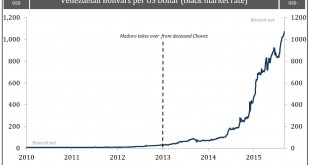

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legislative majority to start holding the government to account. Right on cue, Mr. Maduro just railed a decree through the Supreme Court (TSJ) giving him total control over budgetary measures, utilize any property, suspect constitutional rights...

Read More »2016 off to a turbulent start

Published: 12th February 2016 Download issue: A turbulent start to a volatile year Global markets had a very difficult start to 2016, with equity markets experiencing one of the largest January falls in history, currency markets also seeing major disruption, and a sharp widening of spreads on high yield corporate bonds. By the end of the month, though, there were signs that a rebound was underway. Although the magnitude of the sell-off was clearly a concern, these developments are not out...

Read More »China’s 3 trillion dollar mistake

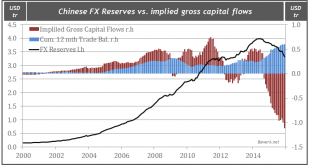

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the United States. One of the many perks enjoyed by global reserve issuer. The factory worker obviously did not do this out of his own volition; on the contrary, he was duped into it by swallowing the propaganda spewed out by party apparatchiks in...

Read More »Global Growth, Commodities, and the Lessons of Brazil

China’s ongoing economic slump has sparked turmoil on world markets, but it’s been particularly challenging for Brazil, which ships 40 percent of its exports to the country. How much does Brazil stand to gain from a stabilization in Chinese demand? Find out what Credit Suisse Chief Economist James Sweeney had to say at Credit Suisse’s 2016 Latin America Investment Conference about the outlook for China and its consequences for Brazil.

Read More »What a Negative SWAP Spread Really Means

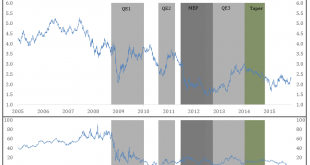

SWAP spreads recently took a nosedive and are once again trading at negative levels, even for shorter maturities. As can be seen from the chart below, treasury yields, here represented by the 10 year maturity, rose during QE policies programs contradicting the very raison d’être spouted by the central bankers. Interestingly enough we also see the same pattern in SWAP spreads. As QE programs were enacted SWAP spreads started to move upwards, just to rollover as the central bank program...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org