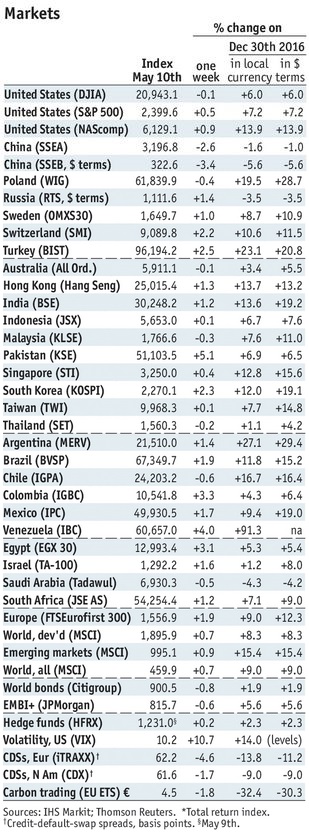

Stock Markets EM FX ended last week on a firmer note, helped by lower US rates and softer than expected CPI and retail sales data. Stabilizing commodity prices also helped EM. Yet these supportive conditions seem unlikely to persist, and we remain defensive on EM. Stock Markets Emerging Markets, May 10 Source: economist.com - Click to enlarge Brazil Brazil will report April tax collections this week, but no date has been scheduled. Collections are expected to rise 8% vs. 3% in March. If so, that would set the table for better budget data that month. The fiscal numbers worsened in March, reflecting a weak economy and rising borrowing costs. China China reports April retail sales and IP Monday. The former is expected to rise 10.8% y/y and the latter by 7.0% y/y. With the exception of new loans, April data have come in a bit on the soft side but markets appear comfortable with this. Poland Poland reports March trade and current account data Monday. It reports Q1 GDP Tuesday, which is expected to grow 3.9% y/y vs. 2.7% in Q4. National Bank of Poland meets Wednesday and is expected to keep rates steady at 1.5%. Poland then reports April industrial and construction output, PPI, and retail sales Friday, with the data expected to show some moderation from the strong March readings.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended last week on a firmer note, helped by lower US rates and softer than expected CPI and retail sales data. Stabilizing commodity prices also helped EM. Yet these supportive conditions seem unlikely to persist, and we remain defensive on EM. |

Stock Markets Emerging Markets, May 10 Source: economist.com - Click to enlarge |

