Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be: “a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the economy; in which the...

Read More »Gold, Stocks & Commodities- A Complicated Correlation

In our July 29 post titled How Gold Stacks Up Against Stocks, Property, Commodities and Big Macs! we showed readers charts of gold as a ratio to other assets and products. We discussed that gold competes with crypto and stocks for the investment dollars. It was clear that gold as a ratio of the S&P 500 Index and of the broader MCSI World Equity Index show that gold is ‘relatively cheap’ compared to these measures. But then we showed that this wasn’t the...

Read More »Weekly Market Pulse: Buy The Dip, If You Can

[unable to retrieve full-text content]If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »Eurodollar University’s Making Sense; Episode 89, Part 2: Let’s Crack China’s RRR Code

[unable to retrieve full-text content]89.2 China Warns World of (Next?) Dollar Disorder. The People’s Bank of China lowers its bank Required Reserve Ratio to get money into a slowing economy. A lowered RRR means that there aren’t enough (euro)dollars flowing into China. Why? Because there aren’t enough (euro)dollars in the world. A lower RRR is a warning for the whole world.

Read More »FX Daily, July 22: Enguard Lagarde

Swiss Franc The Euro has risen by 0.08% to 1.0828 EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally in US shares yesterday, ostensibly fueled by strong earnings reports, is helping to encourage risk appetites today. The MSCI Asia Pacific Index is posting its biggest gain in around two weeks, though Japan’s markets are closed today and tomorrow. The Dow Jones Stoxx 600 is...

Read More »Weekly Market Pulse: As Clear As Mud

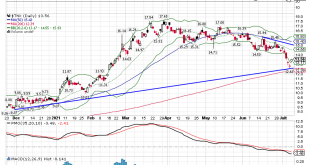

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs. Crude oil has recently joined in, falling 7% from its recent high. Energy stocks are in a full...

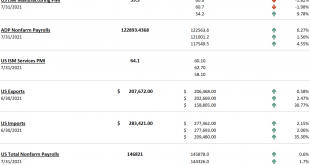

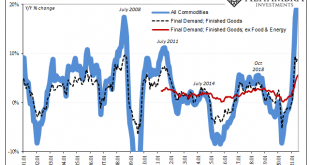

Read More »And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene. The BLS reports today that its main producer price index (PPI), the one for finished goods, was up 9.19% year-over-year in June 2021....

Read More »Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range. The bond rally since April has been of the stealth variety, the financial press and market strategists dismissing every tick down in rates as nothing. It was a lonely trade to put on and yes...

Read More »FX Daily, July 08: Capital Markets Remain Unhinged

Swiss Franc The Euro has fallen by 0.51% to 1.0852 EUR/CHF and USD/CHF, July 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic move in the capital markets continues. The US dollar is soaring as yields and equities slide. The US 10-year yield has fallen below 1.30 to 1.26% European benchmark yields are 1-4 bp lower, while Australia and New Zealand have seen a 7-9 bp drop today. Signals that the...

Read More »FX Daily, June 23: Japan Retains Distinction of being the only G7 Country with Sub-50 PMI Composite

Swiss Franc The Euro has fallen by 0.01% to 1.0956 EUR/CHF and USD/CHF, June 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Federal Reserve officials, lead by Chair Powell, pushed gently against the more hawkish interpretations of last week’s FOMC meeting. Tapering not a rate hike was the focus of discussions. Powell reiterated that price pressures would prove transitory and would ease after the re-opening...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org