They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage. Getting back to just even with February instead is becoming a distant probability, the kind of non-transitory shortfall with which we’ve grown far too accustomed. Therefore, “they” now salivate (reported to be salivating) for more where no more should be necessary: government aid, government spending, and whatever it is the Fed pretends to do. The “V” has changed – and markets are, believe it or not, changing with it. Not in a good way, though not yet necessarily in a bad way. Surefire recovery gave way months ago

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, commodities, contango, Crude Oil, crude oil production, crude production, crude stocks, currencies, demand, DJIA, economy, equities, Featured, Federal Reserve/Monetary Policy, industrial production, Inventory, Markets, newsletter, S&P 500, S&P 500, stocks, WTI, wti futures curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage. Getting back to just even with February instead is becoming a distant probability, the kind of non-transitory shortfall with which we’ve grown far too accustomed.

Therefore, “they” now salivate (reported to be salivating) for more where no more should be necessary: government aid, government spending, and whatever it is the Fed pretends to do. The “V” has changed – and markets are, believe it or not, changing with it. Not in a good way, though not yet necessarily in a bad way. Surefire recovery gave way months ago to more determined doubts which have led, in recent weeks, to another sort of obvious downshifting. “Who knows?” still represents a significant change to sentiment; and that’s not in a good way. Being just what the Fed really does, the desire, at least, for a sentiment boost grows loud. Why anyone is cheering it speaks to the upside-down world of a Greenspan put that just won’t die (the more the Fed feels it has to intervene, the worse off we must be, so the happier we are supposed to be for it?) |

. |

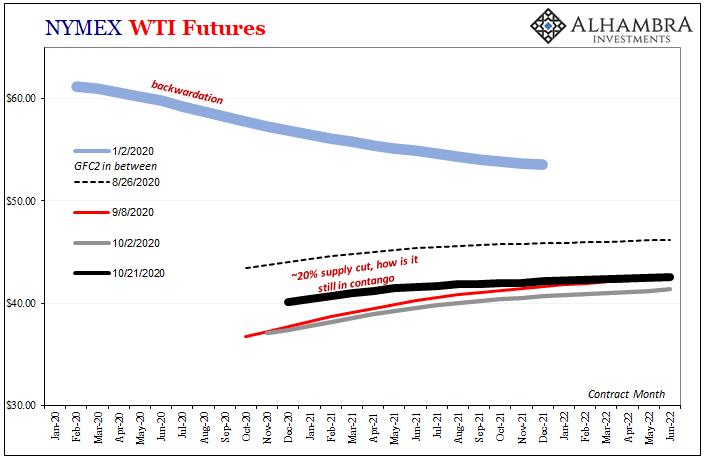

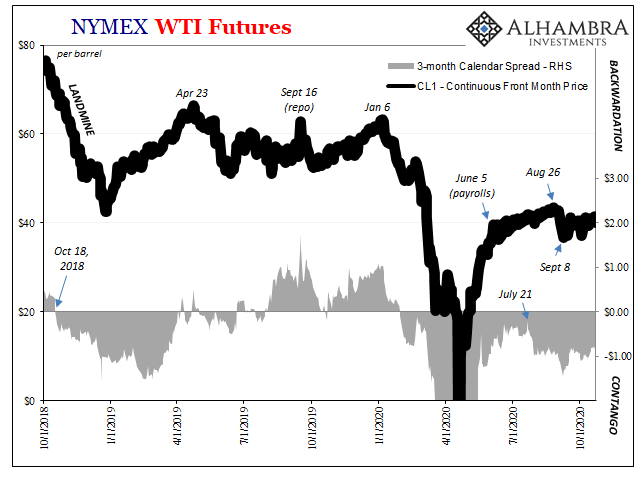

| The best place to start is, as usual, with crude oil. The WTI curve, for all the talk of recovery and inflation these past few months, continues to be in contango. That’s already a bad sign since the curve “should” be in backwardation, the latter shape denoting a physical market balanced with funding conditions whereby oil is incentivized to be used rather than stored.

