Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More »Those over 25 may pay more for Swiss health insurance

© Shannon Fagan | Dreamstime.com 20 Minutes. The Swiss States Council commission on public health endorsed a plan that could lead to higher health insurance premiums for those over 25. Swiss health insurance providers are required to pay into a communal pot to spread risk between insurance companies. The latest plan would reduce the amounts paid into this communal pot for every insured individual between 19 and 25 by...

Read More »The Grand Strategy: Fixed Spheres of Influence or Variable Shares?

Summary: The US has a direct investment strategy for historical reasons. It competes against export-oriented strategies. The FDI strategy does make low-skilled domestic labor compete with low-skilled foreign worker, but skilled workers abroad complement the skilled domestic worker. The rise of the populist-nationalism over the past year or so is partly predicated on a realist view of international relations. ...

Read More »Emerging Markets: What has Changed

Summary Press reports suggest that China’s central bank has ordered banks to limit new loans in Q1. Fitch revised the outlook on Nigeria’s B+ rating from stable to negative. Russia announced details of the FX purchase plan. Brazil’s central bank confirmed it will simplify the reserve requirement system for banks. S&P cut the outlook on Chile’s AA- rating from stable to negative. Mexican announced another hike in...

Read More »With Trump Optimism of Small Business Soars

Pledges for Trump “You boys know what makes this bird go up? Funding makes this bird go up. That’s right. No bucks, no Buck Rogers.” – Gordon Cooper and Gus Grissom, The Right Stuff (film) Things are looking up for the United States economy in 2017. You can just feel it. Something great is about to happen. Sam Sheppard in “The Right Stuff” – a 1983 docudrama about the Mercury 7 program and “the...

Read More »FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

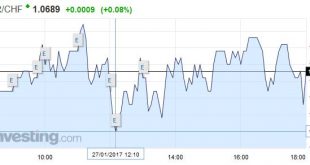

Swiss Franc EUR/CHF - Euro Swiss Franc , January 27(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Sterling Swiss Franc Exchange Rate Update Sterling vs the Swiss Franc has been going in an upwards direction this week after the Brexit verdict released on Tuesday morning. Initially this caused the Pound to fall vs the Swiss Franc but since then Sterling has continued to go upwards. Later today UK Prime...

Read More »Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos’ elites discussed why the world needs to “get rid of currency,” the European Commission has introduced a proposal enforcing “restrictions on payments in cash.” With Rogoff, Stiglitz, Summers et al. all calling for the end of cash – because only terrorists and...

Read More »US GDP Misses, but Final Domestic Sales Accelerate

Summary: Net exports was a large drag on growth. Inventories flattered growth. Underlying signal, final domestic demand, increased 2.5% after 2.1% in Q3. The first estimate of Q4 16 US GDP undershot expectations at 1.9%.Most had looked for annualized pace of a little more than 2% after the 3.5% pace in Q3. The Q3 pace was always suspect given the unsustainable surge in agriculture (soy) exports. Net exports...

Read More »Are Interest Rates No Longer Driving the Dollar?

Summary: Many are concerned that the dollar and interest rates have become decoupled. We are not convinced. Correlations, not to be eyeballed, are still robust. The US 10-year yield is at its highs for the year, and yet the US dollar has been struggling to gain traction.Some suggest that this means that the dollar rally is over. Charts like this one are circulating among market participants. This Great...

Read More »Immigration to Switzerland slows for third year in a row

ZURICH (Reuters) – Net immigration to Switzerland slowed for a third consecutive year in 2016, potentially easing concerns over immigration that have strained Switzerland’s ties with the surrounding European Union. Around 143,100 immigrants arrived in Switzerland in 2016, down nearly 5 percent from the previous year, while around 78,000 foreigners left, an increase of 5.6 percent. This means that net immigration for the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org