Jerome Powell’s speech at Jackson Hole brought limited news, reinforcing our Fed scenario of one quarter-point rate hike per quarter.At the Jackson Hole conference last week, Fed chairman Jerome Powell once again showed his pragmatic and cautious approach to monetary tightening: US rate hikes should continue at a gradual pace, even though the US economy is in strong shape.Powell took a well-trodden path in his Jackson Hole speech, discussing once again the numerous uncertainties around the theoretical concepts (Powell calls them “celestial stars”) that guide US monetary policy –chiefly the theoretical ‘neutral’ rate, as well as the ‘natural’ rate of unemployment. Powell concluded that these theoretical uncertainties meant the current cautious tightening of monetary policy (or “risk

Topics:

Thomas Costerg considers the following as important: Fed rate hikes, Jackson Hole meeting, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Jerome Powell’s speech at Jackson Hole brought limited news, reinforcing our Fed scenario of one quarter-point rate hike per quarter.

At the Jackson Hole conference last week, Fed chairman Jerome Powell once again showed his pragmatic and cautious approach to monetary tightening: US rate hikes should continue at a gradual pace, even though the US economy is in strong shape.

Powell took a well-trodden path in his Jackson Hole speech, discussing once again the numerous uncertainties around the theoretical concepts (Powell calls them “celestial stars”) that guide US monetary policy –chiefly the theoretical ‘neutral’ rate, as well as the ‘natural’ rate of unemployment. Powell concluded that these theoretical uncertainties meant the current cautious tightening of monetary policy (or “risk management” approach in his own word – a concept borrowed from predecessor Janet Yellen) was still warranted.

Importantly, Powell gave a sense that the Fed will remain driven by the following key considerations: (1) a belief that the theoretical neutral rate of interest remains low, and therefore that monetary tightening will remain limited; (2) anchored inflation expectations – paralleled by particularly slow wage growth since Janet Yellen’s time – allow for gradual tightening despite a tight labour market; and (3) a rather downbeat assessment of potential productivity growth also limits the scope for further rate increases (this is in contrast with Alan Greenspan, who was more optimistic (and rightly so) about productivity when he was Fed chairman).

He highlighted his continuity with Fed policy makers since the Alan Greenspan era, who he copiously praised at Jackson Hole. This suggests that the Fed will not ‘lean against the wind’ under Powell, or tighten prematurely because of potential market excesses. Economic variables, not a desire to regulate markets, remain the guiding principle of monetary policy.

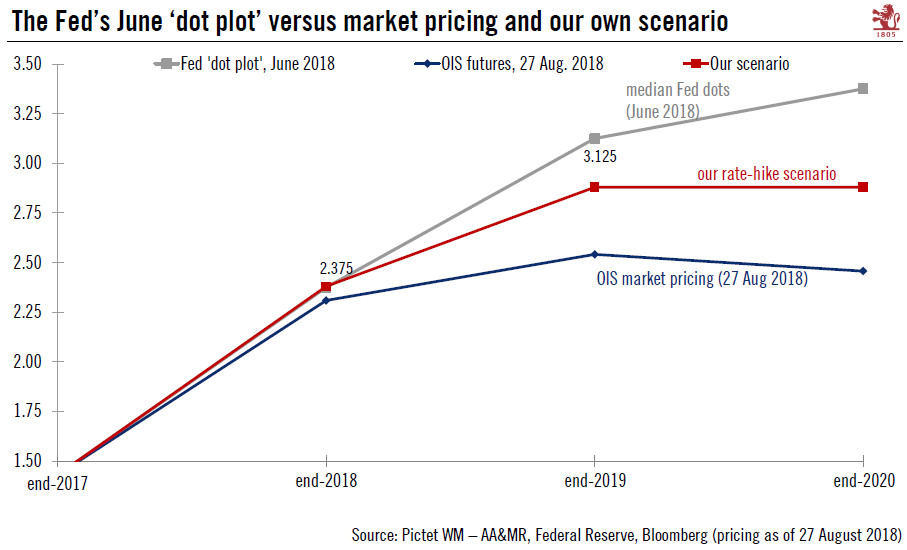

Chairman Powell, who emphasised his ‘middle-of-the-road’ and pragmatic approach to policymaking, signalled that it was business as usual for the Fed, even though recent data has confirmed the vigour of the domestic US economy. In other words, current autopilot tightening, consisting of one quarter-point rate hike per quarter, should continue in the near term. Therefore it is very likely that the September Fed policy meeting (finishing on 26 September) will see another rate increase of 25bps, pushing the upper end of the fed funds rate to 2.25%, and another one in December.

We also still expect two more rate hikes next year, in March and June, when the upper rate of the fed funds target rate should land at 3.0%. We think the Fed will be hesitant to push interest rates above 3.0% unless productivity growth and underlying inflation break out from recent ranges. The Fed is likely to change its characterisation of the policy setting from “accommodative” to “neutral” in the coming months, and that would support our view of rate hikes stopping at 3.0% in 2019.