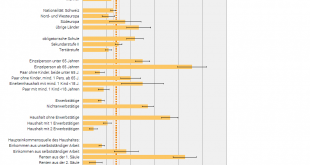

Neuchâtel, 15.05.2017 (FSO) – In 2015 approximately 570 000 people were affected by income poverty in Switzerland. Just under 145,000 of these were employed. The groups most affected were persons living alone or in single parent households with minor children, persons with no post-compulsory education and those living in households where no-one works. The poverty rate has hardly changed when compared with the previous...

Read More »Three Swiss Farms Close a Day

The numbers of farms in Switzerland has halved since 1980 - Click to enlarge The trend for fewer but larger farms continued in Switzerland last year, with the total number dropping by 990 to 52,263. While small and conventionally farmed businesses were throwing in the towel, organic agriculture flourished. The number of jobs in farming dropped 1.3% to 153,400, of which two-thirds were full-time, the Federal...

Read More »Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies

Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies - Click to enlarge – Cyberattacks expected to spread today in “second phase”– UK intelligence says scale of threat significant – Microsoft slams NSA for letting hacking tools cause global malware epidemic– Ransomware attack already crippled more than 200,000 computers in 150 countries– 1.3 million computer systems believed to be at risk–...

Read More »Syngenta deal will ‘drive modernisation’ of Chinese farming

The Syngenta deal is one of a trio of megamergers (Keystone) Syngenta, the Swiss agribusiness group which is being acquired by ChemChina in the biggest foreign takeover by a Chinese company, will help Beijing modernise China’s farm sector while simultaneously remaining firmly a “western company”, its chairman has said. Michel Demaré told The Financial Times that, under its new owners, Syngenta would become “a partner of...

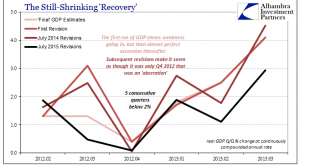

Read More »Hopefully Not Another Three Years

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions...

Read More »FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

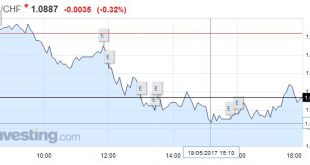

Swiss Franc EUR/CHF - Euro Swiss Franc, May 18(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Yesterday’s dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI’s investigation into Russia’s attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump...

Read More »‘Wolf of Wall Street’ aims to motivate Zurich

A pack of wolves invade Wall Street to promote the movie The real “Wolf of Wall Street“, Jordan Belfort, who was immortalised by Hollywood after serving jail time for stock market fraud, will be teaching sales techniques to business people in Zurich. Not everyone is pleased to see a convicted criminal passing on his secrets. Belfort is due to give a motivational talk in Zurich on May 13 to an audience stumping up CHF799...

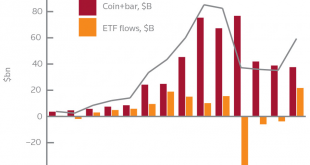

Read More »History of Gold – Interesting Facts and Changes Over 50 Years

History of Gold – How the gold industry has changed over 50 years Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years. Topics covered and interesting historical facts to note include: – Gold market size– Gold mine production “peaked in 2015” – South African production collapse from 1,000 tonnes– South African gold was flown to London and Zurich and an...

Read More »Cabinet sees no need to regulate social media

Fake news: the role of social media remains controversial. (Keystone) Remain vigilant, continue to monitor, but no need for concerted federal action. This was the conclusion of a cabinet report Wednesday on social media and the problems it can provoke, including “fake news” and distorting public opinion. The cabinet decided that, for now, more regulation is not the solution. The phenomena of fake news and alternative...

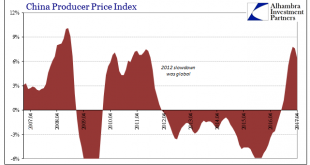

Read More »China Inflation Now, Too

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org