The FOMC decision comes out this afternoon and we expect a dovish hold; this would of course be negative for the dollar Ahead of the decision, May CPI will be reported; the budget statement will be of interest; Brazil reports May IPCA inflation We are still getting mixed messages about Europe’s flagship €750 bln recovery package; French April IP fell -20.1% m/m Japan reported weak May PPI and April core machine orders; Australia reported mixed sentiment indicators; China reported May inflation and loan data The dollar is broadly weaker against the majors ahead of the FOMC decision. The Antipodeans are outperforming, while the Scandies are underperforming. EM currencies are mostly firmer. MYR and THB are outperforming, while IDR and RUB are underperforming. MSCI

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The FOMC decision comes out this afternoon and we expect a dovish hold; this would of course be negative for the dollar

- Ahead of the decision, May CPI will be reported; the budget statement will be of interest; Brazil reports May IPCA inflation

- We are still getting mixed messages about Europe’s flagship €750 bln recovery package; French April IP fell -20.1% m/m

- Japan reported weak May PPI and April core machine orders; Australia reported mixed sentiment indicators; China reported May inflation and loan data

| The dollar is broadly weaker against the majors ahead of the FOMC decision. The Antipodeans are outperforming, while the Scandies are underperforming.

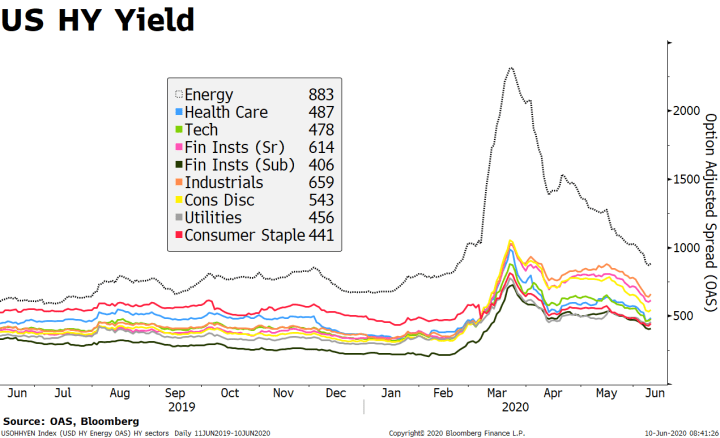

EM currencies are mostly firmer. MYR and THB are outperforming, while IDR and RUB are underperforming. MSCI Asia Pacific was up 0.4% on the day, with the Nikkei rising 0.2%. MSCI EM is up 0.4% so far today, with the Shanghai Composite falling 0.4%. Euro Stoxx 600 is down 0.5% near midday, while US futures are pointing to a lower open. 10-year UST yield is down 3 bp at 0.79%, while the 3-month to 10-year spread is down 3 bp at +64 bp. Commodity prices are mixed, with Brent oil down 2.3%, WTI oil down 2.8%, copper up 0.5%, and gold up 0.2%. High yield spreads continue their rapid narrowing but unlike equities, they have not yet recovered the year’s losses. The most impressive move was in the energy sector, with spread to swap rates now decidedly below 1,000 bps from a high of 2,300 bps in March. The Consumer discretionary sector has also seen a strong recovery with the spread narrowing from about 1,000 bps in March to 543 bps now. The dollar remains under pressure. DXY is trading at the lowest level since March 11 and is likely to test the March low near 94.65. The euro is nearing last week’s high near $1.1385, while sterling made a marginal new high today near $1.2785 and is on track to test the March high near $1.32. Lastly, USD/JPY remains heavy and is likely to test the May low near 106. |

US HY Yield, 2019-2020 |

AMERICAS

The FOMC decision comes out this afternoon and we expect a dovish hold. Dot Plots and new staff forecasts (see below) are likely to show a Fed that remains committed to providing stimulus aggressively. Please see our FOMC Preview for an in-depth discussion of what the Fed could do in the coming months.

A dovish hold would of course be negative for the dollar. Ahead of the meeting, the dollar remains under pressure and we see dollar weakness persisting near-term. From a longer-term perspective, we note that the greenback remains largely rangebound and is unlikely to fall below its 2018 lows. Please see Our Latest Thoughts on the Dollar.

We look forward to getting an updated view on Fed thinking. The language should acknowledge the improvement seen in May, whilst emphasizing that stimulus measures will continue. The recent rise in US yields may also be discussed. In that regard, New York Fed President Williams said recently that the Fed is “thinking very hard” about Yield Curve Control. However, Cleveland Fed President Mester pushed back a bit and said she doesn’t think the Fed is close to trying YCC whilst admitting it is “a tool I think it’s worthwhile thinking about.”

