Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough. After the market slide through Christmas Eve, everything had changed. No inflation (“muted”) on top of far more uncertain economic circumstances. Suddenly, even in the mainstream financial press, people were asking more uncomfortable questions. What if? Powell and the rest of his comrades around the world sprang into action – somewhat. After stubbornly

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, China, consumer spending, currencies, economy, eurodollar futures, Featured, Federal Reserve/Monetary Policy, FOMC, jay powell, LIBOR, Markets, newsletter, rate cuts, Recession, Retail sales, The United States, U.S. Retail Sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough.

After the market slide through Christmas Eve, everything had changed. No inflation (“muted”) on top of far more uncertain economic circumstances. Suddenly, even in the mainstream financial press, people were asking more uncomfortable questions. What if?

Powell and the rest of his comrades around the world sprang into action – somewhat. After stubbornly clinging to “strong” through all of December, policymakers would start out 2019 in conciliatory fashion. Globally, the policy bias had shifted even if very little was done (outside of China).

The narrative which came out of that transition was how the Fed broke the economy. Spurred by boisterous disapproval from the White House, repeatedly calling for rate cuts, blame Jay Powell for disrupting the boom. Though the federal funds upper bound was no more than 2.50%, this coupled with QT (balance sheet runoff leading to lower levels of bank reserves) was what pushed everything off track.

Thus, if the Fed broke it the Fed can fix it. Amplifying the message, President Trump tweeted for an immediate 100 bps cut to the federal funds communication at the last FOMC meeting last month. The stock market bought it – literally. Markets are up because “dovishness” is supposed to assure this weakness never gets farther than “transitory.”

We now have economic data coming in across the world for the month of April 2019. Nope. No signs of a dovish savior. If it doesn’t seem like 250 bps fed funds would ever have been enough to derail a boom, that’s because it wasn’t.

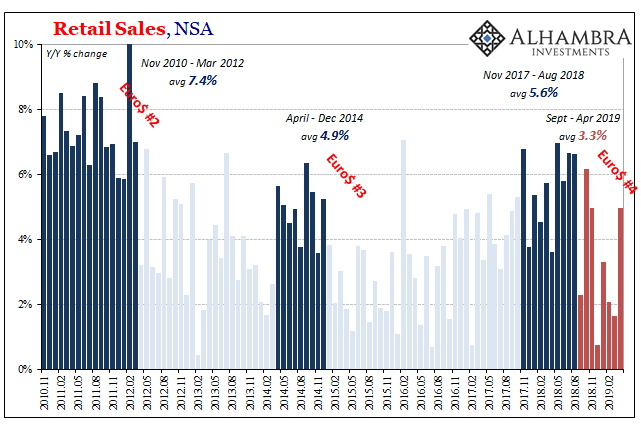

| The Census Bureau reports today another bad month of US consumer spending. Unadjusted Retail Sales rebounded in April 2019 from an atrocious March, up a little less than 5% year-over-year. More importantly, the 6-month average is now just 2.94%. That’s the lowest since 2016, the first time under 3% since the last downturn which was very close to full-blown recession. |

Retail Sales, NSA 2010-2019 |

| Retail sales in an actually booming economy would be above 6% consistently with an occasional month in the double digits. In a recession, we would expect to find 3% with more frequent results less than that number. Going back to last August, that’s just what the Census Bureau has been reporting. |

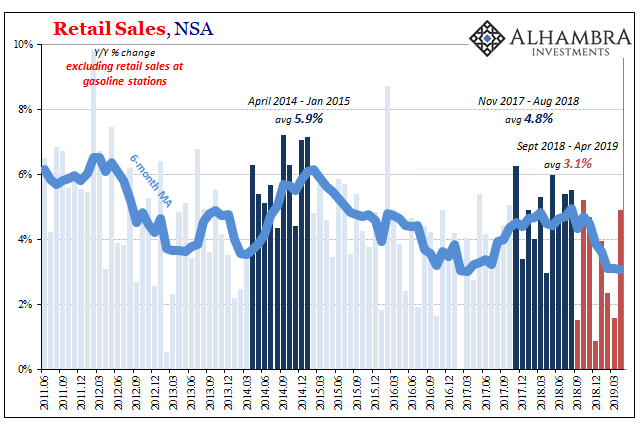

Retail Sales, NSA 2011-2019 |

| Excluding retail sales recorded by gasoline stations, the average gain is stuck at 3.1%. This very nearly matches the worst since 2010. It is increasingly clear that the US economy led by its consumers was especially weak months before the market slide in October. |

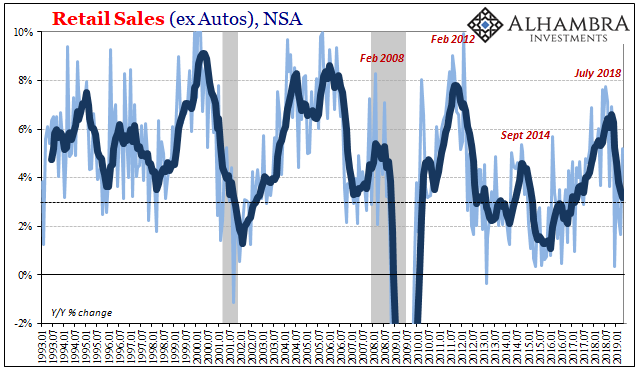

Retail Sales (ex Autos), NSA 1993-2019 |

| It would seem to emphasize more of the traditional business cycle type. Spending falls off leading to an inventory pile up, production is curtailed (as is hiring) which markets then pick up on after several months of anti-booming.

