Swiss Franc EUR/CHF - Euro Swiss Franc , January 27(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Sterling Swiss Franc Exchange Rate Update Sterling vs the Swiss Franc has been going in an upwards direction this week after the Brexit verdict released on Tuesday morning. Initially this caused the Pound to fall vs the Swiss Franc but since then Sterling has continued to go upwards. Later today UK Prime Minister Theresa May will be the first foreign leader to be visiting Donald Trump and the talks are expected to be positive. Even though some of Trump’s executive orders have raised eyebrows and his recent comments on torture have alarmed many the discussions between May and Trump are likely to be focused on trade relations. In his presidential campaign Donald Trump was very outspoken about his support for Brexit and he appears to be very open to carry on the ongoing positive trade relations between the US and the UK. Therefore, this is why I expect Sterling to end the week on a high vs the Swiss Franc as it will be another positive boost to the UK economy during this month. UK GDP figures published yesterday were very positive and it shows that the uncertainty caused by the Brexit vote back in June has not had the negative effect that some had predicted.

Topics:

Marc Chandler considers the following as important: CAD, EUR, EUR/CHF, Eurozone M3 Money Supply, Eurozone Private Sector Loans, Featured, FX Trends, GBP/CHF, JPY, MXN, newsletter, U.S. Gross Domestic Product QoQ, U.S. Michigan Consumer Sentiment, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc , January 27(see more posts on EUR/CHF, ) |

GBP/CHFSterling Swiss Franc Exchange Rate UpdateSterling vs the Swiss Franc has been going in an upwards direction this week after the Brexit verdict released on Tuesday morning. Initially this caused the Pound to fall vs the Swiss Franc but since then Sterling has continued to go upwards. Later today UK Prime Minister Theresa May will be the first foreign leader to be visiting Donald Trump and the talks are expected to be positive. Even though some of Trump’s executive orders have raised eyebrows and his recent comments on torture have alarmed many the discussions between May and Trump are likely to be focused on trade relations. In his presidential campaign Donald Trump was very outspoken about his support for Brexit and he appears to be very open to carry on the ongoing positive trade relations between the US and the UK. Therefore, this is why I expect Sterling to end the week on a high vs the Swiss Franc as it will be another positive boost to the UK economy during this month. UK GDP figures published yesterday were very positive and it shows that the uncertainty caused by the Brexit vote back in June has not had the negative effect that some had predicted. It doesn’t necessarily mean that the UK economy will not suffer from the vote but at the moment it looks as though the economy is very resilient. Next week we finish the month and typically this means that there is little economic data so any movements for GBP/CHF exchange rates will be caused by political events. |

GBP/CHF - British Pound Swiss Franc, January 27(see more posts on GBP/CHF, ) |

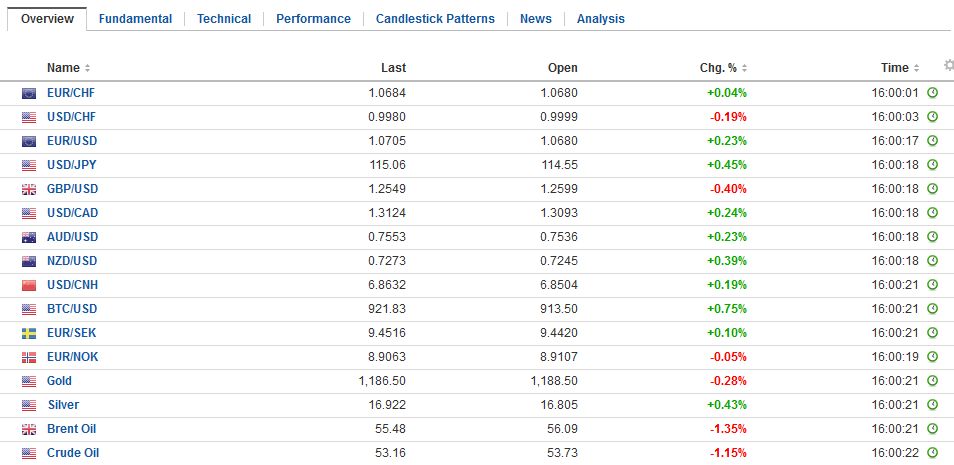

FX RatesThe Lunar New Year celebration thinned participation in Asia, where several centers are closed. Although the MSCI Asia Pacific Index slipped slightly, it rose 1.5% on the week, the fourth weekly gain in the past five weeks. The Nikkei advanced 0.35%, the third rise in a row. The 1.75% gain for the week snaps a two-week decline. |

