The dollar has stabilized a bit; Friday’s US jobs data could be a game changer The US bond market selloff continues; for now, the weak dollar trend is hard to fight The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics German IP came in a bit worse than expected at -17.9% m/m; the OPEC+ deal ended with the expected supply cut deal, lending continued support to crude prices Japan Q1 GDP revised higher on questionable capex readings; China reported a record trade surplus in May; HKMA continues to defend the strong end of the HKD band The dollar is mixed against the majors as the new week begins. The Scandies are outperforming, while sterling and euro are underperforming. EM currencies are mixed too. RUB

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The dollar has stabilized a bit; Friday’s US jobs data could be a game changer

- The US bond market selloff continues; for now, the weak dollar trend is hard to fight

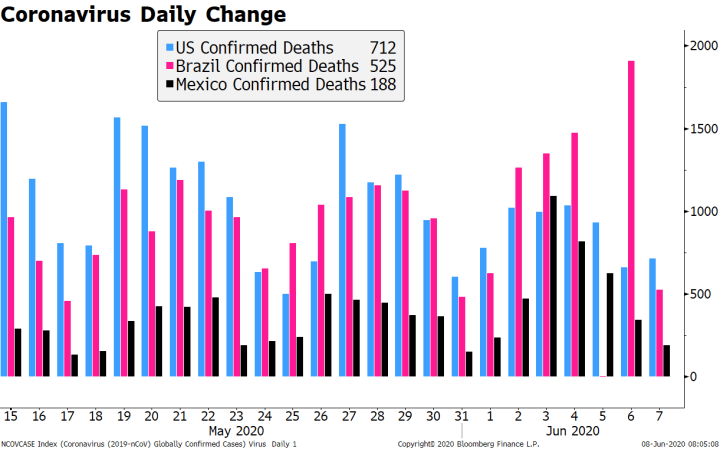

- The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics

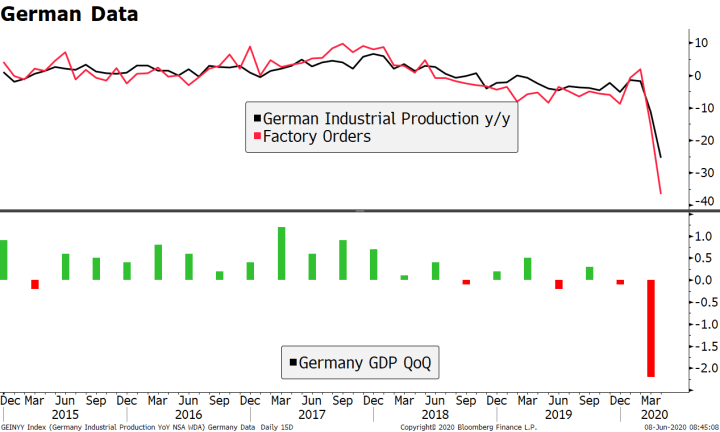

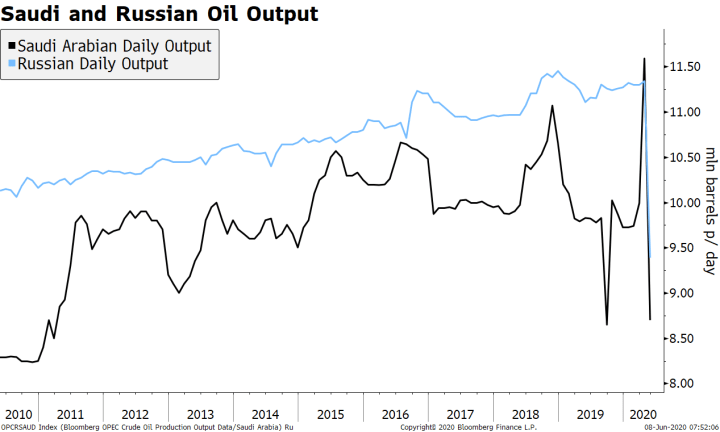

- German IP came in a bit worse than expected at -17.9% m/m; the OPEC+ deal ended with the expected supply cut deal, lending continued support to crude prices

