Limited upside for the dollar against the yen, but significant downside will take time.While widening interest rate differentials are supportive of the US dollar against the yen, if rates rise too far and too fast, they can help the yen against the dollar, as recent financial market volatility has shown. In October, the Japanese yen appreciated by 1.9% against the dollar and outperformed all other major currencies.Coupled with extreme fundamental yen undervaluation, the potential for the greenback to rise above JPY115 seems limited. Indeed, interest rate differentials and global risk appetite favour the yen versus the dollar, as a rapid leap in bond yields tends to lead to a pick-up in volatility. While widening USD/JPY interest rate differential acts as a tailwind for the dollar against

Topics:

Luc Luyet considers the following as important: Fed rate hikes, Macroview, USD currency forecast, yen dollar exchange rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Limited upside for the dollar against the yen, but significant downside will take time.

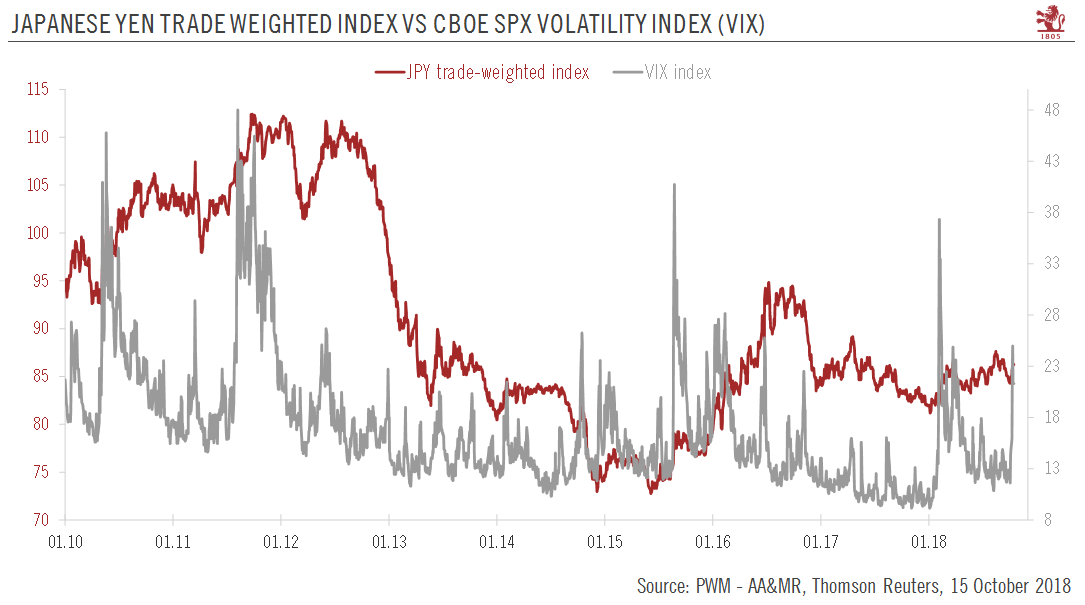

While widening interest rate differentials are supportive of the US dollar against the yen, if rates rise too far and too fast, they can help the yen against the dollar, as recent financial market volatility has shown. In October, the Japanese yen appreciated by 1.9% against the dollar and outperformed all other major currencies.

Coupled with extreme fundamental yen undervaluation, the potential for the greenback to rise above JPY115 seems limited. Indeed, interest rate differentials and global risk appetite favour the yen versus the dollar, as a rapid leap in bond yields tends to lead to a pick-up in volatility. While widening USD/JPY interest rate differential acts as a tailwind for the dollar against the yen, a rapid rise in US Treasury Bond yields would feed into stock market turbulences, favouring the yen.

That said, robust US macro fundamentals are not pointing to a rapid decline in the USD/JPY rate. We see no need to change our projections for the USD/JPY rate. While the interest rate differential should remain a headwind for the yen, the risk of higher US rates feeding into higher US market volatility has increased, potentially putting upward pressure on the yen again. As these two factors tend to cancel each other out, the long-term extreme fundamental undervaluation of the yen favours its appreciation against the greenback.