On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean. As President, Obama’s main task was not to deliver specifics about auto lending or the inner workings at...

Read More »Employment barometer in 1st quarter 2017: Slight increase in number of jobs in 1st quarter 2017

Neuchâtel, 29.05.2017 (FSO) – In the 1st quarter 2017, total employment (number of jobs) rose by 0.4% in comparison with the same quarter a year earlier (-0.1% with previous quarter). In full-time equivalents, employment in the same period rose by 0.2%. The Swiss economy counted 7,200 more vacancies than in the corresponding quarter of the previous year (+13.7%). These are some of the findings from the Federal...

Read More »Big debts at 18 because parents didn’t pay Swiss health insurance bills

© Andrey Popov – Dreamstime.com 20 Minutes. A recent article in the newspaper 20 Minutes highlights the nasty surprise some young people experience when their parents fail to pay their health insurance premiums. Turning 18 is one of life’s key milestones. It corresponds with the end of school and entry into a new world. In Switzerland it is also a health insurance milestone. Switzerland’s system of compulsory basic...

Read More »Weekly Speculative Positions (as of May 23): Speculators Remain Bearish the Dollar and Bullish Bonds

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Emerging Markets: Week Ahead Preview

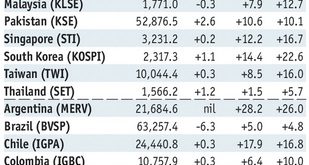

Stock Markets EM FX closed last week on a mixed note, with markets struggling to find a compelling investment theme. The US jobs data this week could provide some more clarity on Fed policy. We still think markets are still underestimating political risk in the big EM countries, including Brazil (Moody’s outlook moved to negative), Mexico (election in state of Mexico), South Africa (ANC debates Zuma’s fate), and Turkey...

Read More »FX Weekly Preview: Twin Peaks: US Economy and EMU Inflation

Summary: US economic data, culminating with the employment report, should be consistent with a re-acceleration of the world’s largest economy after a typical slowdown in Q1. Eurozone price pressures likely eased considerably in May. For the UK economy, the bounce in April was a fluke, and gradual slowdown continues. Japanese investors have bought foreign bonds for three weeks in a row, which is the longest streak...

Read More »FX Weekly Review, May 22 – 27: Is the Dollar Going To Turn?

Swiss Franc vs USD and EUR The Federal Reserve is on track to hike rates in the middle of June. It will be the third hike since the November election. In addition to keeping the door open to another hike this year, the Federal Reserve has signaled its intention to begin, however slowly, the reduction of its balance sheet. In the meantime, regardless of potential changes in its risk assessment, the ECB is unlikely to...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX closed last week on a mixed note, with markets struggling to find a compelling investment theme. The US jobs data this week could provide some more clarity on Fed policy. We still think markets are still underestimating political risk in the big EM countries, including Brazil (Moody’s outlook moved to negative), Mexico (election in state of Mexico), South Africa (ANC debates Zuma’s fate), and...

Read More »Some Swiss cantons overwhelmed with confessions of tax evasion

© Irakite | Dreamstime.com Ahead of the automatic exchange of bank account information, which comes into effect at the beginning of next year, Swiss residents with undeclared foreign bank accounts are rushing to come clean to the tax authorities, according to Swiss broadcaster RTS. According to RTS, 380 have come forward in Fribourg, 173 in Valais, 254 in Jura, around 2,000 in Neuchâtel and 4,000 in Geneva. The canton...

Read More »Swiss mobile providers perform well

Speed and coverage of mobile telecoms is well above average in Switzerland. - Click to enlarge Speed, availability, network responsiveness: on all counts, the mobile experience in Switzerland is “an excellent one”, according to a new report. But improvements could still be made to advance on the leader board. This is the verdict published Wednesday May 24 by OpenSignal, a London-based private held company that issues...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org