The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation Press reports suggest a possible compromise in the UK-EU trade negotiations; oil futures are rising on prospects of an extension of the OPEC+ output curbs RBA kept policy steady, as expected; Moody’s downgraded India by a notch to Baa3 and maintained a negative outlook The dollar is broadly weaker against the majors after reports of a potential Brexit compromise. Aussie and Nokkie are

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The dollar is broadly weaker against the majors after reports of a potential Brexit compromise. Aussie and Nokkie are outperforming, while yen and Swissie are underperforming. EM currencies are mostly firmer. IDR and MYR are outperforming, while TWD and PHP are underperforming. MSCI Asia Pacific was up 1.0% on the day, with the Nikkei rising 1.2%. MSCI EM is up 0.9% so far today, with the Shanghai Composite rising 0.2%. Euro Stoxx 600 is up 1.7% near midday, while US futures are pointing to a higher open. 10-year UST yield is up 1 bp at 0.67%, while the 3-month to 10-year spread is up 1 bp at +54 bp. Commodity prices are mostly higher, with Brent oil up 2.91%, WTI oil up 2.8%, copper up 0.4%, and gold down 0.1%. The dollar remains under pressure. DXY traded today at the lowest level since March 13 near 97.43. Break below the key 97.837 level sets up a test of the March 9 low near 94.65. The euro and sterling are both trading at multi-month highs on reports of a potential compromise in Brexit talks (see below). Lastly, USD/JPY remains stuck in narrow trading ranges just below the 108 level. |

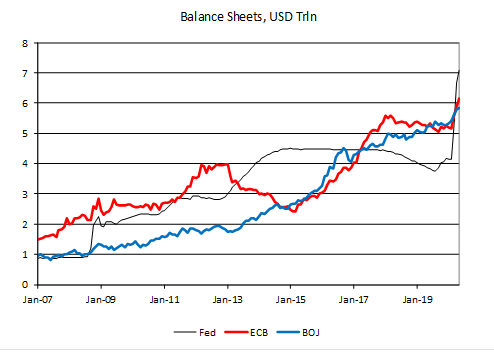

Balance sheets, USD Trin, 2007-2019 |

| There is a debate as to the root causes of recent dollar weakness. Is it the burgeoning national debt? The poor US economic outlook? Political risk from widespread social unrest here in the US. All of these (and perhaps more) have contributed to the dollar’s swoon. But being old-fashioned as we are, we default back to relative monetary policy as the major driver of currency movements.

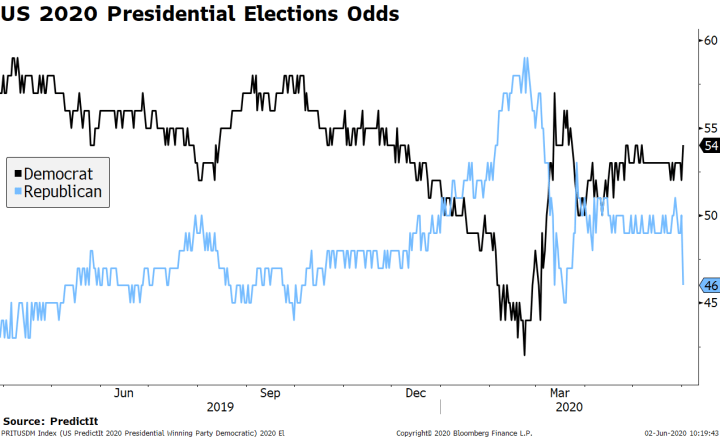

One might ask how much relativity there is given rate are zero (or less) everywhere in the developed world. Well, one glance at the balance sheets of the Fed, ECB, and the BOJ tells us all we need to know. The Fed’s balance sheet has grown 70% since the end of February vs. 18% for the ECB and 8% for the BOJ. Simply put, the Fed has been much more aggressive with its QE than any of its counterparts. As we saw during the financial crisis, the Fed was similarly aggressive, and the dollar came under pressure in the initial stages of QE. Once other central banks played catchup, the dollar recovered. This dynamic may play out again this time. The ECB has expanded its QE already and is likely to do so again this Thursday. We will be sending out a preview later today. Similarly, the BOE is likely to expand its QE at its next policy meeting June 18. AMERICAS The protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds. PredictIt now sees the odds of a Democratic president (presumably Biden) at 54%, up from a low near 40% in late February. We have yet to see any opinion polls taken as the current nationwide protests escalate. We are concerned that Trump will take a hardline stance with the protestors in order to run for re-election as a “law and order” candidate. |