Used because of the robust demand for it, the healthy economic conditions where supply, demand, and dollars are more in harmony. While contango is already one warning, how in the world can the curve still be this way after 20 maybe 25% of supply has been taken offline domestically? |

|

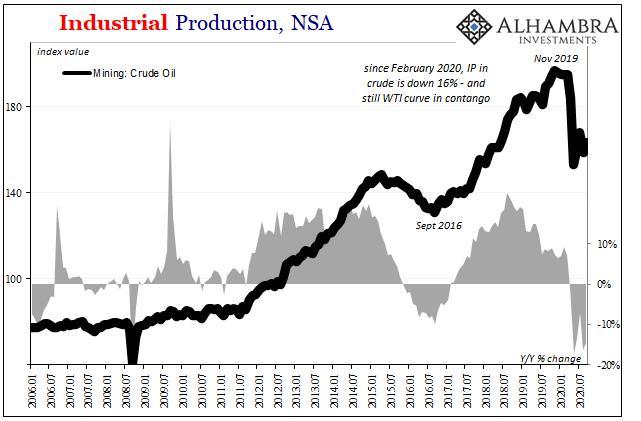

| According to the Federal Reserve’s Industrial Production figures, output in the mining sector dedicated to oil extraction was down about 16% in September when compared to February. | |

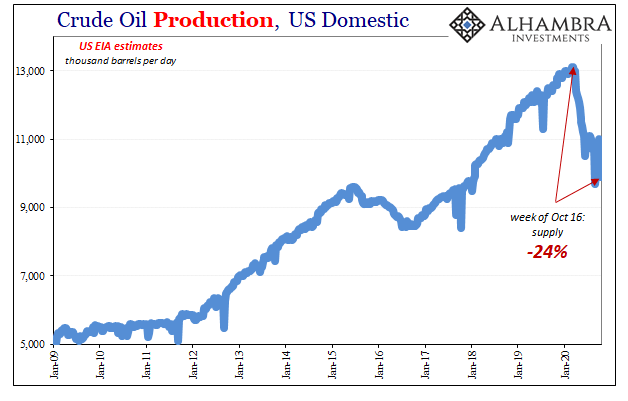

| That’s actually the upper bound, the best-case data now already almost a month stale. Using the weekly US EIA estimates updated now to the middle of October, production levels dropped considerably from late September/early October back down near where they were when Hurricane Laura plowed through the Gulf of Mexico.

In this case, some supply was shuttered as Hurricane Delta went barreling into the same general coastal area as Laura had. The WTI curve barely moved – for either one. With Laura, oil prices dropped. Even as crude production was curtailed to a level of -24% during Delta’s week from the March peak, contango hasn’t really budged, either. |

|

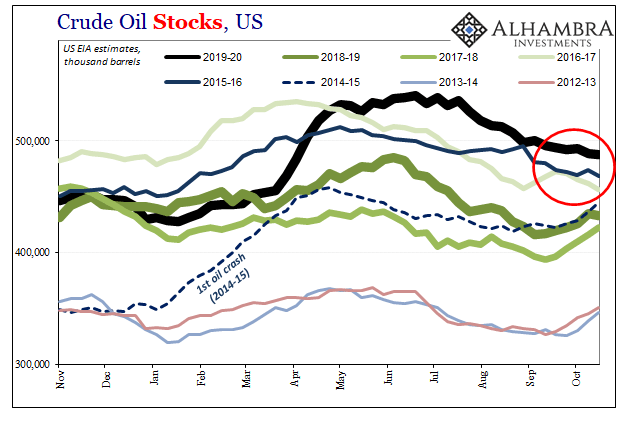

| It can only be questions about future demand and how the presumed rebound in it keeps coming up physically, monetarily short.

To the first part, the physical state of domestic energy, oh boy. There’s really no mystery about WTI’s clinging to contango. Using US EIA’s estimates, crude stocks right now have never been higher. Again, that’s with somewhere around 20%, one-fifth, of domestic production offline as an intermediate-term (rather than short run) baseline. Not for nothing, we’re getting to that period in the calendar when the usual seasonal accumulation starts back up. In other words, having not used nearly as much accumulated stock from prior production during the gigantic positives of mid-2020, oil inventories remain at record highs with low production and now someone’s going to be paying for storage as autumn sets in. Contango. |

|

| The shifting recovery narrative is mirrored damn near perfectly in the changing trajectory of the WTI curve (below). From its big negative front month price in mid-April, WTI and global oil benchmarks surged up from the depths to back around $40 by June 5.

