Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong. What’s the difference between a forecast and a guess? On one level, the answer is “none”: the future is unknown and even the most informed forecast is still a guess. The evidence for this is the remarkable number of informed forecasts that prove to be as completely off-base as the wildest guesses. On another level, there is a big difference between an informed forecast and a guess–if the informed forecast has the consequential system dynamics right. The world is complicated and discerning the consequential dynamics in the tangle of complexity is difficult. Context and perspective matter. So do incentives. To take one example of many, war planners in the Vietnam era

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong.

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong.

What’s the difference between a forecast and a guess? On one level, the answer is “none”: the future is unknown and even the most informed forecast is still a guess. The evidence for this is the remarkable number of informed forecasts that prove to be as completely off-base as the wildest guesses.

On another level, there is a big difference between an informed forecast and a guess–if the informed forecast has the consequential system dynamics right. The world is complicated and discerning the consequential dynamics in the tangle of complexity is difficult.

Context and perspective matter. So do incentives. To take one example of many, war planners in the Vietnam era looked at war from the perspective of “scientific metrics” that focused on collecting data on the efficacy of sorties and combat missions. This resulted in the infamous “body counts.”

The larger context was that war could be productively distilled down to metrics, costs and attrition: the enemy was presumed to be a rational player who will give up when the pain and cost become too high.

Planners slouching in comfortable offices have many incentives to “go along to get along”: and veering off into dynamics that can’t be conveniently measured and questioning the entire foundation of the war’s planning and execution will get you sent to bureaucratic Siberia. “Getting with the program” will get you kudos and promotion.

Hmm, which will most people choose? The Pentagon Papers circulated among hundreds of senior officials, and parts of the report circulated among thousands of lower-ranking employees. Only one person took the risks of sharing the report with the American public.

When it’s important, you have to lie. Indeed. There is a difference between forecasts issued for public consumption and forecasts so unsettling that they’re state / corporate secrets.

Forecasts that end up being right can be wrong for years. An analogy is the erosion of soil beneath a house perched on a bluff. Those with experience who look at the source of erosion and project the eventual consequence– the house breaks into pieces that slide down the hill–raise the alarm, but the cost and difficulty of repair is inconvenient and unwelcome, so the forecast is rejected as overly dire. Surely there is a quick-fix–of course there is, if the right incentives are present.

It’s easy to find people who will issue a rosier forecast for a fee, or shore up the most visible damage for cosmetic purposes. See, all the doom-and-gloomers were wrong. This house is rock-solid.

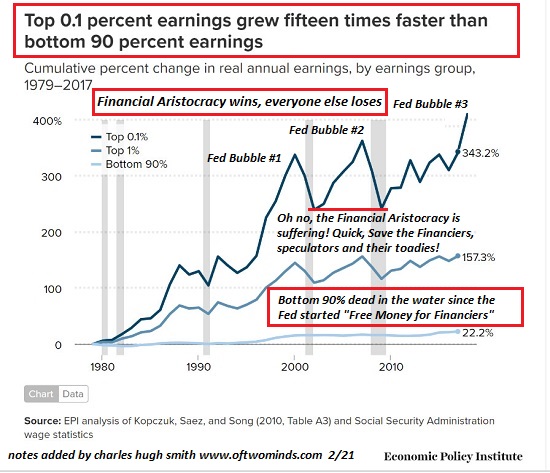

If the erosion is hidden from view, the apparent stability of the house offers “proof” that skeptics are wrong.This is what happened in 2004-2008, as those of us who detected the sources of future instability in the housing market were ignored or mocked. Year after year, the destabilizing dynamics expanded, eventually undermining the entire global financial system. But the incentives to ignore securities designed to fail, liar loans, HELOCs, bubble over-valuations, etc., were just too powerful: we’re booking insane profits, so keep doing what you’re doing.

And so rationalizations, wishful thinking and clinging to illusions of institutional stability (“markets are self-correcting,” “liquidity will smooth out any bumps,” “the mortgage-backed securities are rated AAA,” etc.) reigned supreme until the house suddenly crumbled and slid down the cliff.

