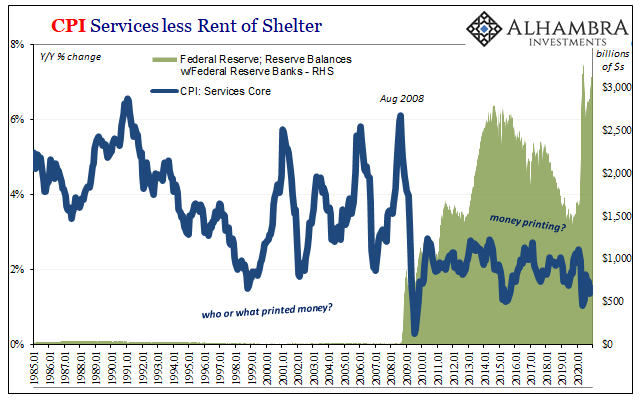

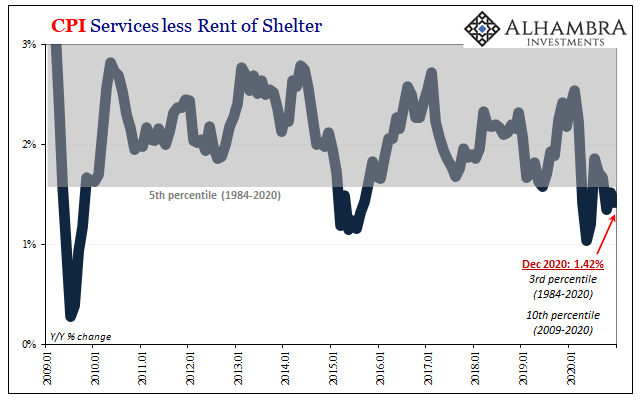

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data. Trillions in bank reserves, sure, but actual money can only be missing. U.S. CPI Services Core Fed, Jan 1985 - -2020 - Click to enlarge U.S. CPI Services Core percentile, Jan 2009 - 2020 - Click to enlarge OK, fine. What about commodities? If the Fed’s monetary fires haven’t fed through to corporate pricing power for the stuff going out the door, then perhaps it just hasn’t gotten that far yet. Given the huge move in especially industrial metals (and others) led by Dr. Copper,

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, commodities, Consumer Prices, Copper, CPI, currencies, Dollar, economy, Featured, Federal Reserve/Monetary Policy, inflation, jay powell, Markets, Metals, money printing, newsletter, PPI, producer prices, QE

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data. Trillions in bank reserves, sure, but actual money can only be missing. |

