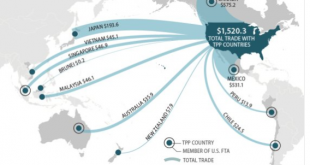

Investors are anxiously awaiting more details on the new US Administration’s economic policies and priorities. Part of the challenge is that the cabinet represents a wide range of views and it is not clear where the informal power lies, or whose call is it. In terms of economic policy, trade is being given priority. It is seen as the key to the jobs and growth objectives. There have been two initiatives: formally...

Read More »More than 3,000 state beneficiaries in Geneva admit not declaring assets or other income

© Gvictoria – Dreamstime.com - Click to enlarge Tribune de Genève. Last October, Geneva state councillor Mauro Poggia, had his department send out close to 91,000 letters to those receiving social benefits, asking them to contact the authorities if they had failed to declare any assets or income. Laurent Paoliello, a spokesperson from the DEAS, said they received 3,200 letters back. So far, we haven’t been through all...

Read More »Precious Metals As Safe Havens – Reassessing Their Role

Precious Metals As Safe Havens – Reassessing Their Role New research confirms that not just gold but also the other precious metals – silver, platinum and palladium bullion – act as safe havens, especially from ‘Economic Policy Uncertainty.’ This is something that is particularly prevalent today due to the ‘Hard Brexit’ impact on the UK and the Eurozone, risk of trade wars and heightened financial and geopolitical...

Read More »Pressure on Greece Mounts, New Crisis Looms

Summary: Greece needs to implement its commitments in the next few weeks or it faces a new crisis. The more the government implements its commitments, the less public support it draws. New elections in Greece cannot be ruled out. The problem is uncomfortably familiar. Greece has a chunky payment due to its official creditors. Reports suggest that Greece has not completed much more than a third of the measures...

Read More »Trump and the Dollar

Summary: US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk. Although in office less than a fortnight, the new US Administration is showing a disregard not only for the domestic convention but international agreements like on...

Read More »France’s FN sets out unorthodox economic plans to support a euro exit

By Ingrid Melander, Leigh Thomas and Simon Carraud Marine Le Pen © Reuters. France's FN sets out unorthodox economic plans to support a euro exit - Click to enlarge PARIS (Reuters) – France’s National Front will combine the euro exit at the heart of its economic platform with a cocktail of unorthodox policies including money printing, currency intervention and import taxes, a top party official told Reuters. A key...

Read More »FX Daily, January 31: Markets Look for Solid Footing

Swiss Franc EUR/CHF - Euro Swiss Franc, January 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday’s drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar’s losses yesterday, which it is...

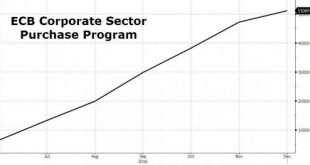

Read More »ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of...

Read More »Silver Speculators Gone Wild – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Silver Gets Frisky Last week, the prices of the metals had been up Sunday night but were slowly sliding all week — until Friday at 7:00am Arizona time (14:00 in London). Then the price of silver took off like a silver-speculator-fueled-rocket. It went from $16.68 to $17.25, or 3.4% in two hours. What does it mean? We...

Read More »Ending Taxation on Monetary Metals

Imagine if you asked a grocery clerk to break a $20 bill, and he charged you $1.40 in tax. Silly, right? After all, you were only exchanging one form of money for another. But try walking to a local precious metals dealer in more than 25 states and exchanging a $20 bill for an ounce of silver. If you do that kind of money exchange, you will get hammered with a sales tax. That’s the price you can pay for bucking the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org