New Dot Plots and quarterly staff forecasts will be released. These will be the first since December, as the Fed declined to do so at the March meeting due to the rapidly unfolding pandemic. We expect the macro forecasts to be on the slightly pessimistic side. Otherwise, markets would likely take optimistic forecasts as a sign that the Fed will start to remove stimulus. In that regard, we expect the Dot Plots to show a median view of no rate hikes through 2022. No member is likely to see a hike in 2020, but we suspect there will be a small minority on the FOMC that pencil in rate hikes in 2021 and 2022 on the view that zero rates should not be maintained once the pandemic has passed. That said, the majority of the FOMC is likely to remain in dovish mode. We note that the Fed waited seven years before its first hike in 2015.

Ahead of the decision, May CPI will be reported. Headline is expected to remain steady at 0.3% y/y, while core is expected to rise 1.3% y/y vs. 1.4% in April. Tomorrow, May PPI will be reported. Headline is expected to remain steady at -1.2% y/y, while core is expected to rise 0.4% y/y vs. 0.6% in April. Still, the inflation data really don’t have much impact right now as policymakers remain focused on boosting growth.

The May US budget statement will be of interest. A deficit of -$544 bln is expected vs. -$738 bln in April. If so, the 12-month total would rise to a record -$2.3 trln. For now, the market and the Fed are absorbing the increased supply of US Treasuries. If yields rise significantly due to a supply-demand imbalance, we suspect the Fed would become more amenable to Yield Curve Control. However, it’s too early for that now.

Brazil reports May IPCA inflation. Inflation is expected to ease to 1.79% y/y from 2.40% in April. If so, it would be the lowest since January 1999 and move further below the 2.5-5.5% target range. Next policy meeting is June 17 and a 75 bp cut to 2.25% is expected. If the real continues to strengthen, we think the odds of a dovish surprise will rise.

EUROPE/MIDDLE EAST/AFRICA

We are still getting mixed messages about Europe’s flagship €750 bln recovery package. On balance we remain optimistic it will go through, but the risks remain that it will be watered down. The sticking point has always been the funding vehicle being joint debt issuance. Reports suggest that Austria, Denmark, the Netherlands, and Sweden are putting up the staunchest opposition to the plan, both in terms of debt mutualization and the size of the package. As it stands, Italy (€82 bln) and Spain (€77 bln) would get the lion’s share of the funds, followed by Poland and France, in a mix between grants and loans.

French April IP fell -20.1% m/m. It was expected to fall -20.0% m/m. Manufacturing fared worse at -21.9% m/m. Italy then reports its IP measure Thursday, which is expected to fall -24.0% m/m. The eurozone-wide measure will be reported Friday and is expected to fall -20.0% m/m vs. -11.3% in March. Given the dire outlook presented by the ECB last week, May is likely to be even worse than April.

ASIA

Japan reported weak May PPI and April core machine orders. PPI fell -2.7% y/y vs. -2.4% expected. This is the lowest since October 2016 and points to deflationary pressures building in the pipeline. Elsewhere, core machine orders contracted -17.7% y/y vs. -13.2% expected and -0.7% in March. This will likely get worse next month, as May appears to have been the worst for the Japanese economy. USD/JPY is trading at its lowest level since May 29. That day’s low near 107.10 is within sight, as the pair is on track to test the May 6 low near 106.

Australia reported ANZ Roy Morgan weekly consumer confidence and June Westpac consumer confidence. The former fell to 97.0 from 98.3 the previous week, while the latter improved to 93.7 from 88.1 in May. May NAB business conditions came in earlier this week at -24 vs. -34 in April, with business confidence improving to -20 from a revised -45 (was -46) in April. With risk appetite recovering, AUD is once again testing the .70 area. Yesterday’s high near .7040 is within sight. If risk sentiment remains positive, the next targets are the July 2019 high near .7080 and then the April 2019 high near .7205.

China reported May inflation and loan data. CPI slowed to 2.4% y/y vs. 2.7% expected and 3.3% in April, while PPI fell -3.7% y/y vs. -3.3% expected and -3.1% in April. The disinflationary trend is supportive for further stimulus, if needed. In that regard, new loans came in at CNY1.48 trln vs. CNY1.6 trln expected, down slightly from CNY1.7 trln in April. Aggregate financing, which includes shadow banking, rose CNY3.19 trln vs. CNY3.1 trln expected. These readings have been elevated in 2020 as the PBOC added stimulus to offset the impact of the pandemic.

Tags: Articles,Daily News,Featured,newsletter