The first quarter just seemed to zoom by this year, bringing continued optimism (or, animal spirits if you prefer) to the stock market and leaving even higher valuations in its wake. The Standard & Poor’s 500 Index returned an impressive 6.07% for the quarter, on the tail of the previous five consecutive quarters of positive performance. The second quarter is now a third of the way through and, we are still comfortably in the black with April up a bit over 1%. As a friend in the industry paraphrased recently, the markets may climb a wall of worry but they typically do not respond well to uncertainty. Most will agree that is usually the case; however, the stock markets have been thriving for a while now, right alongside plenty of uncertainty. The rally has continued in the face of significant political changes in administrations and policies, both here and abroad. It’s held on in spite of intensifying geopolitical tensions in several parts of the world and a rise in populism and protectionism that have the potential to increase those tensions. In the U.S., we are also dealing with healthcare coverage revisions that may or may not happen and will, or will not be an improvement. Logically, we can be fairly certain that whatever the modifications, they will not benefit all corporate entities (i.e.

Topics:

Margarita Fernandez considers the following as important: Featured, Monthly Earnings Update, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The first quarter just seemed to zoom by this year, bringing continued optimism (or, animal spirits if you prefer) to the stock market and leaving even higher valuations in its wake. The Standard & Poor’s 500 Index returned an impressive 6.07% for the quarter, on the tail of the previous five consecutive quarters of positive performance. The second quarter is now a third of the way through and, we are still comfortably in the black with April up a bit over 1%.

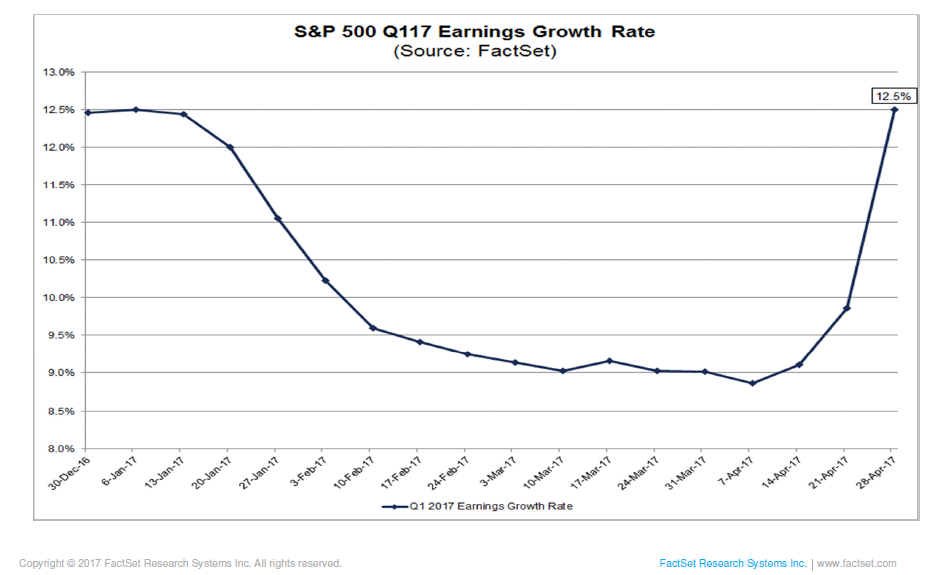

As a friend in the industry paraphrased recently, the markets may climb a wall of worry but they typically do not respond well to uncertainty. Most will agree that is usually the case; however, the stock markets have been thriving for a while now, right alongside plenty of uncertainty. The rally has continued in the face of significant political changes in administrations and policies, both here and abroad. It’s held on in spite of intensifying geopolitical tensions in several parts of the world and a rise in populism and protectionism that have the potential to increase those tensions. In the U.S., we are also dealing with healthcare coverage revisions that may or may not happen and will, or will not be an improvement. Logically, we can be fairly certain that whatever the modifications, they will not benefit all corporate entities (i.e. insurance carriers, medical providers, pharmaceuticals) nor all individuals for that matter. Ditto that to regulatory changes, tax overhaul, infrastructure spending, etc. These varied scenarios have produced some sector and industry rotation as investors struggle to identify (in advance) policy beneficiaries. Getting to this earnings season, which is well underway, I have to say that the eating of the pudding has been pretty satisfying. So far, overall earnings are supporting at least some of the exuberance we saw in first quarter’s stock market performance. At year-end 2016, Factset data indicated that analysts’ were forecasting a 12.5% earnings growth rate for the index and although that number was reduced during the quarter, it is now above that projected earnings growth rate at 13.5%. As seen on the graph below, just last week, that calculation was back to 12.5% – where it stood on December 31st. If we finish earnings season at the initial 12.50% year-over-year growth rate or higher, it will be the highest since the 16.7% for the third quarter of 2011. Looking at Howard Silverblatt’s latest (5/4/17) S&P 500 Earnings and Estimate spreadsheet, as of yesterday, 81% of the S&P 500 companies had reported and 74% of those have beaten estimates. Granted, this is a quite common quarterly occurrence but earnings projections had relatively small cuts during the quarter and are back where they started. Noteworthy, is that with the exception of the Telecom sector – which is a small allocation in the index of about 3%, the remaining 10 Economic sectors had greater than 50% of companies report earnings estimate beats so far. That is pretty impressive considering that much of the rhetoric for this year’s earnings growth revolved around the rebound in energy prices. We are seeing strong earnings beats for the March quarter across sectors, with the biggest gains in the Financials, Information Technology and Health Care sectors. In the Consumer Discretionary space, we await the retail industry reports that are coming up. Results from the retailers have run the gamut over the last year or so as many brick and mortar stores have taken it on the chin, losing market share to on-line competitors while others, such as the home improvement giants, continue to perform well. In closing, no one explains it better than Charles Dickens did so many years ago, “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity…” Happy Mother’s Day to our readership! May 5, 2017 Margarita V. Fernandez Vice President – Alhambra Investment Partners, LLC |

S&P 500 Q117 Earnings Growth Rate, December 2016 - May 2017 |

Tags: Featured,Monthly Earnings Update,newsletter