FX Performance, January 27 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| We have been tracking the potential double bottom in the dollar near JPY112.50 forged over the past two weeks. The neckline is near JPY115.60. If and when it is taken out, the measuring objective is near JPY118.60. The dollar has not closed above the 20-day moving average since January 4. It is found today just below JPY115.10. |

FX Daily Rates, January 27 |

| European equities are trading with a heavier bias. The Dow Jones Stoxx 600 is off around 0.4% near midday in London and is poised to snap a three-day advance. It is holding on to almost a 1% gain on the week, which would be the fourth weekly advance in the past five. The push lower today filled the gap created with yesterday’s sharply higher opening, but the gap from Wednesday may still attract prices. It is found between 362.42 and 363.04. |

FX Performance, January 27 |

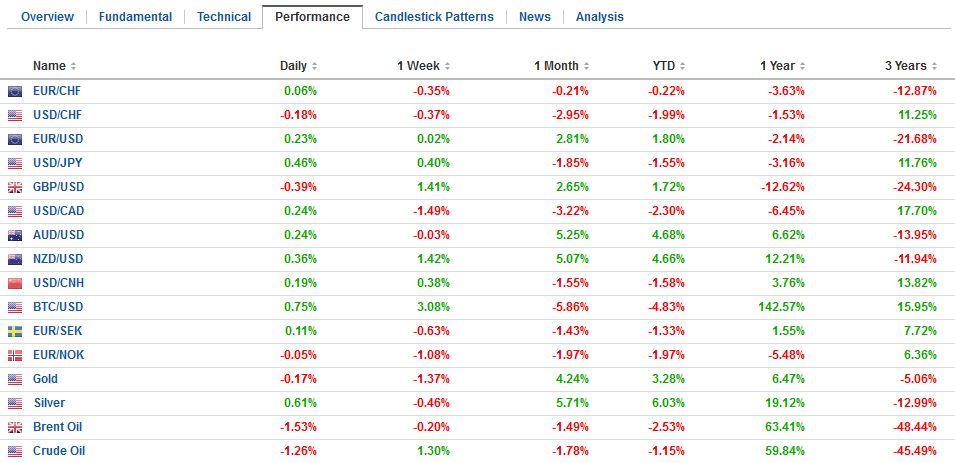

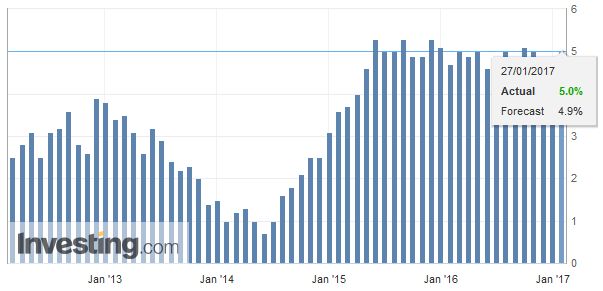

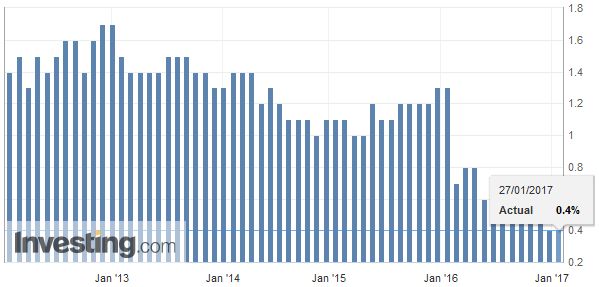

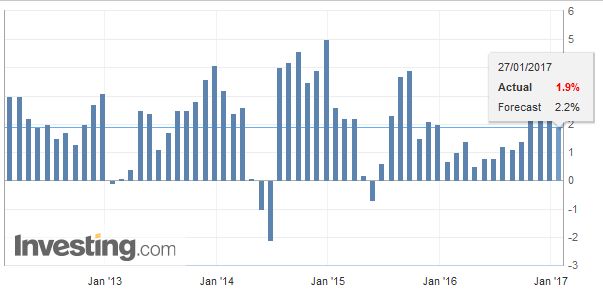

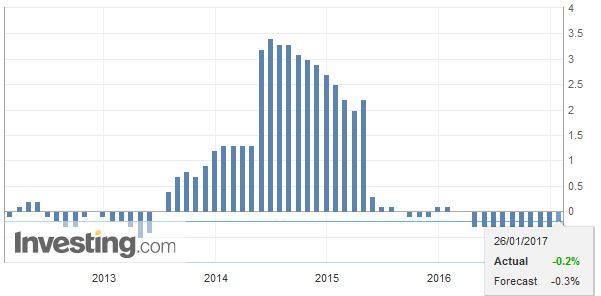

EurozoneThe ECB reported December money supply and lending figures. After year-over-year growth slowed below a 5% pace in October and November, it accelerated back to 5% in December. Lending also improved slightly. Credit extension to non-financial businesses rose 2% from 1.9%. |

Eurozone Private Sector Loans YoY, December 2016(see more posts on Eurozone Private Sector Loans, ) Source: Investing.com - Click to enlarge |

