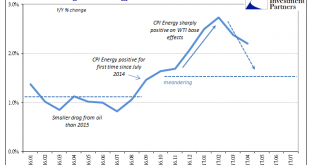

The average annual change in the WTI benchmark price was in April about 25%. That was still a sizable increase year-over-year, and just marginally less than March’s average of 33%. For calculated inflation rates, it represents the last of the base effects that have to this point made it appear as if economic improvement was possibly serious. CPI Changes On Energy, January 2016 - May 2017 - Click to enlarge Combined...

Read More »A Bumper Under that Silver Elevator – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Problem with Mining If you can believe the screaming headline, one of the gurus behind one of the gold newsletters is going all-in to gold, buying a million dollars of mining shares. If (1) gold is set to explode to the upside, and (2) mining shares are geared to the gold price, then he stands to get seriously...

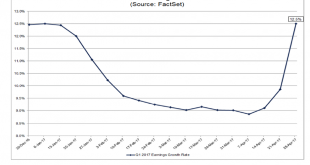

Read More »Earnings Update – The Proof of the Pudding is in the Eating

The first quarter just seemed to zoom by this year, bringing continued optimism (or, animal spirits if you prefer) to the stock market and leaving even higher valuations in its wake. The Standard & Poor’s 500 Index returned an impressive 6.07% for the quarter, on the tail of the previous five consecutive quarters of positive performance. The second quarter is now a third of the way through and, we are still...

Read More »Swiss Producer and Import Price Index in April 2017: +0.8 YoY, -0.2 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

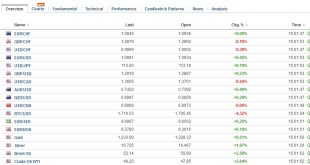

Read More »FX Daily, May 15: Softer Dollar and Yen to Start the Week

Swiss Franc . FX Rates The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated. There is more focus on positive developments elsewhere, especially in...

Read More »Weekly Speculative Positions (as of May 09): Significant Position Adjustment in the Currency Futures

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Yen is the Weakest Currency in the World over the Past Month

Summary: Yen was the strongest currency in the world from mid-March to mid-April. Yen has been the weakest currency over the past month. US rates have risen relative to Japan. Japan has shifted away from QE and toward targeting interest rate. USD/JPY From March 10 through April 11, the Japanese yen was the strongest currency in the world. It appreciated 4.7% against the dollar. Among the majors, sterling...

Read More »Swiss engineers wanted – nerds need not apply

Building a transport tunnel through the Alps requires a lot of technical know-how (Keystone) - Click to enlarge Too many students turn their backs on engineering thinking it is a career for “nerds”, according to a leading Swiss business lobbyist. Changing this perception is key to plugging an expected shortfall of 50,000 engineering professionals in Switzerland. The proportion of engineers in the workforce...

Read More »FX Weekly Preview: Two Known Unknowns

Summary: The Trump Administration seems to be trying to cast the US as a revisionist power. Or perhaps it is like Roman emperors long ago trying to draw greater tribute from others. The outlook of US interest rates is critical to the outlook of the dollar. The main risk to investors in the week ahead comes from two unknowns. On the international stage, the biggest change in the last six months is not China or...

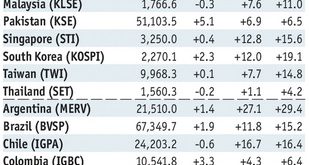

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX ended last week on a firmer note, helped by lower US rates and softer than expected CPI and retail sales data. Stabilizing commodity prices also helped EM. Yet these supportive conditions seem unlikely to persist, and we remain defensive on EM. Stock Markets Emerging Markets, May 10 Source: economist.com - Click to enlarge Brazil Brazil will report April tax collections this week, but no...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org