Since President Trump declared the end of the tariff truce with China in early May, an important focus for investors was the G20 meeting. It was only as it drew near was a meeting between the two heads of state confirmed. What was billed as an extraordinary meeting reportedly lasted less than 90 minutes, and the results were broadly as expected. The press quotes US officials confirming that the talks are “back on track” and that “we are getting a little bit closer,” but what does it really mean? Cloer to what? Aren’t things back to where they were in early May except that there is a higher tax on 0 bln of US imports from China, which remains in place? China will buy US agriculture, and the US will refrain from

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, Featured, Federal Reserve, Interest rates, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Since President Trump declared the end of the tariff truce with China in early May, an important focus for investors was the G20 meeting. It was only as it drew near was a meeting between the two heads of state confirmed. What was billed as an extraordinary meeting reportedly lasted less than 90 minutes, and the results were broadly as expected.

The press quotes US officials confirming that the talks are “back on track” and that “we are getting a little bit closer,” but what does it really mean? Cloer to what? Aren’t things back to where they were in early May except that there is a higher tax on $200 bln of US imports from China, which remains in place? China will buy US agriculture, and the US will refrain from additional tariffs while the negotiations resume. China reportedly made a large soy purchase last week. With the US economy slowing as Q2 wound down, and the tariffs on China blamed in some quarters, Trump may not have been in the mood for escalation. The Atlanta and NY Fed’s GDP trackers are pointing to a dramatic slowing in Q2 to 1.5% and 1.3% respectively from 3.1% in Q1.

Trump made a concession on Huawei. Without fully resolving the situation, US companies may be allowed to resume sales to it. This good news for US tech companies that are involved. Huawei, for example, accounts for reportedly something on the magnitude of 60% of Micron’s sales. It is good for Huawei but does little for the macro situation. Huawei will build up inventory, and it will still have to prepare, as it reportedly has since ZTE first came under scrutiny, to have its own mobile operating system. China will continue to pursue an industrial strategy that allows it to become a world leader in semiconductor fabrication and design.

When China’s imports and exports were growing rapidly, the meme was about its ascendancy. The debates were about if China had surpassed the size of the US economy or, given the demographics, whether China would get old before it became prosperous. With imports and exports falling, partly as a result of China’s import substitution strategy, it is blamed for de-globalization.

This is too narrow of a definition of globalization to be useful. Capital flows have long swamped trade flows. Chinese stocks and bonds are included in global indices, and the weighting will likely increase over time. The yuan is in the SDR, and its share of global reserves is increasing. Cross border movement of information may be growing even faster, and a McKinsey Global has made a case that globalization is evolving from resources to goods to services to data.

The concessions on Huawei may make it more difficult for the US to persuade other countries to ban the tech giant. Many countries in Europe, including the UK, were already balking. By reducing issues to a transactional essence and demonstrating a capriciousness in decision-making, Trump makes it more difficult to secure strategic objectives.

Treasury Secretary Mnuchin had negotiated a trade agreement a year ago that would have had China buy more US goods to reduce the bilateral trade deficit. Trump rejected it, and yet it seems that remains the high watermark. The problem over the years is not what China says. Its declaratory policy is very much to everyone’s liking, like President Xi’s speech at the G20 meeting endorsing free-trade and promising to open its markets more, reducing the list of prohibitions on foreign investment. Problems arise from its operational policy, what it does.

By many important metrics, China is more integrated into the world economy than when US trade negotiators Lighthizer and Navarro were cutting their teeth again Japan in the Reagan Administration, which is another reason why worries that China is de-globalizing distract us from a more import truth. Foreign multinational companies had little to do with Japan’s rapid growth in the 1960s and 1970s. China’s development was predicated on attracting international companies. They would use China’s cheap labor and lax rules for assembly and production work on products meant primarily for foreign consumption. Production for domestic consumption came later, and now General Motors can expect to sell more cars in China than it does in the US.

This has important implications. First, acknowledging that corporate espionage and state-sponsored corporate espionage are beyond the scope of this brief note, often China has not had to steal intellectual property rights, like patents because they were given in exchange for special access or administrative privileges in China. In China’s command-system, the balance of power favors rent seekers, and the rent was often paid with intellectual property.

Second, the role of foreign direct investment in China, which means the presence of production and distribution facilities, creates a vested interest in avoiding a trade war. Several hundred businesses lobbied the Trump Administration to soften its position. In military jargon, this interest group serves as a “fifth column” and is a source of opposition to what seems to be a growing “war camp” in the US.

