In line with expectations, the Fed raised rates at its last meeting. Chair Powell was keen to underline his “middle ground” approach to normalising monetary policy. We still expect 3 additional rate hikes in 2018.On 21 March, the Federal Reserve hiked rates by one quarter point, as widely expected, nudging the interest rate on excess reserves (IOER) to 1.75%.Chair Jerome Powell’s press conference and the accompanying material – in particular the forecasts for future rate hikes (the ‘dots’) – revealed a slightly hawkish tone, mostly due to policymakers’ increased confidence in the growth outlook. Powell in particular highlighted the likely boost from tax cuts and fiscal easing, as well as the improved global growth picture, and the still-accommodative financial market conditions.By

Topics:

Thomas Costerg considers the following as important: Fed March meeting, Fed rate hikes, Macroview, US rate projections

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In line with expectations, the Fed raised rates at its last meeting. Chair Powell was keen to underline his “middle ground” approach to normalising monetary policy. We still expect 3 additional rate hikes in 2018.

On 21 March, the Federal Reserve hiked rates by one quarter point, as widely expected, nudging the interest rate on excess reserves (IOER) to 1.75%.

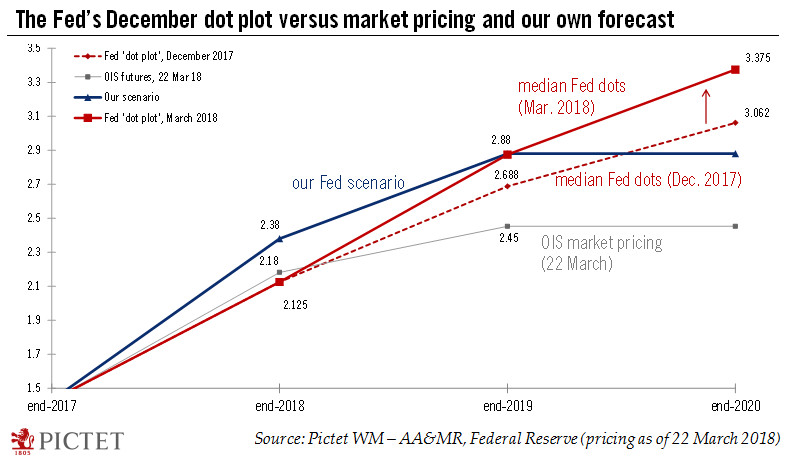

Chair Jerome Powell’s press conference and the accompanying material – in particular the forecasts for future rate hikes (the ‘dots’) – revealed a slightly hawkish tone, mostly due to policymakers’ increased confidence in the growth outlook. Powell in particular highlighted the likely boost from tax cuts and fiscal easing, as well as the improved global growth picture, and the still-accommodative financial market conditions.

By contrast, while Powell mentioned there had been a discussion about the more forceful trade policy from the Trump White House, he hinted that it was premature in affecting policymakers’ outlook.

Overall, Chair Powell left the impression he validated the ‘routine’ of one rate hike per quarter, as he sees it as a good middle ground between a strong labour market but a more subdued inflation picture.

We see no reason to change our Fed scenario that sees three additional rate hikes this year and two more in 2019. The next hike should therefore occur in June, especially as growth data should remain solid (but one needs to be watchful of Trump’s trade actions and rhetoric).