Like a lot of markets in this first set of reopening weeks, there was a ton of in-your-face unbridled optimism – that first “V” narrative about how shutting everything down was easy so it must be just as easy to turn everything right back on. That’s just how it got priced in oil, too, but only up to June 5. Then, like the bond market, “something” changed thereafter. What had been easy “V” up to then instead couldn’t answer for lingering questions therefore leading to growing doubts (unemployment claims the big one). Between June and August 26, WTI’s rise became more muted. Still up, still less contango, but very different from how that first post-GFC2 rebound had gone. |

|

| The toward the end of August, another possible inflection or rollback showed up. There was that initial hiccup and selloff which seemed like it could’ve been September bottleneck related. Maybe it was? Whatever the case, as you can plainly see above, the oil market hasn’t been the same since August 26.

This suggests, as contango and inventory confirm, doubts about the first “V” had been surpassed such that the first “V” narrative has been put out of its misery entirely. In its place, a new “V” narrative has emerged, one premised on “stimulus” which in the media is spun as some awesome thing where instead in markets it represents a serious change over an outcome far more in doubt. The crude curve shows just this evolution – as does the stock market. Seriously. |

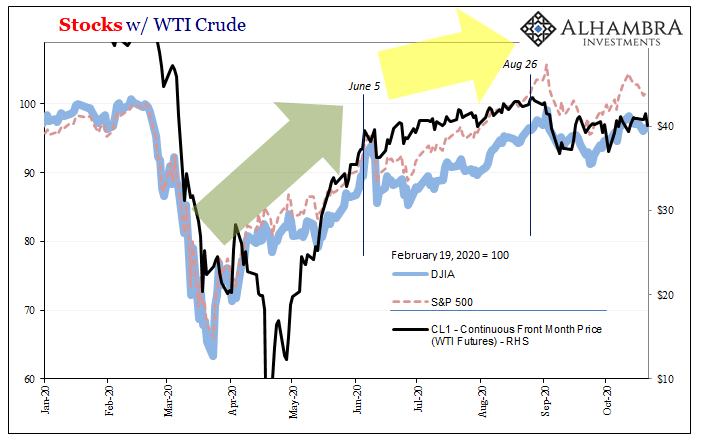

WTI was late to the initial “V” rebound compared to shares because it had been encumbered by physical supply equities don’t have to factor. But from mid-April until early June, both stocks and oil were uniform (joined by fast-rising nominal Treasury yields) in pricing the easy recovery scenario.

Jay Powell’s 60 Minutes of digital money printing didn’t last all that long, however (only a bit more than an hour). June 5 forward, WTI then equities changed trajectory. Still positive and upward, though not nearly as robust.

Late August into early September, however, more sideways to slightly lower across both asset classes; a second clear change in the underlying basis about recovery probabilities. In other words, the need for more “stimulus” became very clearly established. What that ultimately means, neither stocks nor crude right now are particularly enthused.

For oil, a crucial indicator of physical (and dollar) conditions that remain far from ideal. Even in stocks, where sentiment rules everything, there’s been a pause in it deviating now twice from the everything-can-only-be-awesome trend.

Maybe everything will still turn out awesome, but it’s not so certain any longer even in the electronic trading pits at the NYSE.

Over in crude, meaning the real economy, the level of uncertainty raised much higher. One-fifth of crude offline halfway into October, and still contango alongside record inventories.

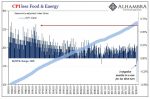

But forget all this. There’s a new “V” in town. Inflation therefore full recovery has been guaranteed by the central bank and whatever it does next. If only it really was a central bank.

Tags: Bonds,commodities,contango,Crude Oil,crude oil production,crude production,crude stocks,currencies,demand,DJIA,economy,equities,Featured,Federal Reserve/Monetary Policy,industrial production,Inventory,Markets,newsletter,S&P 500,stocks,WTI,wti futures curve