There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report. The BLS reported Friday,...

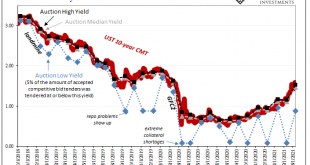

Read More »What Gold Says About UST Auctions

The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first. Combined, fiscal and monetary policy was, they said,...

Read More »Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery. Of course, anyone who’s been paying attention knows that rates have been rising for almost a year –...

Read More »Eurodollar University’s Making Sense; Episode 46; Part 3: Bill’s Reading On Reflation, And Other Charted Potpourri

46.3 On the Economic Road to NothingGoodVilleRecent, low consumer price inflation readings combined with falling US Treasury Bill yields are cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac. [Emil’s Summary] Having studied monetary policy for several years it was only natural that your podcaster spent considerable time contemplating the essential elements of fiction. Some experts say there are five...

Read More »Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag. A Virginia man who was part of the riot wore a T-shirt mocking the holocaust. A Brooklyn judge’s son was photographed in the Capitol wearing an elaborate outfit of furs accented by...

Read More »If the Fed’s Not In Consumer Prices, Then How About Producer Prices?

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data. Trillions in bank reserves, sure, but actual money can only be missing. U.S. CPI Services Core Fed, Jan 1985 - -2020 - Click to enlarge U.S. CPI Services Core percentile, Jan 2009 - 2020...

Read More »FX Daily, November 19: Surging Virus Saps Risk Appetites

Swiss Franc The Euro is stable by 0.00% to 1.0796 EUR/CHF and USD/CHF, November 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the New York City was closing the schools to contain the virus sent stocks reeling in late North American dealings yesterday and spurred some profit-taking in the Asia Pacific and Europe. Equities in the Asia Pacific region were mostly lower, though China, South Korea, and...

Read More »Yep, There’s A New ‘V’ In Town And The Locals…Don’t Seem To Much Care For It

They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage. Getting back to just even with February instead is becoming a distant probability, the kind of non-transitory shortfall with which we’ve grown far too accustomed. Therefore, “they” now salivate (reported to be...

Read More »Monthly Macro Monitor – September (VIDEO)

[embedded content] Alhambra CEO Joe Calhoun and Alhambra’s Bob Williams look at data from the past month and discuss what it means for the economy. You Might Also Like Monthly Market Monitor – July 2020 Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy...

Read More »What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying. Zambia did what everyone does, the country floated its first Eurobond ($750 million). At that point, copper was only down modestly from its 2011 peak. By 2014,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org