Damned If You Do… After waking up on Thursday, we quickly glanced at the overnight market action in Asia and noticed that the Nikkei had tanked rather noticeably. Our first thought upon seeing this was “must be the yen” – and so it was. The BoJ cannot manipulate the yen anymore. June yen futures, daily – taking off again – click to enlarge. Given the BoJ’s bizarre plan to push consumer price inflation to a 2% annualized rate within [enter movable goal post here] years, Mr. Kuroda...

Read More »Gold And Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »With Fiat Money, Everything Is Relative

What Determines a Currency’s Value? At the end of March the price of the euro in terms of US dollars closed at 1.1378. This was an increase of 4.7 percent from February when it increased by 0.3 percent. The yearly growth rate of the price of the euro in US dollar terms jumped to 6 percent in March from minus 2.9 percent in February. EUR-USD, 2007 – today,monthly – click to enlarge. According to most experts currency rates of exchange appear to be moving in response to so many...

Read More »Interest Rates: How Low Can They Go?

When Denmark introduced negative interest rates in 2012, it was a pioneer. But the policy has become such an accepted part of central banks’ toolbox in the years since that financial pundits hardly batted an eyelash when Hungary became the world’s sixth central bank to introduce negative rates in March 2016. As the practice becomes more widespread, the question of how low interest rates can go has become increasingly relevant for investors. While every country (or region, in the case...

Read More »VIDEO: Are Negative Rates All There Is?

Are negative interest rates merely a sign that central bankers have run out of ideas? Could the policy eventually make its way to the United States? Watch Jonathan Wilmot, Credit Suisse’s Head of Macro Investments, Asset Management, discuss what negative rates indicate about global monetary policy.

Read More »Gold and Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »FX Daily April 28: What is the Next Shoe to Drop?

One can appreciate the frustration in Tokyo. The Bank of Japan surprised the world by adopting negative rates in January and the yen rallied. Today it disappointed many by not easing, and the yen rallied. The BOJ next meetings in mid-June and like this week, the outcome of its meeting will be announced the day after the FOMC meeting. There is some idea that BOJ may be waiting for Abe’s new fiscal package and the G7 meeting Japan hosts next month. The FOMC’s statement yesterday did not...

Read More »With Tech Tanking, Can Anything Save The System?

Nice sentence: Tears won’t be confined to Wall Street however: let’s not forget that none other than the Swiss National Bank is also long some 10.4 million shares of AAPL. First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing to explain. The FAANGs (Facebook, Apple, Amazon, Netflix and Google) own their niches and not so long ago were expected to...

Read More »Navigating through rollercoaster markets

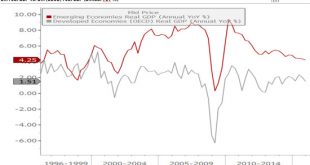

Macroview As growth fails to attain a stronger trajectory and deflation remains a threat, the credibility of central banks has begun to suffer. Yet we remain relatively upbeat on prospects for world growth although we expect continued volatility in some asset classes. April insights from Pictet Wealth Management's Asset Allocation & Macro Research team The current decline in US profit margins would usually herald a recession. The continued decline in earnings expectations is a concern,...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org