BrazilBrazil will report April tax collections this week, but no date has been scheduled. Collections are expected to rise 8% vs. 3% in March. If so, that would set the table for better budget data that month. The fiscal numbers worsened in March, reflecting a weak economy and rising borrowing costs. ChinaChina reports April retail sales and IP Monday. The former is expected to rise 10.8% y/y and the latter by 7.0% y/y. With the exception of new loans, April data have come in a bit on the soft side but markets appear comfortable with this. PolandPoland reports March trade and current account data Monday. It reports Q1 GDP Tuesday, which is expected to grow 3.9% y/y vs. 2.7% in Q4. National Bank of Poland meets Wednesday and is expected to keep rates steady at 1.5%. Poland then reports April industrial and construction output, PPI, and retail sales Friday, with the data expected to show some moderation from the strong March readings. IsraelIsrael reports April CPI Monday, which is expected to rise 0.8% y/y vs. 0.9% in March. This would still be below the 1-3% target range, and so the central bank is likely to remain on hold for now. The next policy meeting is May 29, no change in policy is expected. It then reports Q1 GDP Tuesday, which is expected to grow 3.7% SAAR vs. 6.3% in Q4. ColombiaColombian central bank releases its quarterly inflation report Monday. Colombia then reports Q1 GDP Friday, which is expected to grow 1.1% y/y vs. 1.6% in Q4. CPI rose 4.7% y/y in April, above the 2-4% target. However, the weak economy has led the central bank to accelerate its easing cycle with a 50 bp cut in April. The next policy meeting is May 26, and another 50 bp cut seems likely. Czech RepublicCzech Republic reports Q1 GDP Tuesday, which is expected to grow 2.3% y/y vs. 1.9% in Q4. With the economy still fairly robust, the bank has signaled that it is looking at the next phase of normalizing policy, which is hiking rates. We think this is likely to be in H2 of this year. Next policy meeting is June 29. While no change is expected then, we hope it provides some forward guidance for the markets. HungaryHungary reports Q1 GDP Tuesday, which is expected to grow 3.3% y/y vs. 1.6% in Q4. Despite the robust economy, the central bank remains in dovish mode. The next policy meeting is May 23, and no change is expected then. However, the bank could ease via unconventional policy at its June meeting. SingaporeSingapore reports April trade Wednesday. NODX are expected to rise 12.0% y/y vs. 16.5% in March. The firmer mainland economy is boosting trade data for most of the region. However, the MAS remains cautious and did not adjust its forward guidance at its April meeting. We see steady policy at the next policy meeting in October, but it may tweak forward guidance then to set up a tightening move in 2018. MalaysiaMalaysia reports April CPI Wednesday, which is expected to rise 4.6% y/y vs. 5.1% in March. It then reports Q1 GDP and current account data Friday. GDP growth is expected at 4.6% y/y vs. 4.5% in Q4. Bank Negara just left rates steady at 3.0%, and sounded fairly sanguine about inflation. It views the current spike as transitory and cost-push, rather than demand-pull. Next policy meeting is July 13. South AfricaSouth Africa reports March retail sales Wednesday, which are expected at -1.0% y/y vs. -1.7% in February. The economy remains weak, but the SARB cannot cut rates due to high inflation. The next SARB meeting is May 25, no change in policy is expected. PhilippinesThe Philippines reports Q1 GDP Thursday, which is expected to grow 6.9% y/y vs. 6.6% in Q4. The economy remains robust and inflation is rising, and so we think the central bank will tilt more hawkish in H2 under incoming Governor Espenilla. Indeed, the bank said at this week’s policy meeting that it sees upside risks to inflation. IndonesiaBank Indonesia meets Thursday and is expected to keep rates steady at 4.75%. The bank has signaled that the easing cycle is over. CPI rose 4.2% y/y, near the middle of the 3-5% target range but the highest since March 2016. If price pressures continue rising, BI will likely tilt more hawkish and hike rates in H2. ChileChile reports Q1 GDP and current account data Thursday. GDP is expected to grow 0.2% y/y vs. 0.5% in Q4. The central bank also meets later that day and is expected to cut rates 25 bp to at 2.5% in response to the sluggish economy. MexicoBanco de Mexico meets Thursday and is expected to keep rates steady at 6.5%. Some look for another 25 bp hike, however. April CPI rose 5.8% y/y, the highest rate since May 2009 and further above the 2-4% target range. While further tightening would seem warranted, we think Banxico will remain on hold now. If the Fed hikes in June and price pressures are still rising, then a hike at its June 22 meeting seems likely. |

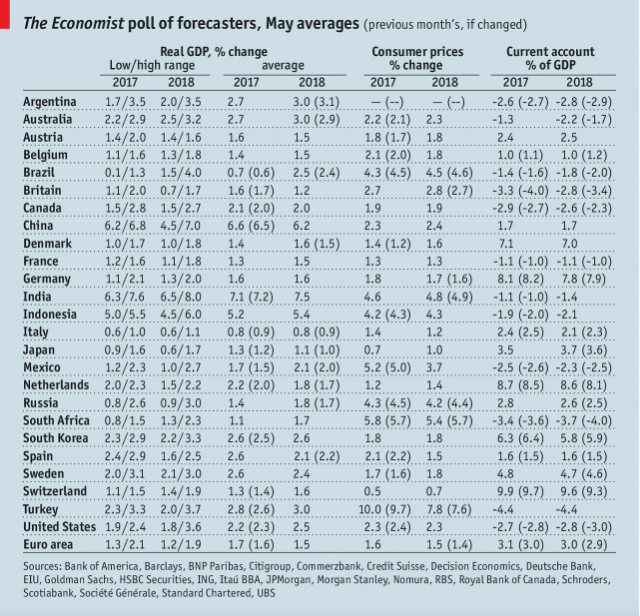

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter