It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of...

Read More »A spanner in the works

While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed. At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its...

Read More »FX Daily, May 06: Trump’s Tariff Tweets Help Investors Discover Volatility

Swiss Franc The Euro has risen by 0.04% at 1.1399 EUR/CHF and USD/CHF, May 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that a US-China deal could be struck by May 10 before the weekend left investors ill-prepared for the presidential tweets yesterday that announced that the US was ending the tariff truce. Trump indicated that the 10% tariff on $200...

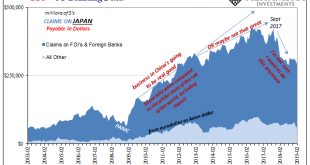

Read More »What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective. Before the...

Read More »FX Daily, May 01: No Help on May Day, which is also Fed Day

Swiss Franc The Euro has fallen by 0.23% at 1.1401 EUR/CHF and USD/CHF, May 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The May Day holiday has shut most markets in Asia and Europe, making for subdued market action. Equity markets that are open, like Australia and the UK, advanced and US shares are trading higher helped by Apple’s upbeat forecasts and...

Read More »Globally Synchronized…

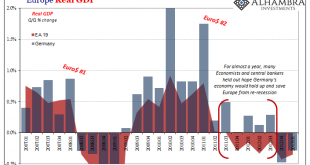

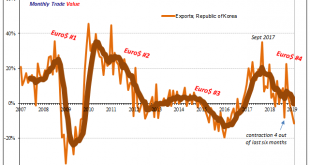

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death. What that meant in the context of globally synchronized growth, 2017’s repeatedly dominant narrative, wasn’t the end of synchronized as many tried to...

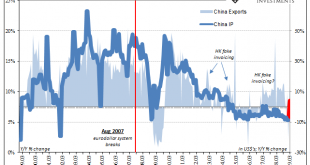

Read More »The Eurodollar, Unfortunately, Is What Is Rebalancing China’s Services Economy

If the “equation” CNY DOWN = BAD is valid, and it is, then what drives CNY downward in the first place? In conventional Economics, authorities command the currency to affect the level of exports. In reality, that’s not at all how it works. The eurodollar system of shadow money is almost purely calculated risk versus return. Before August 2007, everywhere there was believed (far) more return than risk. It’s the nature...

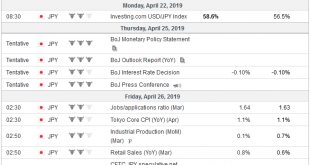

Read More »FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan’s flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%). This coupled with the new cyclical...

Read More »China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in. The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest...

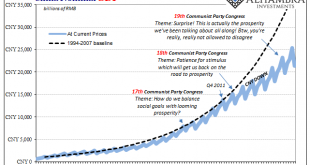

Read More »China’s Blowout IP, Frugal Stimulus, and Sinking Capex

It had been 55 months, nearly five years since China’s vast and troubled industrial sector had seen growth better than 8%. Not since the first sparks of the rising dollar, Euro$ #3’s worst, had Industrial Production been better than that mark. What used to be a floor had seemingly become an unbreakable ceiling over this past half a decade. According to Chinese estimates, IP in March 2019 was 8.5% more than it was in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org