Goldman Sachs discusses CHF outlook and maintains a bullish bias over the medium-term. ‘The SNB surprised markets with a 50bp hike last week and a change to its intervention framework. The move confirms our bullish view on the Franc and is the strongest evidence yet of our “Reverse Currency Wars” thesis-the era of targeting weaker exchange rates is over (and accelerating through the year) is probably too high relative to the SNB’s inflation aim. The Bank’s...

Read More »The Great Crash of 2022

We are now well past the corona crisis of 2020, and most of the restrictions around the world have been repealed or loosened. However, the long-term consequences of arbitrary and destructive corona policies are still with us—in fact, we are now in the middle of the inevitable economic crisis. Proclaiming the great crash and economic crisis of 2022 is at this point not especially prescient or insightful, as commentators have been predicting it for months. The cause is...

Read More »Risk Appetites are Fickle

Overview: Yesterday’s strong US equity gains failed to carry over into today’s session. Japanese and Australian shares fared the best among the large Asia Pacific market, with the Nikkei off less than 0.4% and the ASX off less than 0.25%. However, China’s markets were off more than 1%, while Taiwan and South Korea indices slumped more than 2%. India is off nearly 1.5%. Europe’s Stoxx 600 is down 1.5% and is giving back all of its gains in the past three sessions. US...

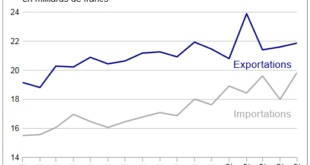

Read More »Swiss Trade Balance May 2022: surge in imports towards a level record

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »ZKB-Ökonomen senken Konjunkturprognose für die Schweiz

Die Ökonomen der Zürcher Kantonalbank (ZKB) rechnen nach dem überraschenden Kurswechsel der SNB für das laufende Jahr und für das kommende Jahr mit einem geringeren Wachstum der Schweizer Wirtschaft als bis anhin. Neu wird für 2022 mit einem Wachstum des Bruttoinlandprodukts (BIP) von 2,7 Prozent nach bisher 3,0 Prozent gerechnet und für 2023 mit einem solchen von 1,5 Prozent nach 1,7 Prozent, wie aus einer am Dienstag veröffentlichten Publikation hervorgeht....

Read More »The Difference Between a Forecast and a Guess

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong. What’s the difference between a forecast and a guess? On one level, the answer is “none”: the future is unknown and even the most informed forecast is still a guess. The evidence for this is the remarkable number of informed forecasts that prove to be as completely off-base as the wildest guesses. On another level, there is a big difference between an informed forecast...

Read More »In Defense of Defaulting on the National Debt

With the acknowledged national debt now a politically and economically unpayable $30 trillion (in reality, its unfunded liabilities are far greater), Americans should start to become acclimated to the realities of the United States’ eventual, inevitable default. While it may seem unfathomable, and the results too catastrophic to imagine, in fact the likely damage to everyday Americans would be minimal in the short term and unquestionably a net plus in the long term....

Read More »Juneteenth and Secular Holidays as Tool of the Regime

Last year Congress officially declared Juneteenth a federal holiday. While Very Serious talking heads attempted desperately to convince those that would listen that Juneteenth was a long-celebrated American holiday, the reality is that it was largely unknown around the nation prior to congressional action. The episode is a useful illustration of how the state weaponizes secular holidays to promote a larger cultural agenda. Prior to nationwide riots in 2020,...

Read More »„Bitcoin is Dead“ mit neuem Spitzenwert in Google Suche

Nach dem spektakulären Absturz in der letzten Woche, verlor der BTC zum Wochenende nochmals und stürzte sogar unter die Marke von 20K. Auf Google wurden darauf Höchstwerte für den Suchbegriff „Bitcoin is Dead“ registriert. Doch ist der BTC wirklich tot? Bitcoin News: „Bitcoin is Dead“ mit neuem Spitzenwert in Google SucheGegen Samstag kam es zum Jahrestiefstwert mit nur noch 17.700 US-Dollar pro BTC. Viele Kritiker hatten sich bestätigt gefühlt, als der Markt in den...

Read More »Equities Jump, Dollar Slips, and European Yields Drop

Overview: Stocks are rallying. Nearly all the large bourses in the Asia Pacific region rose with China being the noted exception. In Europe, the Stoxx 600 is up over 1% to post gains for the third consecutive session, the longest advance this month. US futures are up around 2% as they return from yesterday’s holiday. While the US 10-year yield has edged up 3.26%, European yields are mostly softer, with the peripheral premiums falling more than core rates. The US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org