The Fed remains upbeat on growth and its members may be tempted to raise their rate expectations.Fed Chair Jerome Powell highlighted continuity with Janet Yellen’s monetary policy in his testimony before Congress today.He highlighted “positive developments” since the December meeting. This could be a hint that an additional rate hike could be in the pipeline (The Fed indicated three rate hikes in the December dot plot).Reading between the lines, it remains clear that the Powell Fed will not...

Read More »US tax bill looks set to pass

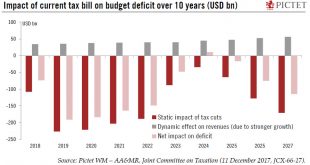

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week, after clearing the conference committee hurdle (a compromise between the House and Senate versions). A few hesitating Republican Senators have eventually said they will vote in favour of the bill, which is key as the Republican majority in the Senate is slim at 52-48. It will...

Read More »Fed’s enthusiasm on tax cut plans remains limited

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’. A salient take -away from the meeting was the Fed’s relative caution about Congress’s tax-cutting plan. Even...

Read More »US tax bill looks set to pass

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week.The Republican leadership seems to have corralled enough support to pass the tax bill approved in conference committee. The bill could be signed into law as soon as this week.The tax bill cuts the corporate tax rate to 21% from 35%, from January 2018. Global corporate taxation will move to a territorial regime, with a one-off tax on foreign investments...

Read More »Fed’s enthusiasm on tax cut plans remains limited

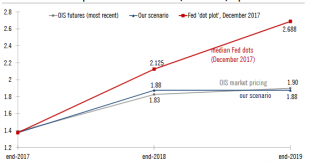

The Fed hiked rates 25bps at its 13 December meeting, as widely expected. We are keeping our scenario unchanged and we expect two rate hikes next year.The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.Chair Janet Yellen was cautious about...

Read More »Early rate hike means change in our U.S. rates scenario

Hawkish comments from several Fed officials mean we now expect three quarter-point rate hikes from the Fed this year, with the first coming this month.As we don’t expect any big negative surprise in the February employment report (to be released on Friday), the probability of a hike next week has risen sharply. We are therefore changing our forecasts for Fed rates this year. Our main scenario is now that the Fed will first hike in March, instead of June. Moreover, to be more consistent with...

Read More »When in doubt….The Fed rethinks pace of rate rises

A generally more cautious Fed emerged from its 14-15 June meeting. We continue to expect just one Fed rate hike in 2016, probably in September Read full report hereFollowing a very weak job report for May, and just one week before the EU referendum in the UK, it should be no surprise that the Fed is in no rush to tighten monetary policy, or to send a strong signal about the timing of the next rate hike. Indeed the Federal Open Market Committee (FOMC) statement struck a more cautious tone,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org