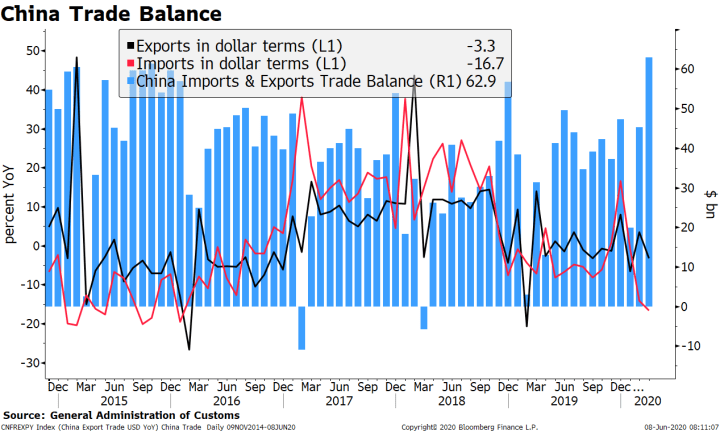

- Japan Q1 GDP revised higher on questionable capex readings; China reported a record trade surplus in May; HKMA continues to defend the strong end of the HKD band

The dollar is mixed against the majors as the new week begins. The Scandies are outperforming, while sterling and euro are underperforming.

EM currencies are mixed too. RUB and ZAR are outperforming, while PHP and TRY are underperforming. MSCI Asia Pacific was up 0.8% on the day, with the Nikkei rising 1.4%. MSCI EM is up 0.3% so far today, with the Shanghai Composite rising 0.2%. Euro Stoxx 600 is down 0.4% near midday, while US futures are pointing to a higher open. 10-year UST yield is up 1 bp at 0.91%, while the 3-month to 10-year spread is up 1 bp at +76 bp. Commodity prices are mostly higher, with Brent oil up 1.1%, WTI oil up 0.6%, copper down 0.2%, and gold up 0.5%.

The dollar has stabilized a bit. DXY is flat on the day but still seems likely to test the March low near 94.65. The euro is nearly a cent off its Friday highs and trading back below $1.13. Sterling has held up a bit better but has been unable to make a clean break above the 200-day moving average near $1.2680 currently. Lastly, USD/JPY has been turned back from the 110 area but should be supported by buoyant market sentiment.

AMERICAS

Friday’s US jobs data could be a game changer. Why? If sustained, the improved data are telling us that the US economy is responding to the unprecedented fiscal and monetary stimulus now in place even as the nation slowly reopens. Yet it is too early for the Fed to think about withdrawing stimulus. And so for now, markets are in a sweet spot where the data are improving, and the Fed is still adding stimulus. As a result, equities are likely to continue rising and the dollar is likely to continue falling. As we noted in our March Fed piece To Infinity (and Beyond), “The dollar typically does poorly at the onset of each round of QE before recovering. ”

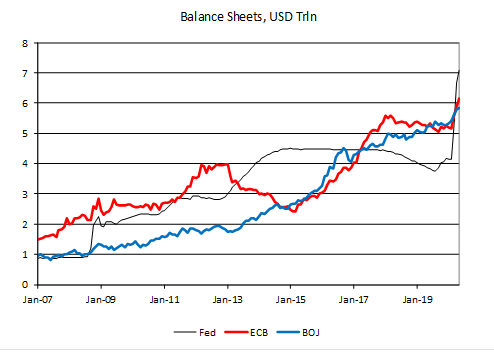

This near-term dollar weakness is likely to be followed by a recovery later the Fed stops adding so much stimulus. Its balance sheet has expanded 70% since the end of February and that pace is simply unsustainable, especially if the data continue to improve. Indeed, the improvement in US data could prove to be a key inflection point for Fed policy in the coming weeks that could be dollar-positive; a coronavirus “taper tantrum” if you will.

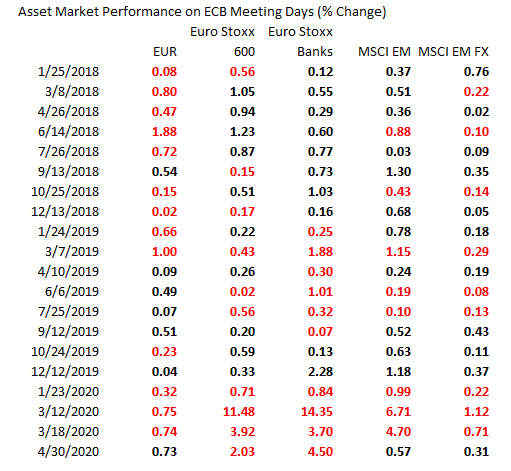

On the other side of the coin, it’s clear that more central banks will be increasing their own QE programs long after the Fed has stopped. The ECB just did so last week and is widely expected to do so again in September. Likewise, the BOE is expected to increase its QE this month. We saw this dynamic play out after the financial crisis, and this turned out to be a big factor in the dollar’s bull run that began in mid-2014.

