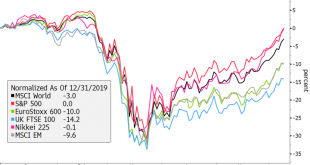

Today’s risk off price action appears to have been triggered by profit-taking; the dollar has gotten some traction The Fed expanded its Main Street Loan Program to include more businesses; the jobs rebound has removed a sense of urgency regarding the next round of fiscal stimulus Some minor US data will be seen today; Mexico reports May CPI Germany reported weak April trade and current account data; there were two important developments in Turkey today Japan reported...

Read More »Dollar Broadly Weaker Ahead of FOMC Decision

The FOMC decision comes out this afternoon and we expect a dovish hold; this would of course be negative for the dollar Ahead of the decision, May CPI will be reported; the budget statement will be of interest; Brazil reports May IPCA inflation We are still getting mixed messages about Europe’s flagship €750 bln recovery package; French April IP fell -20.1% m/m Japan reported weak May PPI and April core machine orders; Australia reported mixed sentiment indicators;...

Read More »Dollar Stabilizes as the New Week Begins

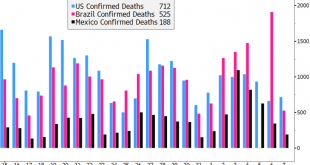

The dollar has stabilized a bit; Friday’s US jobs data could be a game changer The US bond market selloff continues; for now, the weak dollar trend is hard to fight The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics German IP came in a bit worse than expected at -17.9% m/m; the OPEC+ deal ended with the expected supply cut deal, lending continued support to crude prices Japan Q1 GDP revised higher on...

Read More »Dollar Firm as Risk-On Sentiment Ebbs Ahead of ECB Decision

Risk sentiment is taking a breather today after a strong run; the dollar is getting some modest traction Fed tweaked its municipal bond program; weekly jobless claims are expected to rise 1.843 mln; Brazil and Mexico are seeing record high daily death counts ECB is expected to ease today; Germany agreed on a new fiscal package that exceeded expectations BOE warned that UK banks should plan for a possible hard Brexit; Swiss deflation is deepening Australia reported...

Read More »Dollar Broadly Weaker After Reports of Possible Brexit Compromise

The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation Press reports suggest a possible compromise in the UK-EU trade negotiations; oil futures...

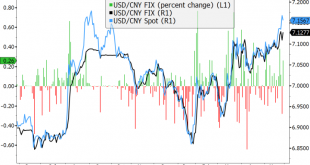

Read More »Dollar Firm as US-China Tensions Continue to Rise

Tensions between the US and China continue to rise; the dollar is finding some traction Fed Beige Book contained no surprises; NY Fed President Williams said the Fed is “thinking very hard” about targeting yields; weekly jobless claims are expected at 2.1 mln vs. 2.438 mln last week Germany reports May CPI; ECB is likely to ease next week; BOE continues to show its dovish colors; Poland is expected to keep rates steady at 0.5% Japan’s Cabinet Office maintained its...

Read More »Hong Kong Turbulence Likely to Rise as US-China Relations Worsen

Recent moves by China call into direct question the “one country, two systems” approach. Hong Kong assets have held up surprisingly well but we see turbulence ahead as US-China relations are set to deteriorate further. POLITICAL OUTLOOK Legislation was introduced last week that allows Beijing to directly impose a national security law on Hong Kong. Local legislative approval would be circumvented but Chief Executive Lam said Hong Kong authorities would fully...

Read More »Dollar Firm as China’s Hong Kong Gambit Triggers Risk-Off Trading

Legislation was introduced that allows Beijing to directly impose a national security law on Hong Kong; US-China tensions are still rising; the dollar is bid as risk-off sentiment takes hold There are no US data reports or Fed speakers today; Canada reports March retail sales; Mexico reports mid-May CPI ECB publishes the account of its April 30 meeting; UK reported April retail sales and public sector net borrowing; parts of the UK curve remain negative China...

Read More »Dollar Firm as US-China Tensions Flare

The virus news stream is mixed; the dollar has stabilized; US-China tensions continue to ratchet up We will get some more US economic data for May; weekly jobless claims are expected at 2.4 mln Eurozone and UK reported firm preliminary May PMI readings; BOE officials continue to take a very dovish tone South Africa is expected to cut rates 50 bp to 3.75%; Turkey is expected to cut rates 50 bp to 8.25% Japan and Australia reported preliminary May PMIs; Korea reported...

Read More »Dollar Treads Water Ahead of FOMC Minutes

The virus news stream is mixed; the dollar has stabilized a bit FOMC minutes will be released; Canada reports April CPI and March wholesale trade sales; the news from Brazil keeps getting worse Another group of EU nations will release their own plan in a rebuttal of France and Germany; UK reported April CPI data Japan reported March core machine orders; Australia reported weak preliminary April retail sales China kept its benchmark Loan Prime Rates unchanged;...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org