US 2020 Presidential Elections Odds, 2019-2020 |

| Yet it will be hard to square this circle when the current turmoil has occurred under his watch. Richard Nixon was able to run this strategy successfully in 1968 because Democrats held the presidency for the two previous terms (JFK and LBJ). Still, it’s a long way until November.

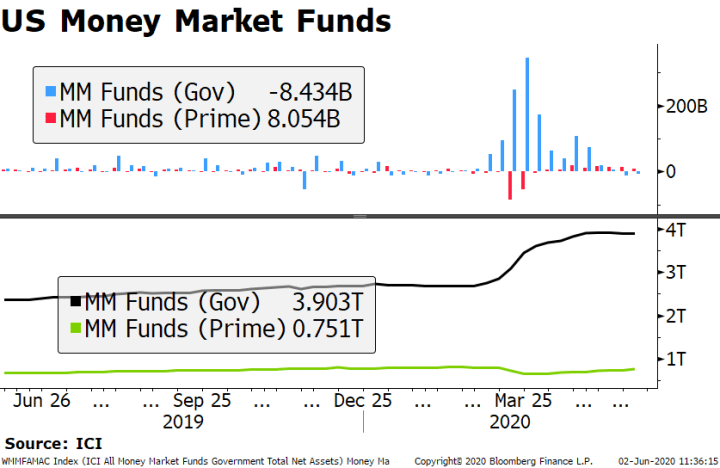

Despite the impressive rally in risky assets from equity to high yield bonds, money market funds remain near record highs. But over the last couple of weeks (ending May 27) we have seen a slight shift in flow patterns: a decline in government paper money market funds and an increase in prime funds. As a reminder, prime funds invest in commercial paper. Still, government money market funds (near $4 trln AUM) remain orders of magnitudes greater than prime funds ($750 bln). Although the AUM for prime funds declined sharply during the crisis and is still 7.3% lower than the February highs. |

US Money Market Funds, 2019-2020 |

| May auto sales will be the only US data release today. Sales are expected to recover to an annualized 11.1 mln pace from 8.58 mln in April, which was the lowest on record dating back to 1976. May retail sales data will be reported June 16 and if auto sales bounce back, there is some chance of a modest rebound in headline sales from the -16.4% m/m drop in April. Note that sales ex-autos still plunged -17.2% m/m in April, so we cannot just blame weak auto sales that month. Furthermore, the outlook for June is not good considering the nationwide riots and looting that will surely depress consumption. With the media embargo in effect for the June 10 FOMC meeting, there are no Fed speakers this week.

The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation. He confirmed that he still plans to invite Russia, Australia, India, and South Korea to the rescheduled summit, calling the current lineup “outdated.” The UK and Canada have already indicated they would block any attempt to re-admit Russia to the G8. Trump said the meeting could be held in September or even after the US elections in November. A senior Russian official said his nation would only take part if it is treated as an equal. |

