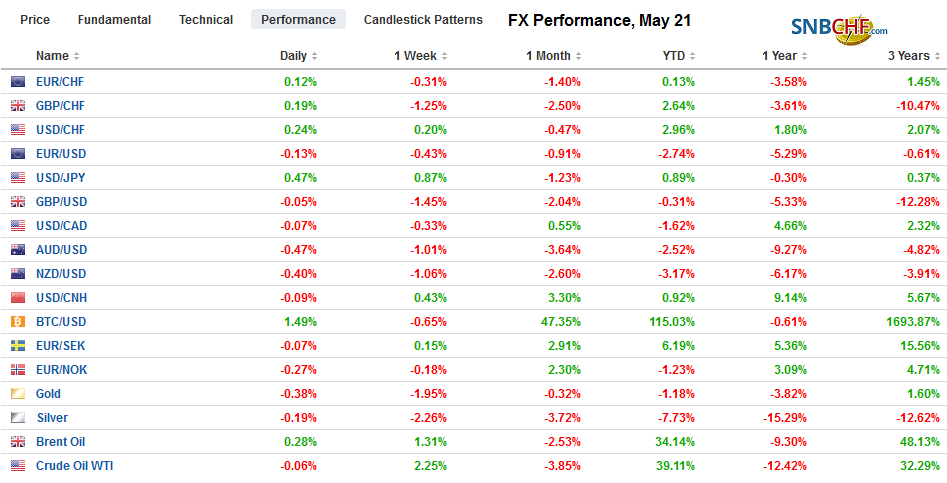

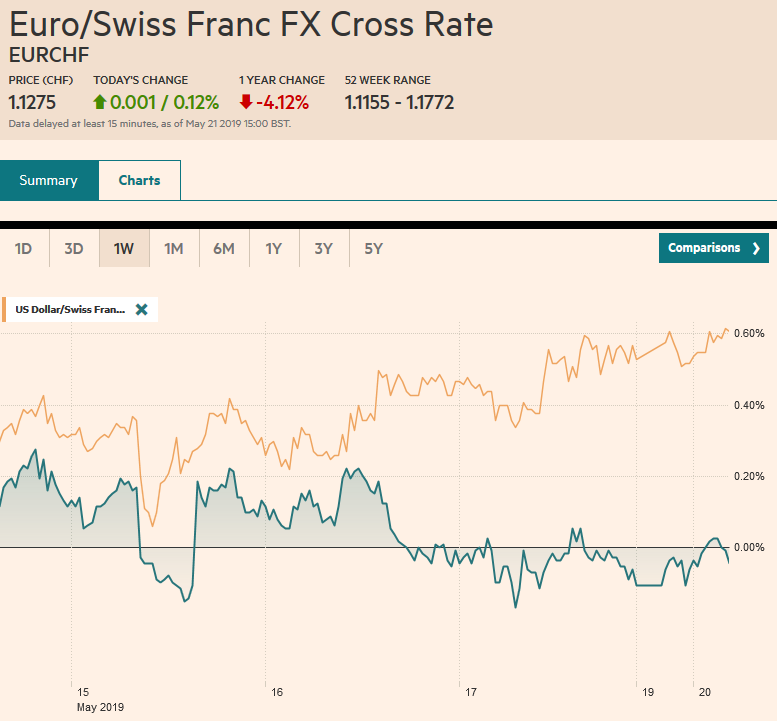

Swiss Franc The Euro has risen by 0.12% at 1.1275 EUR/CHF and USD/CHF, May 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped extend the run in the local equity market to a new record high. European bourses are higher, with the Dow Jones Stoxx 600 rising around 0.3% in the morning session. US shares are firmer, and the S&P 500 is recouping about half of yesterday 2/3 of a percent decline. The Philadelphia Semiconductor Index (SOX)

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, China, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.12% at 1.1275 |

EUR/CHF and USD/CHF, May 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped extend the run in the local equity market to a new record high. European bourses are higher, with the Dow Jones Stoxx 600 rising around 0.3% in the morning session. US shares are firmer, and the S&P 500 is recouping about half of yesterday 2/3 of a percent decline. The Philadelphia Semiconductor Index (SOX) lost four percent yesterday, third consecutive drop and more than the previous two sessions. Some reprieve is expected today. Bond markets are little changed, though Australian bond yield of 1.63% (down four basis points on the day) appears to be a new record low. European periphery yields are lower. The US dollar is firmer against most of the major currencies. With heightened speculation for a rate cut, the Australian dollar is showing the way, with a 0.5% loss. The euro is threatening to extend its record-long run against sterling for the 12th session. Firmer equities and peripheral European bonds have done little more emerging market currencies. Nearly all are soggy today, led by the Turkish lira, where the central bank effectively cut interest rates by reducing the swap rate 150 bp to 24%. |

FX Performance, May 21 |

Asia Pacific

The US granted a short reprieve for some users of Huawei equipment (August 19). This does not represent a softening of the US position and Commerce Secretary Ross had indicated this was likely. Still, the underlying tension has not dissipated despite some modest market moves. Some investors are looking for the commercial beneficiaries of the squeeze on Huawei, and Samsung, for example, helped lead Korean shares higher today. Tariffs are disruptive, but also encourage the targeted country to move up the value-added chain. The tariffs will not encourage China to give up its import substitution strategy. To the contrary, it will encourage even greater self-reliance. It may take a little time, but China will become a large semiconductor producer. Currently, it imports around 80% of its needs. China will also break the US duopoly of mobile operating systems and reports lend support to our contention that Huawei has been preparing for this eventuality since ZTE was sanctioned and will launch its own mobile operating system. Separately, but related, some investors are trying to game out China’s likely retaliatory tools. China accounts for around 80% of US rare earths, used extensively in hybrid autos and technology products. China had weaponized its rare earths in a dispute with Japan a few years ago. China rare earth producers rallied today.