| Lending to households increased to 2.3% from 2.1%. Improving credit conditions and rising price pressures may keep the hawks pressing for more tapering soon.

Next week’s preliminary January CPI may provide more ammunition. Recall that the aggregate headline rate jumped to 1.1% in December from 0.6% in November. It is expected to have risen toward 1.5% in January. However, the increase is largely a function of energy prices. The core rate is expected to remain at 0.9%. The trough was near 0.6%. |

Eurozone M3 Money Supply YoY, December 2016(see more posts on Eurozone M3 Money Supply, ) Source: Investing.com - Click to enlarge |

Italy |

Italy Wage Inflation YoY, December 2016 Source: Investing.com - Click to enlarge |

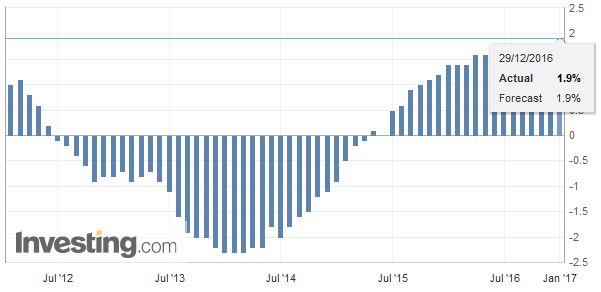

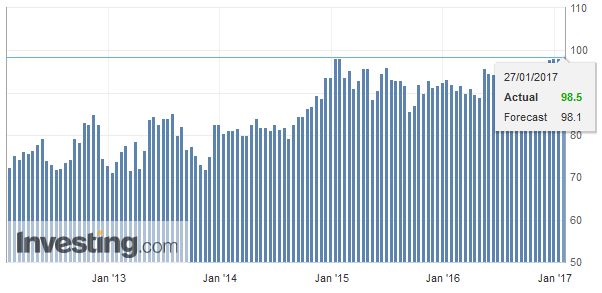

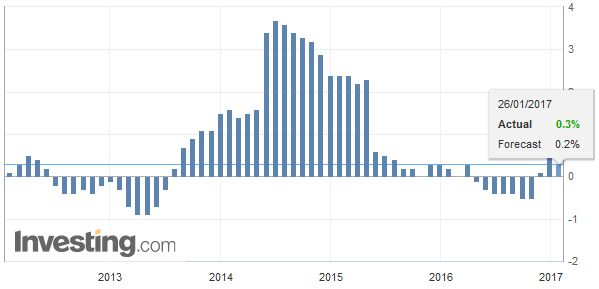

United StatesThere are three highlights from the North American session today. First, investors will receive the first estimate of US Q4 GDP. After yesterday’s inventory and trade data, the Atlanta Fed’s GDP Now estimate ticked up to 2.9%. The New York Fed tracker is for 2.1%, while the Bloomberg consensus is for a 2.2%. This compares with a 3.5% pace in Q3. It is not just the pace, but the composition of growth changed. There were a bit less consumption and a larger drag from the external sector. The core PCE deflator may have eased to 1.3% from 1.7%. |