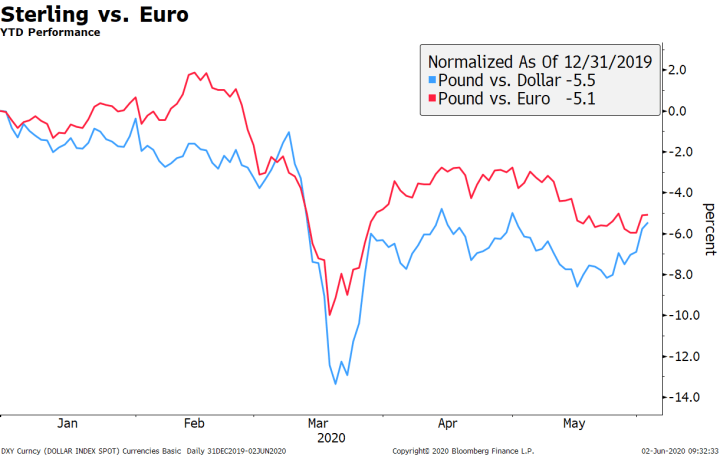

Sterling vs. Euro, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

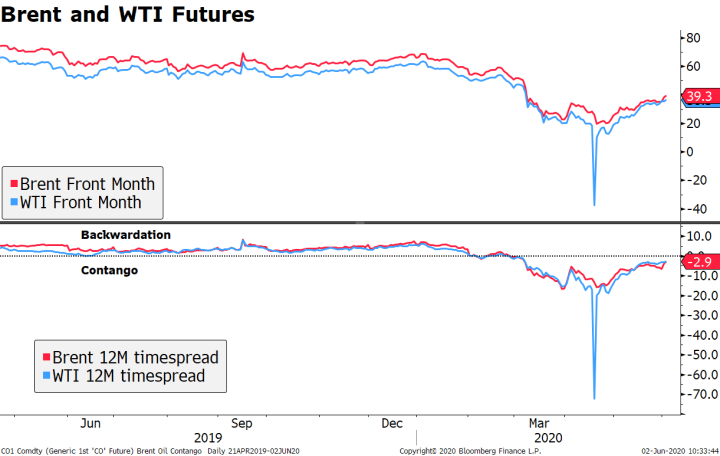

Press reports suggest a possible compromise in the UK-EU trade negotiations. The report by The Times mentioned regulatory alignment (a.k.a. “level playing field) and fishing access as the areas where the UK’s position could be softened. However, that softening would only come if the EU eases some of its demands in these contentious areas and so the optimism may be overdone. In theory, this is the last round of negotiations before the next summit and the last opportunity to secure at least an extension beyond the year-end cliff. For now, markets are ignoring reports of another area of disagreement as the UK and EU are now arguing about the terms of a new extradition treaty. The UK reportedly wants its judges have greater powers to refuse EU extradition requests than currently under the European Arrest Warrant system now in place until December 31. Conversely, the EU wants its courts to be able to refuse certain UK extradition requests for suspects facing life sentences. Both the euro and pound are rallying sharply. The euro traded at the highest level since March 17 near $1.1190. Clean break of the $1.1165 area sets up a test of the March 9 high near $1.15. Likewise, cable traded at the highest level since May 1 near $1.2575. Clean break of the $1.2515 area sets up a test of the March 9 high near $1.32. Some key levels to watch for up ahead are the April highs near $1.2645 and the 200-day moving average near $1.2670. Oil futures are rising on prospects of an extension of the OPEC+ output curbs. Brent is up nearly 3% on the day to near $40 per barrel while WTI is about the same to around $36.40 per barrel. Russia seems to be the last major player still not officially making the extension, though reports suggest it will do so today. Saudi Arabia is calling for the output reductions to be maintained for an additional 1-3 months. Also, of note, the contango in both curves is almost gone, meaning that curve is nearly flat. |

Brent and WTI Futures, 2019-2020 |

ASIA

Reserve Bank of Australia kept policy steady, as expected. The bank sounded upbeat, with Governor Lowe noting that “It is possible that the depth of the downturn will be less than earlier expected.” He added that “The rate of new infections has declined significantly, and some restrictions have been eased earlier than was previously thought likely.” However, he warned that “It is likely that this fiscal and monetary support will be required for some time.” Q1 GDP data will be reported tomorrow, with growth expected to slow to 1.4% y/y vs. 2.2% in Q4. It’s clear that policymakers will remain in wait and see mode to see how the economic outlook develops as restrictions are lifted.

Moody’s downgraded India by a notch to Baa3 and maintained a negative outlook. The agency noted that “The negative outlook reflects dominant, mutually-reinforcing, downside risks from deeper stresses in the economy.” Moody’s added that stresses in the economy “could lead to a more severe and prolonged erosion in fiscal strength than Moody’s currently projects.” Our own sovereign ratings model has India at BBB-/Baa3 and so the downgrade was warranted. We are planning to update our model later this month and with the rapidly deteriorating outlook for India, we think there are rising risks of an eventual move to sub-investment grade.

Tags: Articles,Daily News,Featured,newsletter