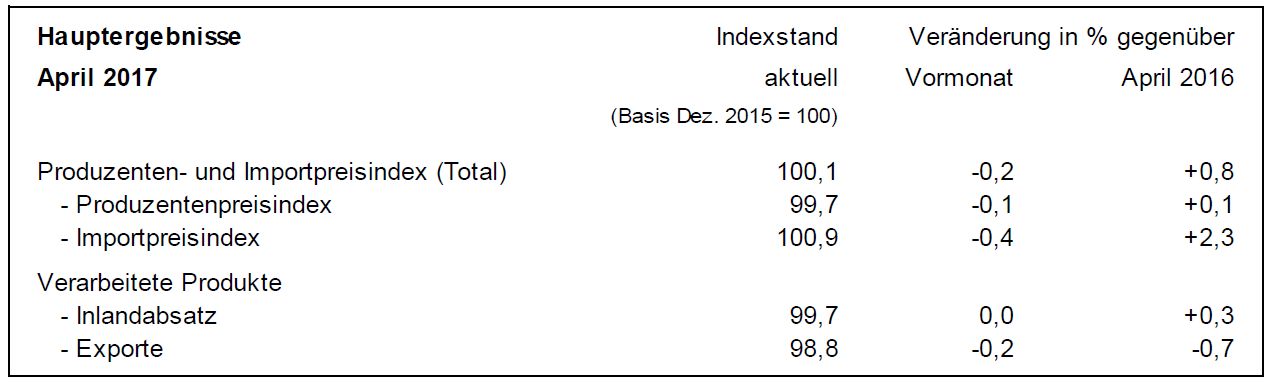

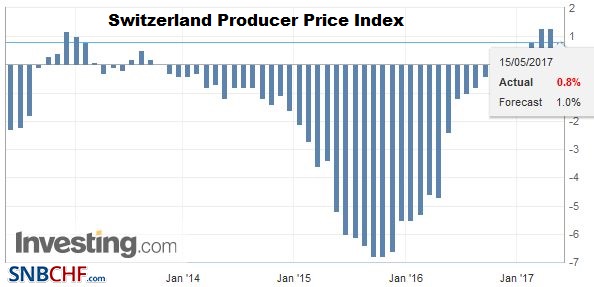

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued? Producer and Import Price Index in April 2017 From the data release of Swiss Statistics: Neuchâtel, 15.05.2017 (FSO) – The Producer and Import Price Index fell in April 2017 by 0.2% compared with the previous month, reaching 100.1 points (base December 2015 = 100). This decline is due in particular to lower prices for petroleum products and machinery. Compared with April 2016, the price level of the whole range of domestic and imported products rose by 0.8%. These are some of the findings from the Federal Statistical Office (FSO). Switzerland Producer Price Index (PPI) YoY, April 2017(see more posts on Switzerland Producer Price Index, ) Source: investing.

Topics:

George Dorgan considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Producer Price Index

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued?

Producer and Import Price Index in April 2017

From the data release of Swiss Statistics:

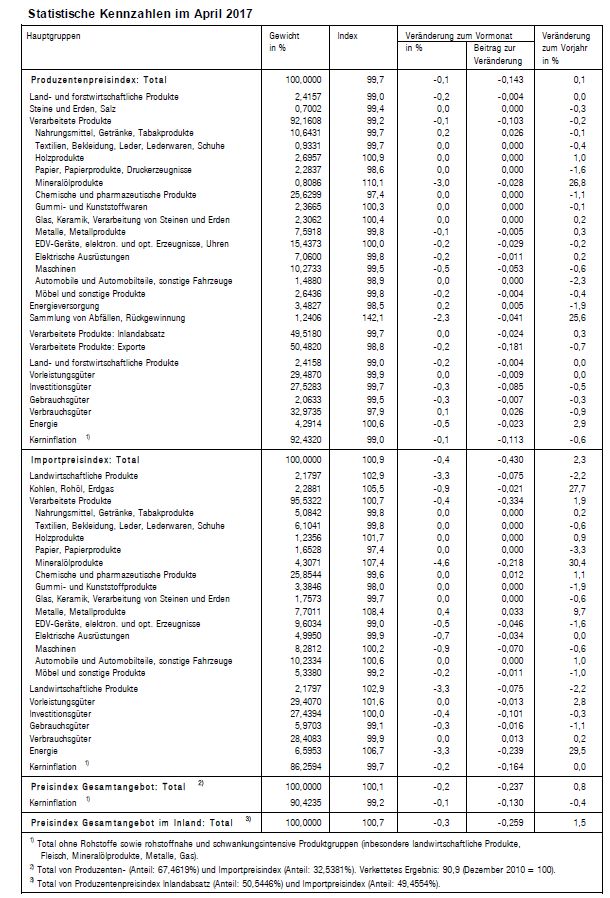

| Neuchâtel, 15.05.2017 (FSO) – The Producer and Import Price Index fell in April 2017 by 0.2% compared with the previous month, reaching 100.1 points (base December 2015 = 100). This decline is due in particular to lower prices for petroleum products and machinery. Compared with April 2016, the price level of the whole range of domestic and imported products rose by 0.8%. These are some of the findings from the Federal Statistical Office (FSO). |

Switzerland Producer Price Index (PPI) YoY, April 2017(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge |

Download press release: Producer and Import Price Index in April 2017

German text: Produzenten- und Importpreisindex im April 2017

Tags: Featured,newsletter,Switzerland Producer Price Index