As it is, the US bond market selloff continues. The 10-year yield is currently around 0.91%, the highest since March 20. This is about half the drop from the March 19 high near 1.27% to the April 21 low near 0.54%. A break of the 0.99% area would set up a test of that March high. We do not think the Fed will be happy with the steepening yield curve.

For now, the weak dollar trend is hard to fight. The Fed continues to boost its balance sheet aggressively and that is likely to remain the major driver near-term. Yet the improvement in US data could prove to be an inflection point for Fed policy in the coming weeks that could be dollar-positive; a coronavirus “taper tantrum” if you will.

| The FOMC decision comes Wednesday. No policy changes are expected but we should get an updated view on current Fed thinking. We may get some pushback against the steeper yield curve. New York Fed President Williams said recently that the Fed is “thinking very hard” about Yield Curve Control. However, Cleveland Fed President Mester pushed back a bit and said she doesn’t think the Fed is close to trying YCC whilst admitting it is “a tool I think it’s worthwhile thinking about.” Both are voters this year. Due to the media embargo, there are no Fed speakers until Powell’s post-decision press conference.

The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics. President Bolsonaro has backpedaled on the decision after enormous criticism and the government has resumed releasing data. But even that was a mess, with different sets of data released. Everyone knows that virus data collection is fraught with challenges. We also realize that in many countries (including the US) there have been allegations that sectors of the health system have purposely inflated the number of Covid-related deaths. But even if true, the way to tackle this is through thorough investigation, not withholding data. |

Coronavirus Daily Change, 2020 |

EUROPE/MIDDLE EAST/AFRICAGerman IP came in a bit worse than expected at -17.9% m/m and -25.3% y/y in April, confirming the heavy hit to the country’s economic prospects. The record contraction did take place before the re-opening begun, so there is a sense that the worst may be behind us – assuming no second wave. France reports April IP Wednesday, which is expected to fall -20.0% m/m. Italy then reports its IP measure Thursday, which is expected to fall -24.0% m/m. The eurozone-wide measure will be reported Friday and is expected to fall -20.0% m/m vs. -11.3% in March. Given the dire outlook presented by the ECB last week, May could be even worse than April, with recovery seen in June as the lockdowns ease further. |

German Data, 2015-2020 |

| The OPEC+ deal ended with the expected supply cut deal, lending continued support to crude prices. Aside from the one-month extension to its production quotas, it intends to adopt stricter compliance measures. The latter means that members who fail to implement the agreed cuts will have to make up for that in the subsequent months. The biggest offenders have reportedly been Iraq, Nigeria, and Kazakhstan. |

Saudi and Russian Oil Output, 2010-2020 |

ASIAJapan final Q1 GDP data was reported today at -2.2% SAAR vs. -2.1 expected and -3.4% preliminary. The improvement came largely from a revised 8% SAAR surge in capital expenditures vs. -2.1% preliminary. However, readings here were based on a corporate survey that the Finance Ministry said had a low response rate due to the pandemic. The ministry said this may have skewed the results and so it will release updated readings next month. April current account data was also reported today at an adjusted JPY252.4 bln. China May trade surplus expanded on the back of a surprisingly sharp contraction in imports and a less pronounce export contraction. Exports came in at -3.3% (-6.5% expected), helped by sales of medical equipment, while imports came in at -16.7% (vs. -7.9% expected). The surplus grew from $41 bln to a record $63 bln on the month. The yuan continues its appreciating trend at around CNY7.08, largely following the direction of the broad dollar weakening trend of the last several sessions. We suspect the record trade surplus and rising yuan may lead to another round of complaints from US officials. However, we believe the US will refrain from escalating the trade war again ahead of the November elections. This is a simple case of “all bark, no bite.” HKMA defended the strong end of the HK band for the third straight day. Today, it sold HKD4.263 bln and follows HKD8.758 bln sold last Friday and HKD977 mln last Thursday. Sentiment regarding Hong Kong has remained unshakeable despite rising political tensions. Recall that the HKMA has unlimited resources (HKD) to defend the strong end. |

China Trade Balance, 2015-2020 |

Tags: Articles,Daily News,Featured,newsletter