Risk-off sentiment has intensified; as a result, the dollar is getting some more traction Fed Chair Powell pushed back against the notion of negative rates in the US; US Treasury completed its quarterly refunding Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week; Mexico is expected to cut rates 50 bp to 5.5%There have been growing discussions about negative rates in the UK; weak UK data, rising Brexit risks, and a more dovish BOE have taken a toll...

Read More »Dollar Mixed as Markets Await Fresh Drivers

The virus news stream is mixed; the dollar continues to consolidate; US-China tensions continue to rise US Treasury wraps up its quarterly refunding; April budget statement is a harbinger of things to come; the next round of stimulus will be contentious We got some dovish BOE comments yesterday; UK continues to play Brexit hardball; UK data was slightly better than expected but awful nonetheless Japan reported March current account data; RBNZ expanded its QE program...

Read More »Dollar Mixed as Doves Fly

Measures of cross-market implied volatility have been stable for a few weeks now Weekly jobless claims are expected at 3 mln; reports suggest House Democrats are pushing ahead with a possible vote next week on another relief package Canada reports April Ivey PMI; Peru is expected to keep rates steady; Brazil COPOM delivered a dovish surprise last night The Bank of England delivered a dovish hold; The Norges Bank surprised markets with a 25 bp cut to 0%; Czech...

Read More »Negative News from Europe Helps Dollar Build on Gains

UK has been confirmed to have the highest death toll in Europe the dollar is getting more traction Reports suggest Congress is resisting President Trump’s call for a payroll tax cut; ADP private sector jobs data is expected to come in at -21 mln Brazil is expected to cut rates 50 bp; Fitch cut its outlook on Brazil to negative; Chile is expected to keep rates steady Sterling remains under pressure as Brexit talks sour; the EC warned that the future of the eurozone is...

Read More »Dollar Remains Under Pressure as Europe Unveils Some Plans to Reopen

Global equity markets continue to trend higher; the dollar remains under pressure The two-day FOMC meeting ends today; the first look at Q1 US GDP comes out France and Spain laid out plans to reopen; the UK will rely on a contact tracing plan to limit the viral spread Ahead of the ECB meeting Thursday, European policymakers are showing a similar willingness to act as needed Fitch cut Italy by a notch to BBB- with stable outlook; Germany reports April CPI Reports...

Read More »Dollar Remains Under Pressure as Risk-on Sentiment Persists

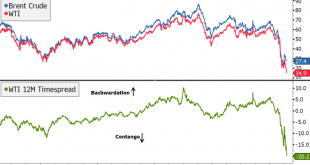

The death toll from the virus continues to trend lower in Europe and the US; the dollar remains under some pressure The Fed announced an expansion of its Municipal Liquidity Facility (MLF); regional Fed manufacturing surveys for April continue to roll out; other data will be reported Sweden kept rates and QE steady, as expected; Hungary is expected to stand pat too Oil prices are tumbling again Japan reported soft March jobs data; HKMA stepped up its intervention...

Read More »Dollar Steady as Global Economy Falls Off a Cliff

The virus news stream is negative today; the dollar is trying to build on its recent gains Weekly jobless claims are expected at 4.5 mln vs. 5.245 mln last week; regional Fed manufacturing surveys for April continue to roll out ECB confirmed reports that it will accept sub-investment grade debt as collateral; EU leaders will hold a video conference today Preliminary April eurozone PMI readings were awful; UK readings were even worse Japan reported weak preliminary...

Read More »Dollar Stalls as Market Sentiment Improves

The virus news stream remains mixed; oil remains at center stage with still extreme volatility. The White House and House Democrats struck a deal on a new aid package worth $484 bln Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon ECB will consider accepting sub-investment grade bonds as collateral in its operations; reports suggest Italy will boost its fiscal stimulus efforts UK reported March CPI data; Turkey is expected...

Read More »Dollar Firm as Equities and Oil Start the Week Under Pressure

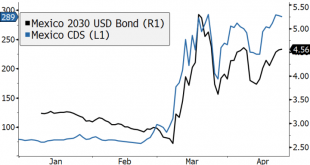

The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln; the extra fiscal stimulus will add to downward ratings pressure on the US Chicago Fed National Activity Index for March will be reported; late Friday, Moody’s downgraded Mexico a notch to Baa1 with negative outlook The debate about re-opening...

Read More »Dollar Firm in Thin Holiday Trading

The virus news stream is mostly positive today; yet risk assets are starting the week under some modest pressure The dollar took a hit last week but we think it will recover; some US data releases from Good Friday are worth repeating With most of Europe closed today, the news stream from the region is very light; oil prices could not extend their gains today after OPEC+ finalized output cuts over the weekend India March CPI is expected to ease to 5.90% y/y from 6.58%...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org