Risk sentiment is taking a breather today after a strong run; the dollar is getting some modest traction Fed tweaked its municipal bond program; weekly jobless claims are expected to rise 1.843 mln; Brazil and Mexico are seeing record high daily death counts ECB is expected to ease today; Germany agreed on a new fiscal package that exceeded expectations BOE warned that UK banks should plan for a possible hard Brexit; Swiss deflation is deepening Australia reported weak April trade and retail sales data; Thailand reported May CPI The dollar is mostly firmer against the majors as risk on sentiment ebbs ahead of the ECB decision. Swissie and yen are outperforming, while Stockie and Aussie are underperforming. EM currencies are mostly weaker. PHP and HKD are

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Risk sentiment is taking a breather today after a strong run; the dollar is getting some modest traction

- Fed tweaked its municipal bond program; weekly jobless claims are expected to rise 1.843 mln; Brazil and Mexico are seeing record high daily death counts

- ECB is expected to ease today; Germany agreed on a new fiscal package that exceeded expectations

- BOE warned that UK banks should plan for a possible hard Brexit; Swiss deflation is deepening

- Australia reported weak April trade and retail sales data; Thailand reported May CPI

The dollar is mostly firmer against the majors as risk on sentiment ebbs ahead of the ECB decision. Swissie and yen are outperforming, while Stockie and Aussie are underperforming. EM currencies are mostly weaker. PHP and HKD are outperforming, while PLN and CZK are underperforming. MSCI Asia Pacific was up 0.3% on the day, with the Nikkei rising 0.4%. MSCI EM is up 0.1% so far today, with the Shanghai Composite falling 0.1%. Euro Stoxx 600 is down 0.5% near midday, while US futures are pointing to a lower open. 10-year UST yield is flat at 0.74%, while the 3-month to 10-year spread is flat at +60 bp. Commodity prices are mostly lower, with Brent oil down 0.6%, WTI oil down 1.4%, copper down 0.7%, and gold up 0.6%.

Risk sentiment is taking a breather today after a strong run. The latest salvo in the US-China conflict came from the Trump administration curtailing passenger flights to the US by Chinese airlines. The move was retaliation for similar measures taken by China. The measure by the US allows Chinese carriers to operate one flight for each that China grant the US. While tensions remain at a slow simmer, there is always a risk that they boil over from time to time.

The dollar is getting some modest traction. DXY traded yesterday at the lowest level since March 12 near 97.185 before seeing a modest bounce today. The technical picture is bad for the dollar, as the break below the key 97.837 level earlier this week sets up a test of the March 9 low near 94.65. Likewise, the euro traded yesterday at the highest level since March 12 and is on track to test the March 9 high near $1.15. Sterling is likely to encounter stiff resistance at the April high near $1.2650 and then the 200-day moving average near$1.2675. Lastly, USD/JPY finally broke higher to trade today at the highest level since April 9 just above 109. Next key level is 109.50, as a break above that sets up a test of the March 24 high near 111.70.

AMERICAS

The Fed tweaked its municipal bond program. Each state will be allowed to designate two cities or counties as eligible for the Fed’s emergency program regardless of population. Previously, the program was open to cities with at least 250,000 residents and counties with at least 500,000 residents. States will also be able to designate two issuers whose revenues are derived primarily from operating government activities such as public transit, airport, and utilities. Illinois this week became the first to tap the $500 bln facility announcing plans for a one-year $1.2 bln loan at a rate of 3.82% to cover its revenue shortfall.

Weekly jobless claims are expected to rise 1.843 mln vs. 2.123 mln last week. If so, this would be the smallest rise but would still mean that around 43 mln have become jobless over the last nine weeks, nearly 30% of the labor force. The good news is that continuing claims fell last week for the first time since the pandemic began, and by a whopping 3.86 mln. This suggests some workers have been able to go back to work in May, and consensus sees another 1 mln drop today. If sustained, this drop in continuing claims would be a very good sign. May Challenger job cuts and April trade (-$49.2 bln expected) will also be reported today.

Brazil and Mexico are seeing record high daily death counts. Deaths in Mexico were nearly 1,100, according Bloomberg data, while those in Brazil rose to around 1,350. The government of both countries have been widely criticized for their late response and dismissive posture during the early stages of the virus spread, somewhat along the lines of the US.

| EUROPE/MIDDLE EAST/AFRICA

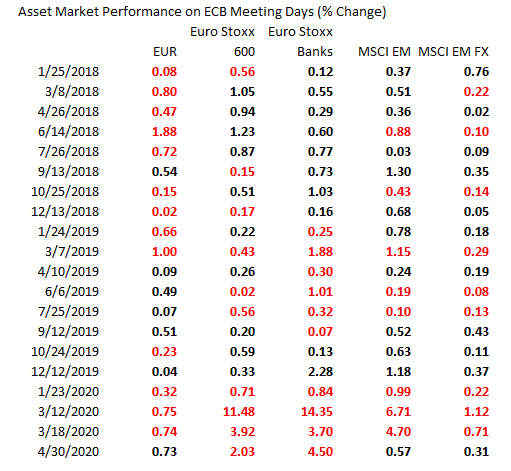

The European Central Bank is expected to ease today. Bloomberg consensus sees a EUR500 bln increase in its PEPP. Please see our ECB preview for a rundown of the possible moves today. We note that the euro has generally tended to weaken on ECB decision days (see table below). Ahead of the ECB decision, the eurozone reported April retail sales. Sales fell -11.7% m/m vs. -15.0% m/m expected and a revised -11.1% (was-11.2%) in March. |