U.S. CPI Services Core Fed, Jan 1985 - -2020 |

U.S. CPI Services Core percentile, Jan 2009 - 2020 |

|

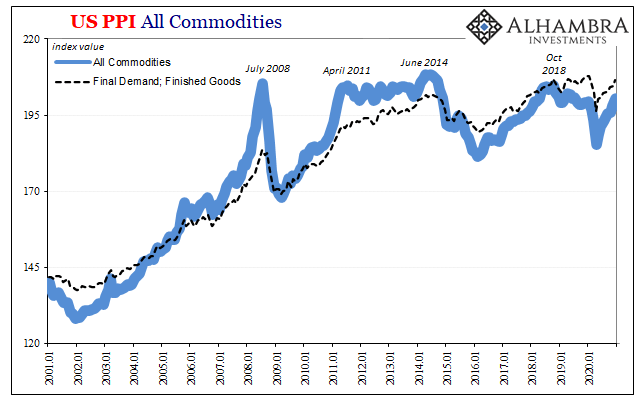

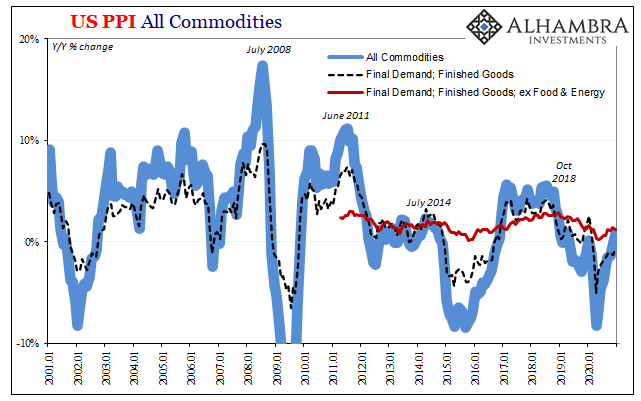

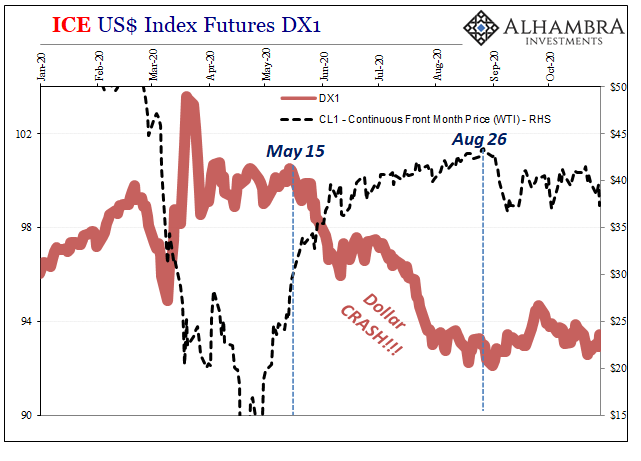

| OK, fine. What about commodities? If the Fed’s monetary fires haven’t fed through to corporate pricing power for the stuff going out the door, then perhaps it just hasn’t gotten that far yet. Given the huge move in especially industrial metals (and others) led by Dr. Copper, though companies aren’t raising prices on the goods (and services) they’re sending out maybe that’s just because they haven’t yet passed along the rapidly rising prices of the materials coming in.

Cost-push. After all, it would stand to reason that if commodities are on their way up – for inflationary reasons of imminent currency “devaluation” – we should be able to see it by now at least in the form of widespread producer price inflation. |

Copper Futures, Continuous Front Month, Jan 2002 - 2021 |

| And if so, that would have to eventually feed through to what consumers end up paying, too.

It’s not here, either. Though commodity prices are absolutely rising and have made a pretty substantial move, so far it has been limited to just those as serious pricing pressures have yet to materialize in any other input prices around both the goods and services sector. The BLS’s PPI is rebounding and is moving higher along with copper and its metal mates, even after nine months (through December) the increase – more importantly the rate of increase – isn’t the kind you’d associate with even modest inflation let alone the first obvious stages indicating soon to be out-of-control prices driven by unbelievable monetary excess. In fact, like consumer prices in the CPI and PCE Deflator, finished goods commodity prices (excluding food and energy) in the PPI have decelerated quickly over the final three months of 2020 (up just 0.2% during Q4 as a whole). The same three months that retail sales have declined, jobless claims have picked up, and at least one month of headline payroll negative. Most of the increase in overall producer prices during December had been driven by gasoline. The fact that industrial metal prices have continued to rise, copper setting another multi-year high recently, suggests more of its own fundamental properties like supply – including those linked to China, rather than anything of US inflationary currency. |

U.S. PPI, Jan 2001 - 2020 |

| In other words, the PPI is consistent with the CPI as well as metals prices rising rapidly due to supply not currency factors (short and long run). So far as the Fed killing the dollar, spiking the inflationary collapse in it, like bond yields that haven’t moved all that much or even the dollar’s exchange value itself (outside EUR and GPB), why haven’t these prices/indices moved so much more than they have?

The metals, like oil, we can account for on physical factors. The rest of the system, both in and out, it’s the same disinflationary. Inflation, uncontrolled and otherwise, is not a small group of prices or a narrow sector of asset classes experiencing even large increases. |

U.S. PPI Index Commodities Finished Goods, Jan 2001 - 2020 |

| It’s when everything, or nearly everything, goes up at the same time and in a sustained fashion.

What we see here, which is only slightly less worrisome than the historically low consumer price increases, is the same limited, constrained rebound from the latest trough. That it isn’t anything more than this is another tally on the lengthening list of evidence against Jay’s “flood.” |

Federal Reserver: H.10 Foreign Exchange Rates, Jan 2008 - 2021 |

Episode 41; Part 2: Professor Copper’s Got Other Courses To Teach

Tags: commodities,Consumer Prices,Copper,CPI,currencies,dollar,economy,Featured,Federal Reserve/Monetary Policy,inflation,jay powell,Markets,Metals,money printing,newsletter,PPI,producer prices,QE