The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday Fed manufacturing surveys for September will continue to roll out; weekly jobless claims will be reported; Brazil left rates unchanged at 2.0% but introduced some additional dovish guidance BOE is expected to deliver a dovish hold; UK government reached a...

Read More »Dollar Bounce Ends Ahead of ECB Decision

The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill US reports August PPI and weekly jobless claims; US will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25% ECB is expected to keep policy steady; there were some eurozone IP readings; UK published its so-called Internal Market Bill Japan may go to the polls...

Read More »Sterling Pounded by Brexit Developments

The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation The Brexit fallout widens; UK will have trouble striking new trade deals if it can’t be counted on to honor its past agreements; no surprise then that sterling remains under pressure...

Read More »Dollar Bid as Market Sentiment Yet to Recover

The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges The White House is asking Congress to pass another $1 trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit Chancellor Sunak addresses UK Parliament today; Brexit talks continue; Nigeria devalued its official exchange rate yesterday RBNZ is considering an extension...

Read More »Dollar Soft Ahead of Jobs Report

Re-shutdowns continue to spread across the US; the dollar has come under pressure again Jobs data is the highlight ahead of the long holiday weekend in the US; weekly jobless claims will be reported FOMC minutes were revelatory; the Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals; US House passed the latest China sanctions bill The UK offered a home to nearly 3 mln Hong Kong citizens; Russia President Putin will...

Read More »Dollar Begins the Week Under Pressure Again

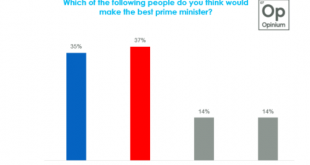

The virus news stream remains negative; pressure on the dollar has resumed The US economy is taking a step back just as Q3 is about to get under way; there are some minor US data reports today UK Labour leader Starmer overtook Prime Minister Johnson in the latest opinion poll; Macron’s party did poorly in French local elections French and German leaders meet to discuss the planned EU pandemic rescue package; UK and EU begin their “intensified timetable” for Brexit...

Read More »Dollar Firm as Risk-Off Sentiment Persists

Higher infection numbers in the US and other countries continue to fuel risk aversion across global markets; the IMF released more pessimistic global growth forecasts yesterday The US has rekindled trade provocations against China through Huawei; weekly jobless claims will be reported; regional Fed manufacturing surveys for June will continue to roll out Fitch cut Canada’s rating by a notch to AA+ with stable outlook; Mexico is expected to cut rates 50 bp to 5.0%;...

Read More »Dollar Firm as Risk-Off Sentiment Returns

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works Brazil announced a slew of new easing measures to improve liquidity conditions in local credit markets; Mexico...

Read More »Dollar Suffers as Stimulus Efforts Boost Market Sentiment

Market sentiment reverse sharply to the positive side due to several factors; as a result, the dollar has suffered The Fed beefed up its support for the corporate bond market; all eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today The Trump administration is reportedly preparing a large infrastructure bill; May retail sales will be the data highlight Comments from UK and EU officials have sparked optimism about Brexit talks; UK...

Read More »Dollar Firm as Risk-Off Sentiment Intensifies After FOMC Decision

Concerns about still rising infection numbers and a second wave ofCovid-19 have contributed to today’s downdraft in risk assets; for now, the weak dollar trend is hard to fight Despite delivering no change in policy, the Fed nonetheless sent an unequivocally dovish signal; stocks have not reacted well to the Fed; weekly jobless claims and May PPI will be reported Peru is expected to keep rates steady at 0.25%; Brazil inflation data supports a 75 bp cut next week The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org