We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to trade partners.On the other side, a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to...

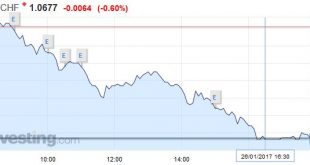

Read More »FX Daily, January 26: EUR/CHF collapses to 1.670

Swiss Franc The euro collapsed today, both against USD and CHF. One reason might be the new record for Swiss exports and for the Swiss trade balance. EUR/CHF - Euro Swiss Franc, January 26(see more posts on EUR/CHF, ) - Click to enlarge Sterling gains almost 2% against the Swiss Franc in 3 days, will the Pound continue to climb from here? The Pound has continued to climb throughout the week, after it was...

Read More »Switzerland’s Gold Exports To China Surge In December

Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More »Cool Video: Bloomberg’s Daybreak–Trump and Rates

On what Trump’s first working day as POTUS, I had the privilege to be on Bloomberg’s Daybreak to talk about the wagers on US interest rates in the futures market. In the most recent CFTC reporting week, which ended on January 17, speculators in the 10-year note futures market reduced the record net short position. It is only the second week reduction since the end of November. Anchor Alix Steel noted that while the...

Read More »Swiss fact: work days lost to strikes in Switzerland close to one ninth of neighbouring countries

Across the ten years to 2008, Switzerland lost an average of 3 working days per 1,000 workers to strikes a year. This compares to 32 days in Austria, 33 days in France, and 55 days in Italy. Germany was close behind Switzerland with 4 days. The combined average for Switzerland’s neighbours: Austria, Germany, France and Italy, was 26 days. Switzerland’s 3 day average was one ninth or 11% of this. © Ifeelstock |...

Read More »UBS Consumption Indicator: Automobile market with record year-end results

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator rose from 1.45 to 1.50 points in December. The positive trend of last fall continued and signalizes solid growth prospects for private consumption this year. New car registrations...

Read More »FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

Swiss Franc EUR/CHF - Euro Swiss Franc, January 25(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF The pound is higher against the Swiss Franc as we finally get some clarity over just what Brexit means. The pound was initially expected to fall but contrary to popular expectation it found favour as Theresa May finally delivered some clarity over just what Brexit means. Most...

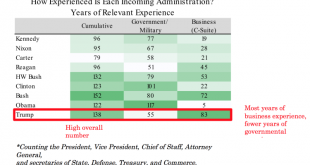

Read More »Ein Macher im Weißen Haus

Donald Trump sagt den alten Eliten den Kampf an. Europas Bürokraten müssen sich warm anziehen. Kürzlich stellte der Hedgefonds-Mogul Ray Dalio eine Analyse des Führungsteams von Donald Trump ins Netz („Reflections on the Trump Presidency, One Month after the Election“). Darin fasste er die Erfahrung zusammen, die die Spitzenleute der Regierungen seit Kennedy in leitenden Positionen in den Bereichen Regierung und Militär...

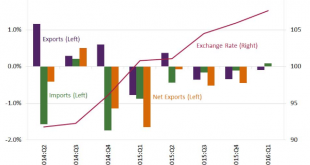

Read More »Great Graphic: How a Strong Dollar Weighs on Net Exports

Investors appreciate that a strong dollar can impact US growth through the net export component of GDP. The dollar’s appreciation can push up the price of exports and lower the cost of imports. The St. Louis Fed took a look at how the strong dollar from 2014 to the beginning of 2016 impacted the net export function of GDP. It is clear that a strong dollar in this period was associated with a drag on growth from net...

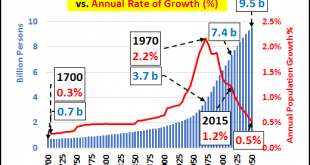

Read More »Policy Makers – Like Generals – Are Busy Fighting The Last War

Submitted by Chris Hamilton via Econimica blog, The Maginot Line formed France’s main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success…as the Germans never seriously attempted to attack it’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org