There was a contradiction between Trump’s fiscal policy (tax cuts and spending increases) and trade goals. The ultimate reason the US runs a large chronic current account deficit is that it consistently chooses to borrow to fund its expenditures rather than tax. The suppliers of the capital and goods to the US shifts depending on a host of political and economic factors. China’s share of US imports surpassed Japan’s at its peak by several percentage points. However, China’s exports are more import-intensive, the yuan’s share of US imports is less than the yen’s share.

There is also a contradiction between Trump’s trade policy and his re-election goal. The trade tensions, which also contribute to the shift in fiscal policy from stimulative to restrictive, are hitting an economic expansion that was already beyond mature–it is the longest in modern times–. Many of the models that the media cite, which project Trump’s re-election, are often based on economic variables, especially the labor market and growth.

The risk to growth comes not just from the threat of tariffs but of existing ones, and the US resort to “national security” justification can have extremely broad implications. The US Supreme Court, in effect, recently affirmed the President’s expansive authority to define national security. The resumption of negotiations with China will allow the focus to shift to Europe and Japan, but also India, and maybe Vietnam, whose bilateral surplus is growing. US and Indian negotiations are to begin in earnest.

Europe had to find a payments system work around US sanctions on Iran or risk Iran violating the agreement by enriching uranium passed its treaty cap. This may become a new flashpoint. Turkey is to take delivery soon of the Russian-made anti-aircraft battery that was designed to shoot down NATO planes. This too may become a new point of attention as US-China trade talks are routinized.

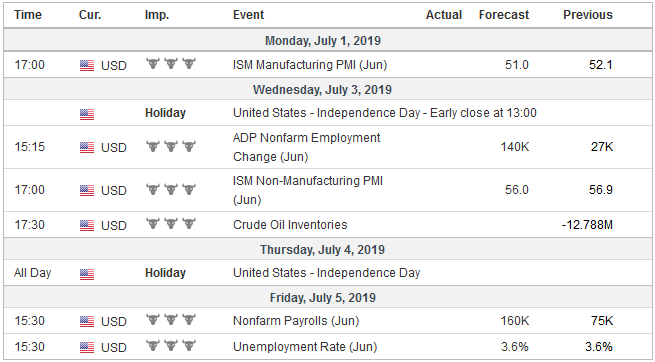

United StatesThe US employment data at the end of a holiday-shortened week are arguably the most important high-frequency report. There are few inputs and contains information that allows economists to better forecast income, consumption, retail sales, manufacturing, industrial and construction output, and GDP itself. Action Economics survey found a median forecast of 165k increase non-farm payrolls after a disappointing 75k in May. This would be a little above the three-month moving average, which stands at slightly more 150k. Yet the slowdown is unmistakable. Year-to-date, the US economy has added an average of a net new 165k jobs a month compared with 230k average in the same year-ago period. Average hourly earnings are forecast to have risen by 0.3% in June, which would lift the year-over-year rate back to 3.2%, where it was in March and April before dipping in May. The cycle peak may have been in February at 3.4%. If the median forecasts prove accurate, investors will likely not be deterred from expectations for a 25 bp Fed cut at the end of the month. However, a 50 bp cut continues to seem like a stretch, though the Bloomberg model suggests the 24% chance such a move has been discounted, while the CME’s model puts it at 28%. The market is pricing in a 1-in-5 chance that the Fed cuts rates in each of the four FOMC meetings in H2. Barring another significant disappointing jobs report, it would seem we are at peak dovishness toward the Fed. The most direct implication is that short-term US rates would be around a near-term bottom. Consolidation rather than a reversal is likely. The less direct implications are for the dollar (near-term supportive after a two-week decline) and equities (consolidation/correction?). The resumption of trade talks will, perhaps ironically, reinforce the significance of the CNY7.0 level, which was approached in June. The dollar was near CNY6.75 before the tariff truce ended. At the same time, China’s soft PMI readings underscore the likelihood of additional stimulus. |

Economic Events: United States, Week July 01 |

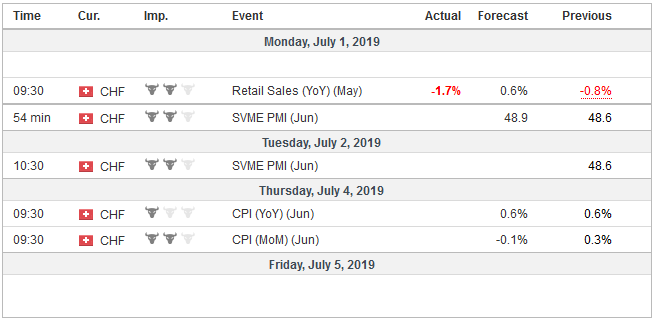

Switzerland |

Economic Events: Switzerland, Week July 01 |

Tags: #USD,China,Featured,Federal Reserve,Interest rates,newsletter