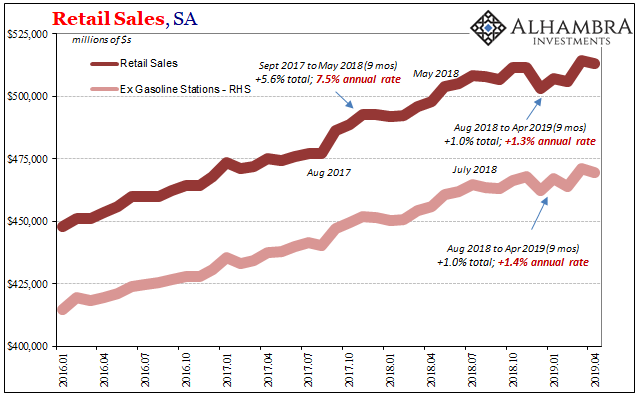

Seasonally-adjusted, retail sales have essentially shown no growth dating back to last summer. Beginning in August, consumer spending basically shut down. |

Retail Sales, SA 2016-2019 |

| Overall retail sales are up just 1%, an annual rate of 1.3% which is consistent with a relatively severe recession. The results are the same with or without gasoline station sales, meaning that the downturn is widespread. Neither the oil price crash of late 2018 nor its rebound in early 2019 is showing up as a direct effect.

Another sign of weakness is the increased volatility in each seasonally-adjusted series. The whole point of making these adjustments is to smooth out short run fluctuations as best as possible. Substantial macro factors, meaning not transitory, end up producing greater uncertainty in economic terms as well as for statistical processing. As consumers process the overall environment, particularly their perceptions of the labor market regardless of the unemployment rate, in the aggregate they can react with sudden care one month, more carefree the next, and then fear the following. The data becomes unstable because the underlying economy already is. |

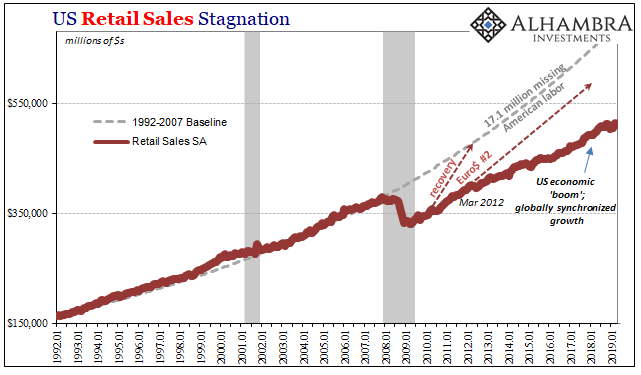

US Retail Sales Stagnation, 1992-2019(see more posts on U.S. Retail Sales, ) |

| For their part, US central bankers continue to forecast a rebound in the second half of this year. They do so because they always forecast a rebound (that never really happens) but also in large part based on their own actions, this Fed “pause.” If, however, the Fed wasn’t responsible for the downturn then any change in policy won’t make much if any difference. The closer we get to the second half still pointing toward downturn, not even share prices are going to be able to hold up based on hope alone.

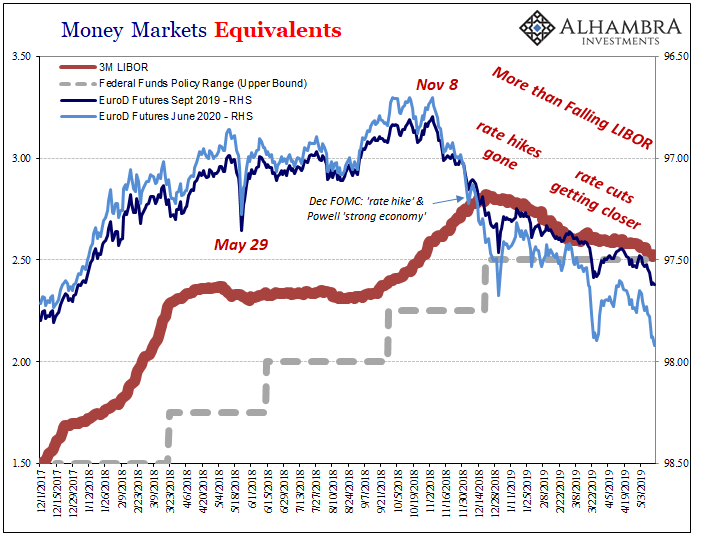

It took several months of rather substantial weakness and market rebellion for them just to stop talking about a strong economy. The markets that actually do matter (below) appreciate how Economists are always behind the curve. The Fed didn’t break it, nor can it fix it. What we see in the economic data is the very clear path toward rate cuts beginning in 2019. These won’t pull the economy out of its slump, merely signal that even the empty suits at the Federal Reserve have finally admitted how things have gone wrong. They are always the last to figure these things out, just behind the stock market. |

Money Markets Equivalents, 2017-2019 |

Tags: consumer spending,currencies,economy,eurodollar futures,Featured,Federal Reserve/Monetary Policy,FOMC,jay powell,Libor,Markets,newsletter,rate cuts,recession,Retail sales,U.S. Retail Sales