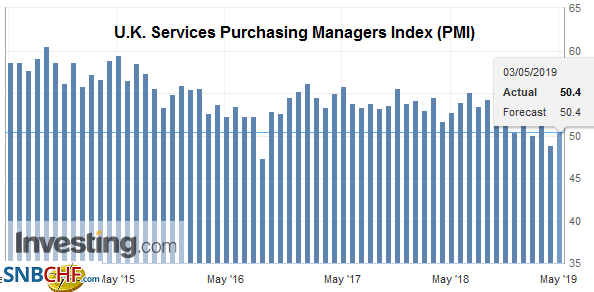

| Separately, the UK saw a better than expected service and composite PMI. The service PMI bounced back from the 48.9 reading in March to 50.4 in April as it returns to expansion mode. The PMI composite rose to 50.9 from 50.0. Recall that it averaged 50.6 in Q1. |

U.K. Services Purchasing Managers Index (PMI), April 2019(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

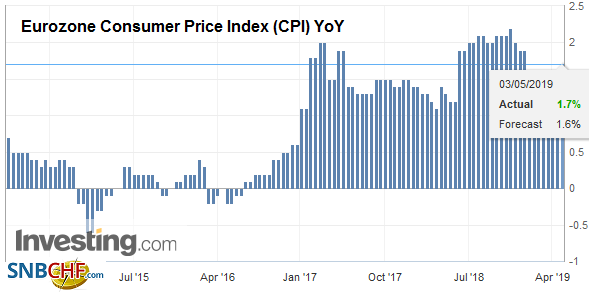

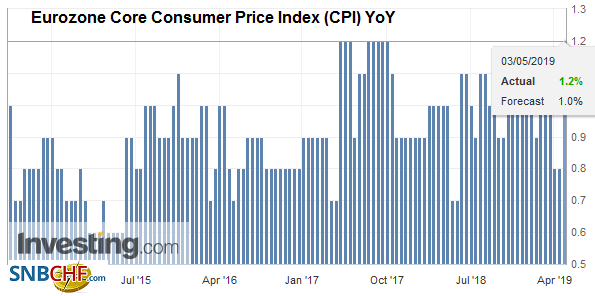

| Based on a few countries preliminary April CPI figures warned that the aggregate figure had upside potential. It did not disappoint. April headline CPI rose 1.7% from 1.4% in March, which is slightly more than economists expected. |

Eurozone Consumer Price Index (CPI) YoY, April 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The core rate rose to 1.2% from 0.8%, while economists expected a gain to only 1%. The euro barely reacted. Still, it should not be lost that the economic data from the eurozone-the first look at Q1 GDP and April inflation-were stronger than expected. |

Eurozone Core Consumer Price Index (CPI) YoY, April 2019(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro fell three days last week and is down for the third session this week. The single currency bottomed last week near $1.1100 and bounced to $1.1265 in the middle of this week before hitting a wall of sellers. The slippage below $1.1170 today is troublesome from a technical point of view and warns of the risk of a retest on $1.1100. There are 1.5 bln euros in options between $1.1150 and $1.1155 that will be cut today. Even if the US jobs data disappoint, the euro may find it difficult to return above the $1.12 area as there are 2.6 bln euros struck between $1.1200 and $1.1210 that expire today. Sterling has drifted lower and slipped through yesterday’s $1.30 low, after the PMI data. There is an expiring option for GBP500 mln at $1.30 and options for a few hundred million pounds half a cent below (~GBP385 mln) and half a cent above (~GBP265 mln).

