Next year is likely to mark the end of the tightening cycle as the Fed fund rates moves closer to the Fed’s estimate of the nominal neutral rate.The Federal Reserve estimated the theoretical, inflation-adjusted (‘real’) neutral rate at 0.8% in Q3 18, slightly down from 0.9% in Q2, but in line with the average since 2016.Adding core PCE inflation of 1.8% year-on-year in October (down from 1.9% in September), this means a ‘spot’ nominal neutral rate of 2.6%.The Fed’s strategy has been to...

Read More »USD/JPY: a difficult balance

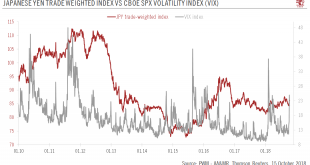

Limited upside for the dollar against the yen, but significant downside will take time.While widening interest rate differentials are supportive of the US dollar against the yen, if rates rise too far and too fast, they can help the yen against the dollar, as recent financial market volatility has shown. In October, the Japanese yen appreciated by 1.9% against the dollar and outperformed all other major currencies.Coupled with extreme fundamental yen undervaluation, the potential for the...

Read More »Fed rate decoupling

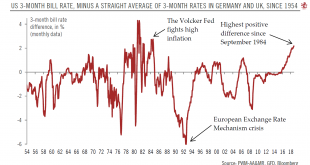

Monetary policy drift to continue.Fed likely to keep tightening while buoyed by a solid domestic backdrop Looking at the Federal Reserve (Fed) from the other side of the Atlantic, the question is really to what extent the Fed can continue to ‘decouple’ its monetary policy from other main global central banks, including those in Europe.The three-month Treasury bill rate in the US is at c.2.2%, while a straight average of the corresponding rate in Germany (c.-0.6%) and the UK (c.0.7%) is...

Read More »Extraordinary times for the US economy

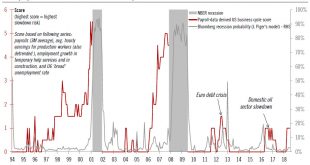

Fed officials compete to trumpet about the health of the US economy.We have long-highlighted how solid the US economy is, in-line with our ongoing scenario of 3% GDP growth for the year. That strong corporate investment is driving this offers still better news, given its potential to ultimately feed stronger productivity growth.Another positive lately is that US firms’ solid optimism about investment is coupled with strong hiring intentions. This is all the more striking given that hiring...

Read More »Taking the Fed’s dots at face value

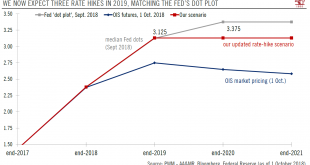

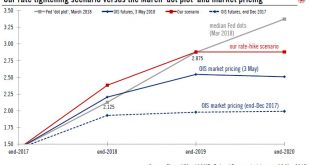

We now expect the Fed to raise rates three times next year instead of two.The Federal Reserve (Fed) is subtly turning more hawkish, mostly due to its increased confidence in the US outlook. While the Fed’s ‘dot plot’ chart (which illustrates the central bank’s rate hike projections) was unchanged in September from June, we think the chart’s message that there will be three Fed rate hikes next year should be taken more seriously by the market.Consequently, we are revising up the number of...

Read More »Powell maintains his middle-of-the-road approach to tightening

Jerome Powell’s speech at Jackson Hole brought limited news, reinforcing our Fed scenario of one quarter-point rate hike per quarter.At the Jackson Hole conference last week, Fed chairman Jerome Powell once again showed his pragmatic and cautious approach to monetary tightening: US rate hikes should continue at a gradual pace, even though the US economy is in strong shape.Powell took a well-trodden path in his Jackson Hole speech, discussing once again the numerous uncertainties around the...

Read More »US employment – chugging along

The July employment report confirmed that the US economy is in great shape, and still unaffected by international trade tensions.The US labour market remains in fine fettle, as the three-month average in job growth up to July was 224,000. The unemployment rate dropped to 3.9%, while the ‘broader’ unemployment rate (U6) fell to 7.5%, its lowest level since May 2001.Wage growth remained relatively tame (especially in light of the low unemployment rate), with average hourly earnings growth at...

Read More »Fed meeting confirms our forecast for tightening

Fed rate hikes this year are on auto pilot. But things could change in 2019.As widely expected, on 13 June the Federal Reserve raised its fed funds target rate range by 25bps (and the interest rate on excess reserves by 20bps), bringing the range to 1.75-2.0%. The ‘dot plot’ median (Fed members’ forecasts of future rate hikes) rose from three rate hikes in 2018 to four. Fed members still expected three additional hikes next year.A fed funds rate of up to 2% is new territory for the Fed,...

Read More »Fed not deviating from rate-hiking routine

At its latest meeting, the Fed showed it remained cool-headed about inflation risks. It should not deviate from its gradualist approach of one rate hike per quarter.The Federal Reserve meeting of 1-2 May 2018 brought no surprises. As the Fed kept rates unchanged (i.e., the Fed’s interest rate on excess reserves still at 1.75%), as widely expected, the focus was on the post-meeting statement for possible signals on future rate hikes. There was no press conference.The question was how the Fed...

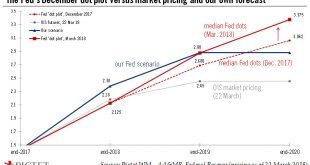

Read More »March Fed review – Mr. Middle Ground

In line with expectations, the Fed raised rates at its last meeting. Chair Powell was keen to underline his “middle ground” approach to normalising monetary policy. We still expect 3 additional rate hikes in 2018.On 21 March, the Federal Reserve hiked rates by one quarter point, as widely expected, nudging the interest rate on excess reserves (IOER) to 1.75%.Chair Jerome Powell’s press conference and the accompanying material – in particular the forecasts for future rate hikes (the ‘dots’) –...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org