U.S. Gross Domestic Product (GDP) QoQ, Q4 2016(see more posts on U.S. Gross Domestic Product QoQ, ) Source: Investing.com - Click to enlarge |

| Second, the University of Michigan provides its final consumer confidence reading for January and the results of its inflation expectations survey.The preliminary report showed the 5-10 year inflation expectation at 2.5% vs., 2.3% in December. The 12-month average is 2.5%, and the 24-month average is 2.6%. |

U.S. Michigan Consumer Sentiment, December 2016(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

JapanThe pullback in the yen this week lent support to Japanese equities. The yen is off about 0.5% today against the dollar, which is trying to establish a foothold above JPY115.00. If the greenback holds today’s gain, it will be the second consecutive weekly gain and the third in the past four weeks. With the 10-year JGB yield near 10 bp, it is not surprising that the BOJ entered the market to buy bonds earlier today, according to reports. Earlier, Japan reported CPI figures. Although in absolute terms, the numbers were soft, they were a little better than had been expected and reinforces ideas that the worst of deflation has passed. Headline CPI rose 0.3% year-over-year, down from 0.5% in November and better than the 0.2% consensus. Excluding fresh food, prices were off 0.2%. Excluding food and energy, CPI was off 0.2% compared with -0.4% in November. Tokyo, which reports CPI with a smaller lag saw better than expected January readings. |

Japan National Consumer Price Index (CPI) YoY, December 2016(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The BOJ meets next week. Although it most likely will not change policy, it will review its economic assessment. The yen’s pullback over the past few months and higher oil prices, coupled with stronger exports may encourage guard optimism. There is scope for it to tweak higher its outlook for both growth and inflation. |

Japan National Core Consumer Price Index (CPI) YoY, December 2016(see more posts on Japan National Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

United Kingdom

The third highlight is UK Prime Minister May’s meeting with US President Trump. The most May can hope for are some friendly words about the potential for a free-trade agreement with the US. It does fit in with Trump’s seemingly antipathy toward the EU and his support for Brexit. Trump also favors bilateral agreements over the multilateral efforts. However, such an agreement is hardly imminent. The UK is still a member of the EU and cannot negotiate a bilateral agreement. The new US Administration’s trade focus is on NAFTA. Ironically, May is embracing global trade and international cooperation as the US seems to be distancing itself from such goals. Although she shares the criticism of the liberal internationalist interventionism, she recognizes that if the UK and US take a step back, others (like Russia and China) take a step forward.

Mexico

Tensions between the US and Mexico may be the worst since 1920 were when US President Coolidge threatened to invade. Trump has some discretion as US President but the idea of a 20% tariff on Mexican imports to pay for the wall is bluster. First, it violates the NAFTA agreement. Second, if there were not NAFTA, it would violate the WTO. Third, the President would need Congressional support. He can impose a 15% temporary tariff claiming a balance of payments emergency, but this is extreme. Fourth, Mexico could retaliate.

Trade between the two countries is very complex. Some goods may cross the border several times before final good is finished. Research suggests that as much as 40% of the content of Mexico’s exports originate in the US. Several European and Japanese automakers have production facilities in Mexico. If new tariffs become onerous, their production may not be moved to the US, but it could go home or to a third country.

Earlier in the week, we noted the potential double top in the dollar near MXN22.00. The neckline near MXN21.50 was violated. The minimum measuring objective was near MXN21.00, which has been marginally surpassed (yesterday’s low was near MXN20.86). The peso has fared well despite the escalation of tensions. The peso is trading with a lower bias today, but it is poised to snap a six-week slide. Even with the small losses showing now, the peso is up a little more than 1.6% on the week.

Canada

The Canadian dollar is up nearly as much as the peso this week, making it the strongest of the majors. The Canadian dollar has been helped by three considerations. First, it is not the target of new US Administration, and to the contrary, Trump’s support for the pipelines was seen as favorable. Second, the 10-year rate differential has moved in Canada’s favor this week, and the two-year is stable. Third, oil prices are firm for the second consecutive week. It is the sixth advance in seven weeks. Important support is seen near CAD1.30. A move now above CAD1.3135 could spur a push into the CAD1.3185-CAD1.3220 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone M3 Money Supply,Eurozone Private Sector Loans,Featured,GBP/CHF,MXN,newsletter,U.S. Gross Domestic Product QoQ,U.S. Michigan Consumer Sentiment