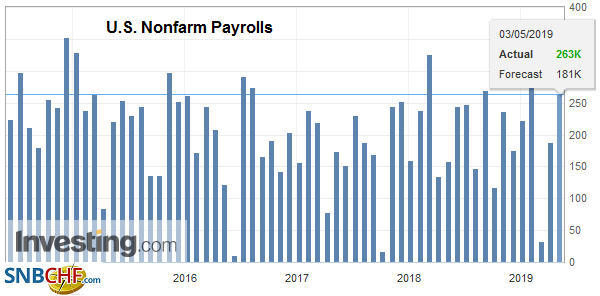

United StatesThe median forecast for US non-farm payrolls is for around 190k increase, in line with the March increase. Although there was a fluke of only 33k jobs created in February, the underlying averages have been fairly stable. The six-month average is 207k. The 12-month average is 211k, while the 24-month average is 202k. |

U.S. Nonfarm Payrolls, April 2019(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

| The 12-month average peaks in a business cycle, as one would expect. In this long cycle, it peaked in February 2015 near 260k. Average hourly earnings are expected to rise by 0.3%, which if it materializes, would lift the year-over-year rate to 3.3% from 3.2%. The average workweek edged up to 34.5 hours from 34.4 hours in February. The workweek has moved back and forth between 34.4 and 34.5 hours since September 2017. |

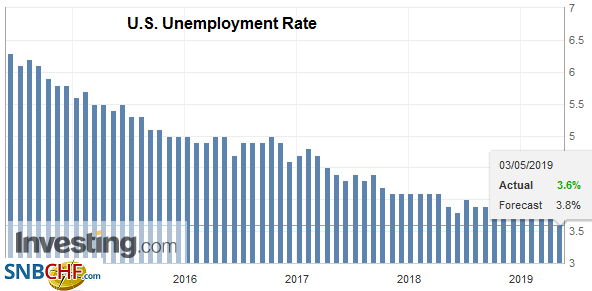

U.S. Unemployment Rate, April 2019(see more posts on U.S. Unemployment Rate, ) Source: investing.com - Click to enlarge |

| With the FOMC meeting past, the quiet period ends with a bang. At least eight Fed officials are speaking today, including Clarida and Williams. Separately, a couple of hours after pledging to fight on, Moore candidacy was pulled. It was never official. Trump seemed to let the markets and press do the vetting. While many economists were critical of Moore’s economics, ultimately it was his non-economic work that undermined him. An important consideration here is that the Republicans have a three-seat majority in the Senate. It became clear that a fourth Republican Senator was not going to support Moore. Moore was the fourth candidate to the Fed that was unsuccessful (Cain, Liang, and Goodfriend). Two have been successful (Clarida and Quarles). |

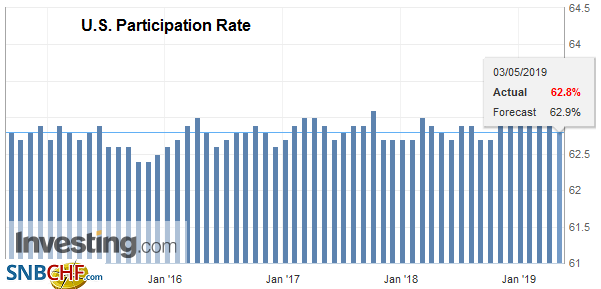

U.S. Participation Rate, April 2019(see more posts on U.S. Participation Rate, ) Source: investing.com - Click to enlarge |

Weaker GDP and a central bank espousing a softer form of neutrality weigh on the Canadian dollar. It gave up its earlier gains and is now a little lower on the week. The US dollar’s response to the jobs data will determine how it closes, but the greenback rose in three of the past four weeks. Oil prices have not helped this week. WTI for June delivery is off for the second consecutive week for the first time this year. It peaked on April 23 at $66.60 and yesterday, dipped below $61. Nearby resistance is pegged near $62. The US dollar peaked around CAD1.3520 in late April. The Dollar Index is firmer today, and it has met the (61.8%) Fibonacci retracement (~97.90) of its recent pullback. The recent high was 98.35, which is also its best level since Q2 17. Like with the GDP report a week ago, we warn of the risk of “buy the rumor sell the fact” type of activity.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,Federal Reserve,newsletter,OIL,U.K.,U.K. Services PMI,U.S. Participation Rate,U.S. Unemployment Rate