News that South Korean exports fell 11.7% in the first 20 days in May, the biggest decline in three months is the latest sign that the regional disruptions continue. Singapore’s economy expanded 1.2% in Q1 (median expectation for 1.4%), but the 7.1% quarterly contraction in manufacturing and a decline in non-oil exports is worrisome. Last week, Japan reported a 33% decline in its preliminary April machine tool orders. The final estimate is expected in a couple of days.

The market was whipsawed in Australia. First, news that regulators were proposing that a dilution of the macro-prudential rules to make it easier to buy homes was seen as an alternative to a rate cut and the Australian dollar rallied. A combination of the RBA minutes and comments from Governor Lowe put a rate cut back into play, and the Australian dollar was sold. Interpolating from the OIS, more than 70% chance of a cut in early June has been discounted, up from less than 60% yesterday and a little more than 33% chance a week ago.

For the fourth consecutive session, the dollar is making a higher low against the yen. It could be the first session in two weeks that the greenback holds above JPY110 (where a $375 mln option is struck that will be cut today). Initial resistance is seen near JPY110.30 and then JPY110.60-JPY110.70. The Australian dollar is poised to test last week’s low near $0.6865. The flash crash (Jan 3) low was near $0.6740, and that is the next significant target. The Chinese yuan edged slightly higher for the second consecutive session.

Europe

The US is warning that it will move to sanction companies involved with the Nord Stream 2 pipeline that allows Russian natural gas to be shipped directly to Germany and bypass Ukraine. It is controversial even within Europe. The project is to formally start toward the end of the year, though permits from Denmark have yet to be resolved.

Reports suggest that on the sidelines of the OECD meeting, the US, Europe, and Japan will discuss ways to address China’s corporate subsidies. Although the US and Europe do not agree on subsidies, as the recent WTO decision against Airbus and Europe’s case against Boeing subsidies illustrate, there is a shared antipathy toward China’s behavior, both in terms, of forced technology transfers and in state subsidies. According to the WTO, all but one of China’s top 100 publically listed companies have a majority stake held by China’s government.

With more MPs coming out in opposition to May’s Withdrawal Bill it is possible that it is not even presented in early June as the Prime Minister wants. Some are still hopeful that a resounding defeat for the Tories in the EU Parliament election and the prospects of leaving without an agreement would force the House of Commons to support the despised Withdrawal Bill, but this seems too fanciful. Instead, the focus in recent days has turned to who will succeed May. PredictIt.Org still has May most likely still Prime Minister at the end of next month and sees Johnson as the next Tory leader.

Sterling is at new four-month lows today (~$1.2685). It has been up only in two sessions since Trump declared an end to the tariff truce. It closed near $1.3175 on May 3. Initial resistance is now seen around $1.2710-$1.2725. The next target is $1.26. Sterling has not risen at all against the euro since May 3. Over this period, the euro has risen from about GBP0.85 to almost GBP0.88, which is a 50% retracement of this year’s decline. The February high was near GBP0.8840 and the next (61.8%) retracement is closer to GBP0.8865. The euro is trading at its lowest level against the dollar since May 3, slipping below $1.1150. Today’s high (~$1.1170) stopped shy of the 1.3 bln euro option at $1.1180 that expires today. The intraday technicals do not rule out another test on it, in the US morning. The big downside target is the late April low a little above $1.1100 (where a 680 mln option will be cut later today).

America

US April existing home sales are expected to have bounced back (~2.7%) after falling almost 5% in March. Existing home sales rose three months in 2018. An increase in April would be the second here in 2019. Evans and Rosengren from the Federal Reserve speak today. There is practically no chance of a rate cut in June. Rate cut expectations are concentrated in Q4. Meanwhile, while the FCC chair backed the T-Mobile/Sprint merger, the Justice Department seems to be pushing T-Mobile to boost its offer. Canada returns from its long holiday weekend, but not economic releases are scheduled. March retail sales will be reported tomorrow, and a strong rise (~1.2%) is expected. Mexico’s calendar is also light today, and it too reports March retail sales tomorrow. A small (-0.1%) decline is forecast. Note that Argentina bonds seemed to respond favorably to news that Cristina Fernandez de Kirchner will run for Vice President in October.

The US dollar remains in the CAD1.34 to CAD1.35 range. Within the context of narrowing of the US two-year premium and firm oil prices, the recovery in equities may see the US dollar fray the lower end of its range against the Canadian dollar. The month’s low is near CAD1.3380. The dollar also appears to have entered a near-term trading range against the Mexican peso–roughly MXN19.00 to MXN19.25.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CNY,China,Featured,newsletter