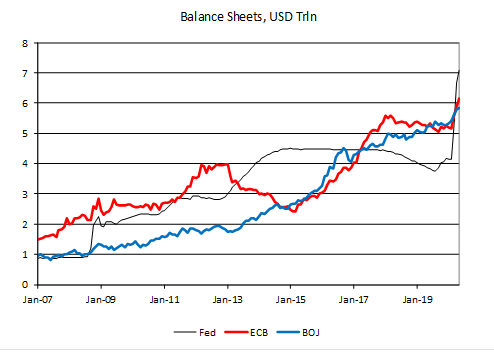

ECB Assets |

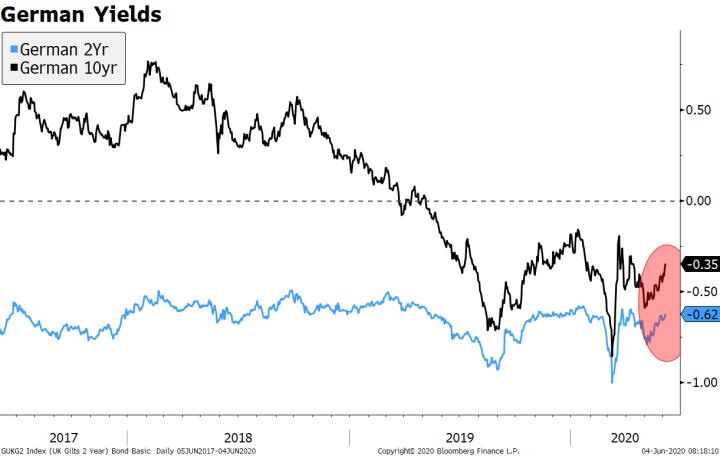

| The German government agreed on a new fiscal package that exceeded expectations. The package came in at €130 bln euros (close to 4% of GDP), above the roughly €100 bln expected and relatively broad in scope with cash for both consumers and businesses. It included the €300 euro per child allowance advocated by the Social Democrats, along with a 3 ppts VAT cut to 16% until the end of the year, a loan program for SMEs, help for struggling municipalities, investment in green industries and the 5G network, amongst other measures. If anyone was still in doubt the shift underway in German fiscal policymaking, this package (along with the broader European package) should settle it. Of note, German yields have been on an uptrend since early May with the 10-year rising nearly 30 bps to -0.35%, but still well within recent ranges. |

German Yields, 2017-2020 |

The Bank of England warned that UK banks should plan for a possible hard Brexit. The bank warned that a no-deal outcome is “one of a number of outcomes that UK banks need to prepare for.” This follows reports that Governor Bailey held a conference call where he asked UK banks to step up their preparations for a possible hard Brexit. Brexit talks this week have so far yielded little in terms of headlines, with UK officials pushing back on reports that they are willing to compromise in the contentious areas of fisheries and the level playing field. UK construction PMI for May was reported at 28.9 vs. 29.4 expected and 8.2 in April.

Swiss deflation is deepening. May CPI fell -1.3% y/y, as expected and down from -1.1% in April. This nearly matches the low of -1.5% seen back in September 2015. Yesterday, Q1 GDP came in weaker than expected, contracting -2.6% q/q and -1.3% y/y. Swiss National Bank next meets June 18, and new economic forecasts will be issued. Whilst officials say rates could be cut further, we do not think the bank will go more negative. For now, we expect policymakers to continue focusing on the exchange rate with its ongoing intervention program. In that regard, the SNB must be happy that EUR/CHF is traded this week at the highest level since January. A break above the 1.0832 area would set up a test of the December high near 1.1034.

ASIA

Australia reported weak April trade and retail sales data. Exports contracted -11% m/m vs. -14% expected, while imports contracted -10% m/m vs. -6% expected. Sales contracted -17.7% m/m vs. -17.9% expected. Despite the ongoing weakness in the data, policymakers are likely to remain in wait and see mode to see how the economic outlook develops as restrictions are lifted. The RBA sounded a bit upbeat this week, noting that the worst may be over. AUD is reflecting this optimism too, trading this week at the highest level since January and nearing a test of that month’s high near .7030.

Thailand reported May CPI. Headline inflation came in at -3.44% y/y vs. -3.21% expected and -2.99% in April. Deflation is the worst since July 2009 and would move further below the 1-4% target range. Next policy meeting is June 24. At its May meeting, the bank cut rates 25 bp to 0.5% and said that it “stands ready to use additional monetary policy tools if needed.” Minutes from the meeting show the central bank was worried about recent baht strength and that the economy was likely to contract by more than it previously expected. We think this raises the odds of a dovish surprise in this month.

Tags: Articles,Daily News,Featured,newsletter