I find two kinds of forecasts persuasive: 1) those based on the fact that humans are still running Wetware V1.0 and so history not only rhymes, the harmonies repeat, too, and 2) a systems-level understanding in which inputs and processes can be identified and compared to outputs has a much higher chance of being on the right track than other approaches.

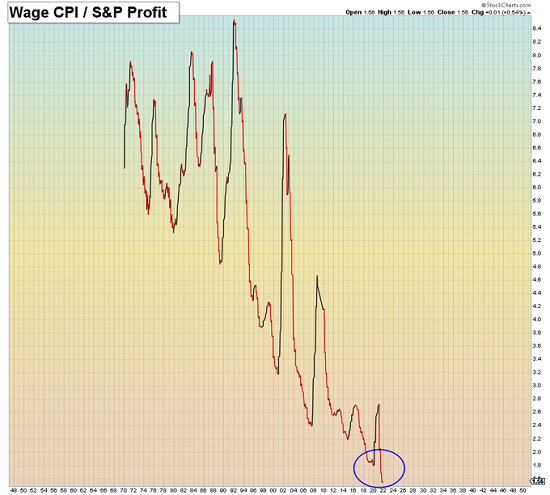

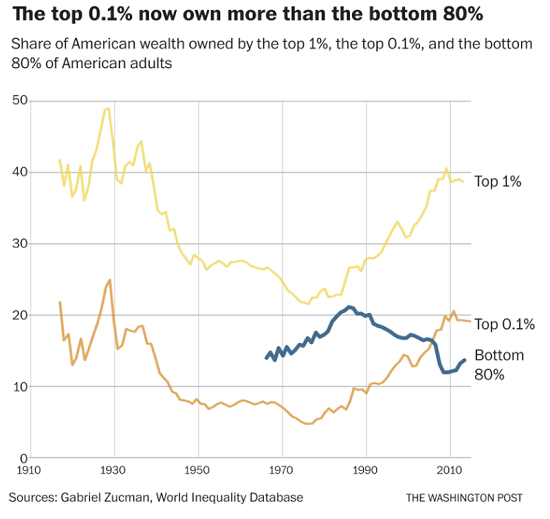

The other benefit of this approach is that the base assumptions are discernable. For example, if a forecast is based solely on financial metrics, we can readily discern its core flaw: the global economy has shifted from an abundance of cheap resources to real-world scarcities, and finance is slowly but surely losing its dominance. Other inputs are becoming more consequential.

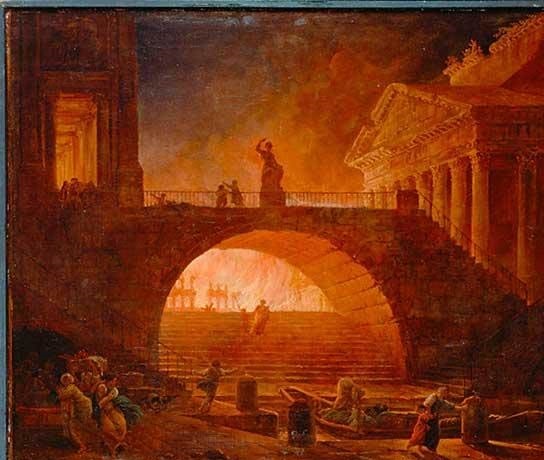

A meteor strike changes everything in one stroke. Erosion is slow and tedious until the consequences pile up and trigger the dramatic collapse of the house, a collapse that the mainstream said was “impossible” due to all the jury-rigged repairs.

The skeptics were derided as doom and gloomers and mocked for being wrong for years. When their forecast finally manifests, those who were caught off guard are resentful of those who were right.

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong.The decay is brushed off until the conflagration has consumed all that was presumed to be permanently stable due to “self-correcting mechanisms.” Too bad gravity isn’t self-correcting.

Tags: Featured,newsletter